Answered step by step

Verified Expert Solution

Question

1 Approved Answer

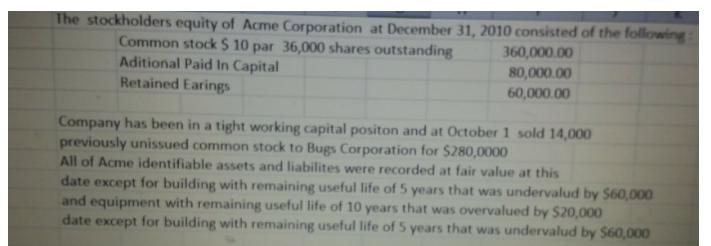

The stockholders equity of Acme Corporation at December 31, 2010 consisted of the following Common stock $ 10 par 36,000 shares outstanding Aditional Paid

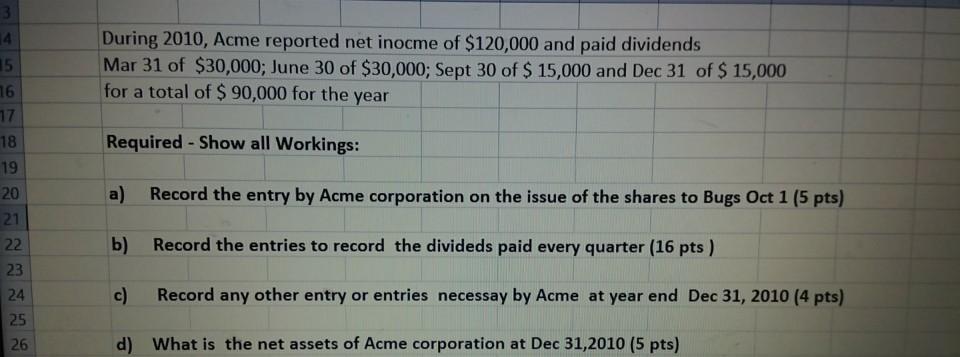

The stockholders equity of Acme Corporation at December 31, 2010 consisted of the following Common stock $ 10 par 36,000 shares outstanding Aditional Paid In Capital Retained Earings 360,000.00 80,000.00 60,000.00 Company has been in a tight working capital positon and at October 1 sold 14,000 previously unissued common stock to Bugs Corporation for $280,0000 All of Acme identifiable assets and liabilites were recorded at fair value at this date except for building with remaining useful life of 5 years that was undervalud by S60,000 and equipment with remaining useful life of 10 years that was overvalued by $20,000 date except for building with remaining useful life of 5 years that was undervalud by S60,000 3 During 2010, Acme reported net inocme of $120,000 and paid dividends Mar 31 of $30,000; June 30 of $30,000; Sept 30 of $ 15,000 and Dec 31 of $ 15,000 for a total of $ 90,000 for the year 14 15 16 17 18 Required-Show all Workings: 19 20 a) Record the entry by Acme corporation on the issue of the shares to Bugs Oct 1 (5 pts) 21 22 b) Record the entries to record the divideds paid every quarter (16 pts ) 23 24 c) Record any other entry or entries necessay by Acme at year end Dec 31, 2010 (4 pts) 25 26 d) What is the net assets of Acme corporation at Dec 31,2010 (5 pts)

Step by Step Solution

★★★★★

3.36 Rating (140 Votes )

There are 3 Steps involved in it

Step: 1

It is assumed that the dividend is paid in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started