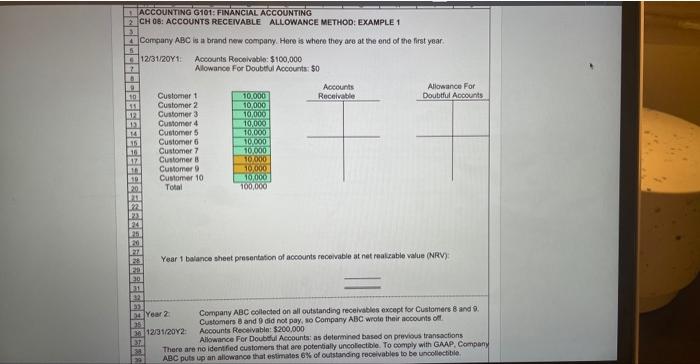

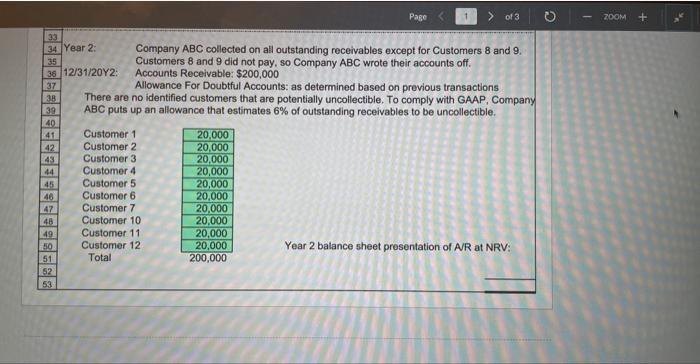

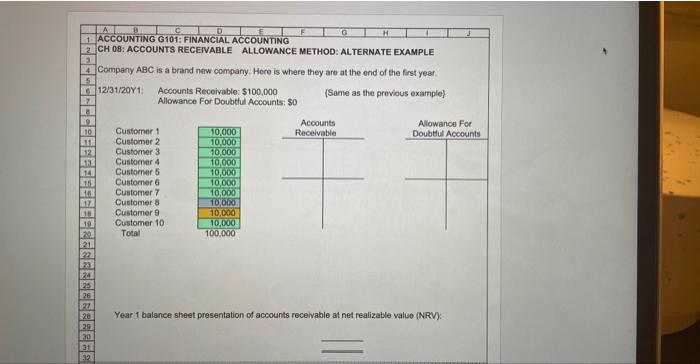

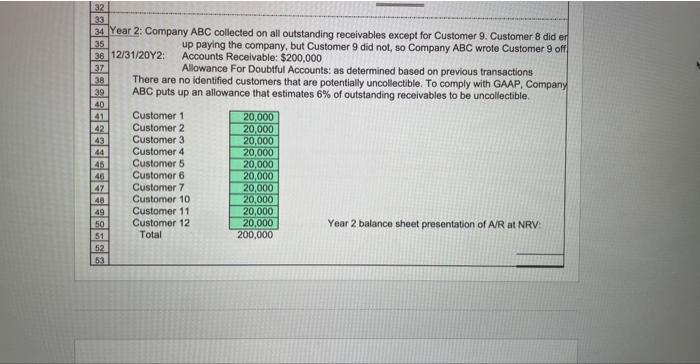

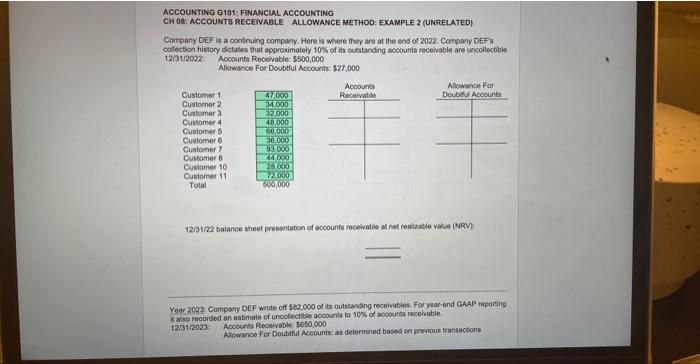

ACCOUNTING GIO1: FINANCIAL ACCOUNTING CH O6: ACCOUNTS RECENAALE ALLOWANCE METHOD: EXAMPLE 1 4 Company ABC is a brand new company. Here is where they are at the end of the first year. 55 12/3120Y1: Accounts Receivable: $100,000 Alowance For Doubtivi Accouetts $0 Year t balance sheet presentafion of accounts recoivable at net realsable value (NRV: Company ABC oollected on all outstanding receivables except for Customers 8 and 0 . Custamers bb and 9 did not pay, io Company ABC wrote their accounts of Accounts Recolvabin: $200.000 Alocounts Rece Fer Doubdul Accounts: as determinod based on previous transections There are no identfied eustomers that are poterdialy uncolectiole. To comply with GAAP, Compary ABC puts up an allowance that estimates 6K of cutstanding rectivabies to be unoollectible. 2: Company ABC collected on all outstanding receivables except for Customers 8 and 9 . Customers 8 and 9 did not pay, so Company ABC wrote their accounts off. 120Y2: Accounts Receivable: $200,000 Allowance For Doubtful Accounts: as determined based on previous transactions There are no identified customers that are potentially uncollectible. To comply with GAAP, Company ABC puts up an allowance that estimates 6% of outstanding receivables to be uncollectible. Year 2 balance sheet prosentation of AVR at NRV: 1. ACCOUNTING G101: FINANCIAL ACCOUNTING 2. CH 08: ACCOUNTS RECEIVABLE ALLOWANCE METHOD: ALTERNATE EXAMPLE 44 Company ABC is a brand new company. Hore is where they are at the ond of the frst year. E 12/31/20Y1: Accounts Recoivable: $100,000 (Same as the previous example) Allowance For Doubthul Accounts: $0 Year 1 balance sheet presentation of accounts recelvable at net realizable value (NRV): Year 2: Company ABC collected on all outstanding receivables except for Customer 9 . Customer 8 did er 12/31/20Y2: Accounts Recelvable: $200,000. Allowance For Doubtful Accounts: as determined based on previous transactions There are no identified customers that are potentially uncollectible. To comply with GAAP, Company ABC puts up an allowance that estimates 6% of outstanding receivables to be uncollectible. Year 2 balance sheet presentation of A/R at NRV: ACCOUNTING G101: FINANCUAL ACCOUNTING CH 03: ACCOUNTS RECENABLE ALLOWANCE METHOD: EXAMPLE 2 (UNRELATED) Company DEF is a continuing compony. Hore is where they are at the end of 2022. Company DEFis collection history delates that approximately 10% of is oulstanding accounts receivable are encellectible 12/312022: Accounts Receivatle: $500,000 Aloreacice For Dovbllul Aocounts: $27,000 1231/2 balance sheet presentation of accounts recelvable at net reaizakio value (NRV) Year 2023; Compamy DEF weote off 562,000 of ts outseanding receirables. For year-end CAAP raparting it a.so rocorded an estimale of uncolecthle ocoounts to 10% of accoumas nacelvable 1331/2023? Account frecelvablec $550,000 Afowance For Doubtful Accounts: as dotermined based en previous transactons