Answered step by step

Verified Expert Solution

Question

1 Approved Answer

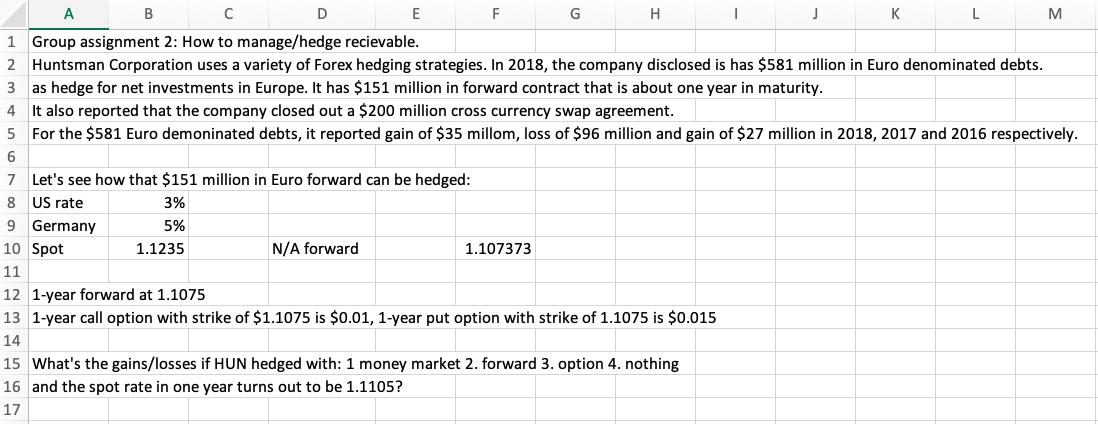

A D E F H K 1 Group assignment 2: How to manage/hedge recievable. 2 Huntsman Corporation uses a variety of Forex hedging strategies.

A D E F H K 1 Group assignment 2: How to manage/hedge recievable. 2 Huntsman Corporation uses a variety of Forex hedging strategies. In 2018, the company disclosed is has $581 million in Euro denominated debts. as hedge for net investments in Europe. It has $151 million in forward contract that is about one year in maturity. 4 It also reported that the company closed out a $200 million cross currency swap agreement. For the $581 Euro demoninated debts, it reported gain of $35 millom, loss of $96 million and gain of $27 million in 2018, 2017 and 2016 respectively. 3 6 7 Let's see how that $151 million in Euro forward can be hedged: 8 US rate 3% 9 Germany 5% 10 Spot 1.1235 N/A forward 1.107373 11 12 1-year forward at 1.1075 13 1-year call option with strike of $1.1075 is $0.01, 1-year put option with strike of 1.1075 is $0.015 14 15 What's the gains/losses if HUN hedged with: 1 money market 2. forward 3. option 4. nothing 16 and the spot rate in one year turns out to be 1.1105? 17

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started