Answered step by step

Verified Expert Solution

Question

1 Approved Answer

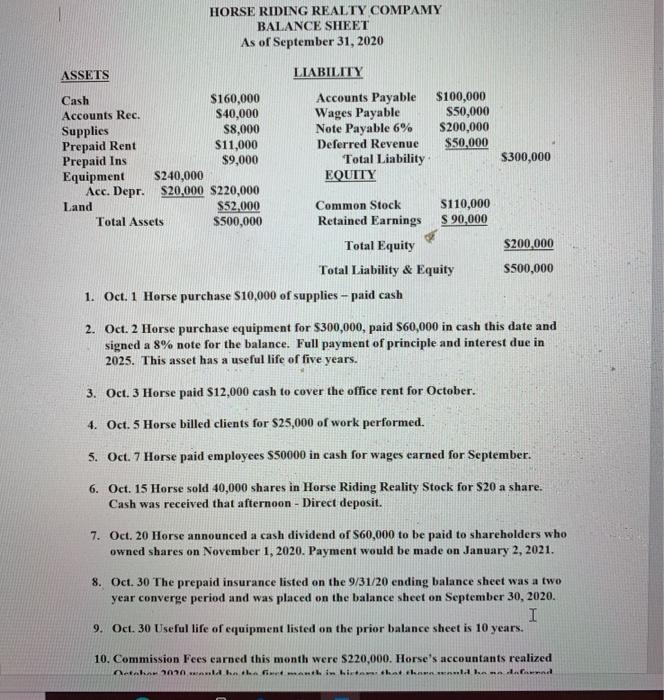

HORSE RIDING REALTY COMPAMY BALANCE SHEET As of September 31, 2020 ASSETS LIABILITY $100,000 S50,000 $200,000 S160,000 S40,000 S8,000 $11,000 $9,000 Accounts Payable Wages

HORSE RIDING REALTY COMPAMY BALANCE SHEET As of September 31, 2020 ASSETS LIABILITY $100,000 S50,000 $200,000 S160,000 S40,000 S8,000 $11,000 $9,000 Accounts Payable Wages Payable Note Payable 6% Deferred Revenue Total Liability EQUITY Cash Accounts Rec. Supplies Prepaid Rent Prepaid Ins Equipment Acc. Depr. $20,000 S220,000 $50,000 $300,000 S240,000 S110,000 S 90,000 Common Stock $52,000 S500,000 Land Total Assets Retained Earnings Total Equity $200,000 Total Liability & Equity S500,000 1. Oct. 1 Horse purchase S10,000 of supplies - paid cash 2. Oct. 2 Horse purchase equipment for $300,000, paid S60,000 in cash this date and signed a 8% note for the balance. Full payment of principle and interest due in 2025. This asset has a useful life of five years. 3. Oct. 3 Horse paid $12,000 cash to cover the office rent for October. 4. Oct. 5 Horse billed clients for $25,000 of work performed. 5. Oct. 7 Horse paid employees S50000 in cash for wages earned for September. 6. Oct. 15 Horse sold 40,000 shares in Horse Riding Reality Stock for $20 a share. Cash was received that afternoon - Direct deposit. 7. Oct. 20 Horse announced a cash dividend of S60,000 to be paid to shareholders who owned shares on November 1, 2020. Payment would be made on January 2, 2021. 8. Oct. 30 The prepaid insurance listed on the 9/31/20 ending balance sheet was a two year converge period and was placed on the balance sheet on September 30, 2020. 9. Oct. 30 Useful life of equipment listed on the prior balance sheet is 10 years. 10. Commission Fees carned this month were $220,000. Horse's accountants realized Octahor 200anld hn tha Get anth in hirt hat shnraenald kn na dalarrnd Cash was received that afternoon - Direct deposit. 7. Oct. 20 Horse announced a cash dividend of S60,000 to be paid to shareholders who owned shares on November 1, 2020. Payment would be made on January 2, 2021. 8. Oct. 30 The prepaid insurance listed on the 9/31/20 ending balance sheet was a two year converge period and was placed on the balance sheet on September 30, 2020. 9. Oct. 30 Useful life of equipment listed on the prior balance sheet is 10 years. 10. Commission Fees earned this month were $220,000. Horse's accountants realized October 2020 would be the first month in history that there would be no deferred revenue on the balance sheet. 11. Oct. 31. Balance on the supplies is $1500. 12. Oct. 31 Income Tax Rate for Werner is 20%. 13. October 31- Prepare Financial Statements for the Month of October I

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer HORSE RIDING REALTY COMPANY Balance Sheet As on 31st Oct 2020 Assets Current Assets 1048000 C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started