accounting hw.

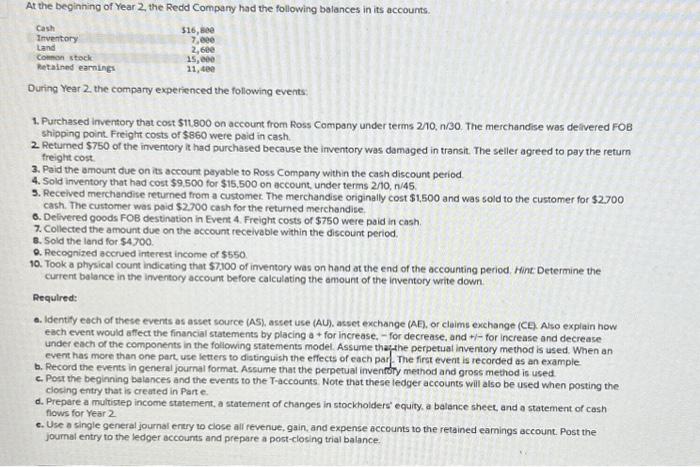

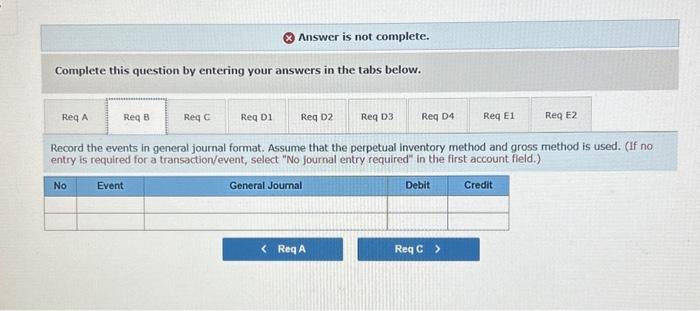

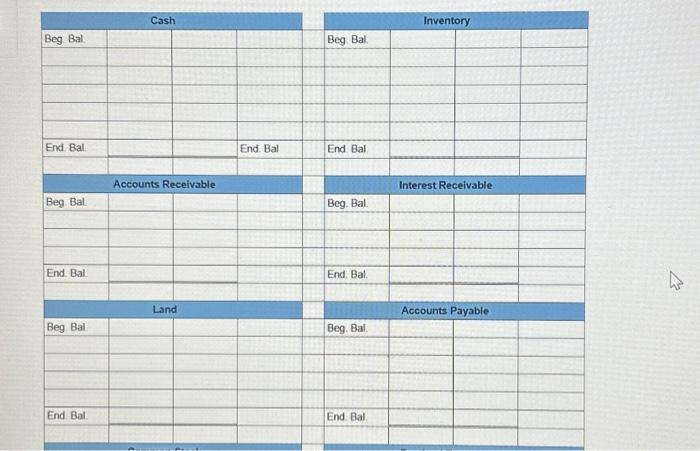

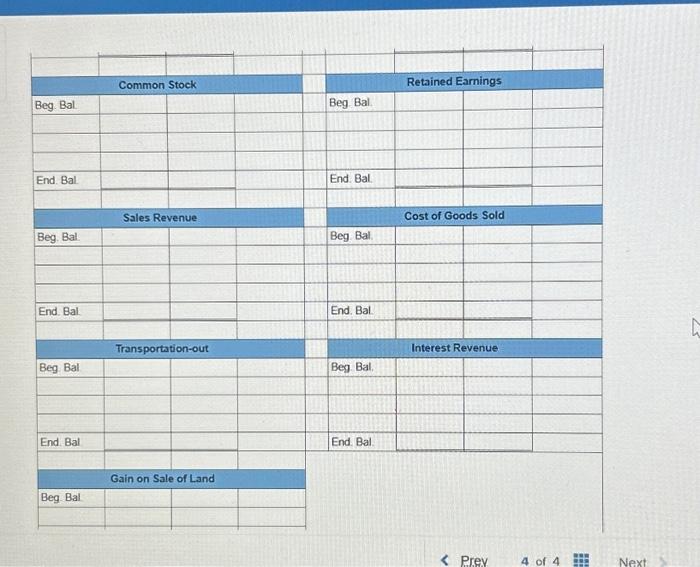

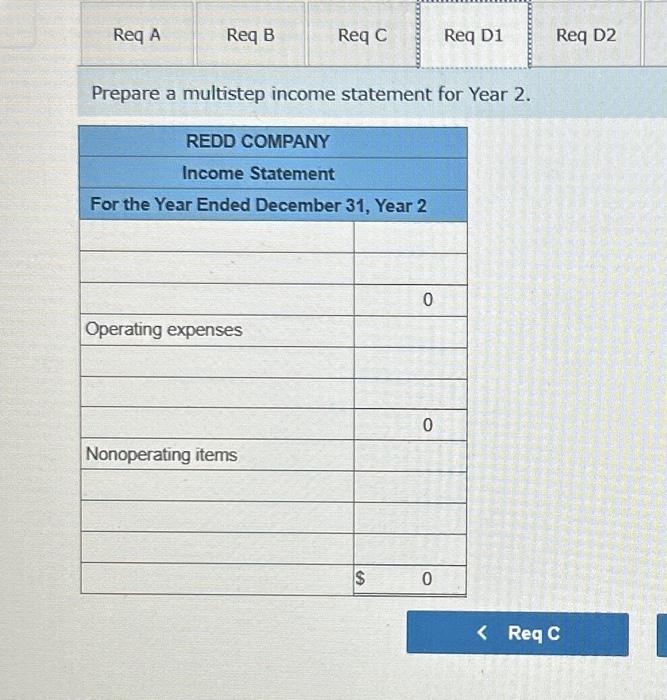

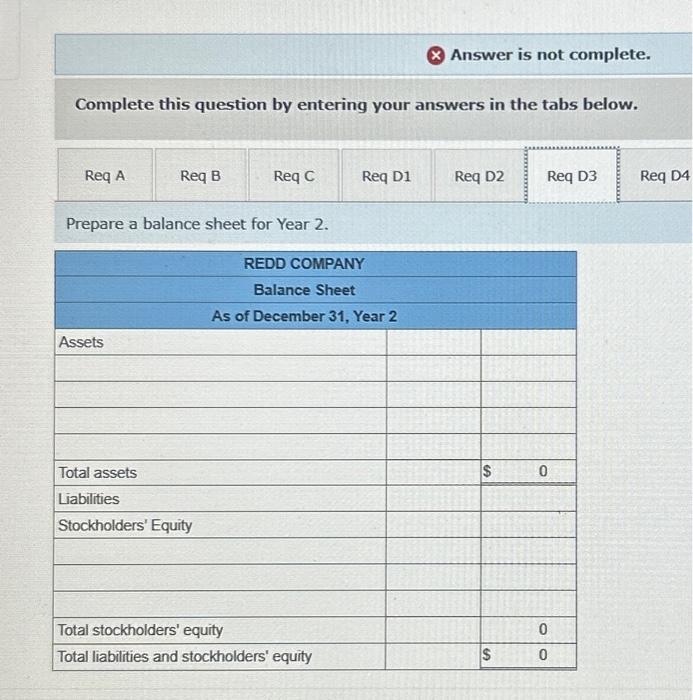

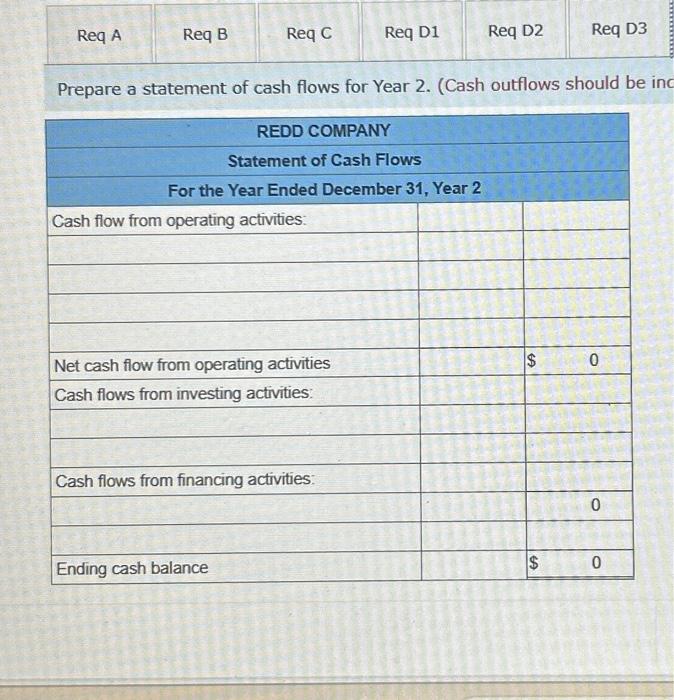

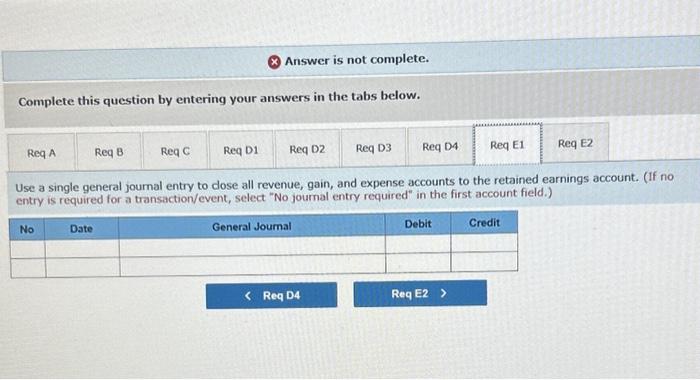

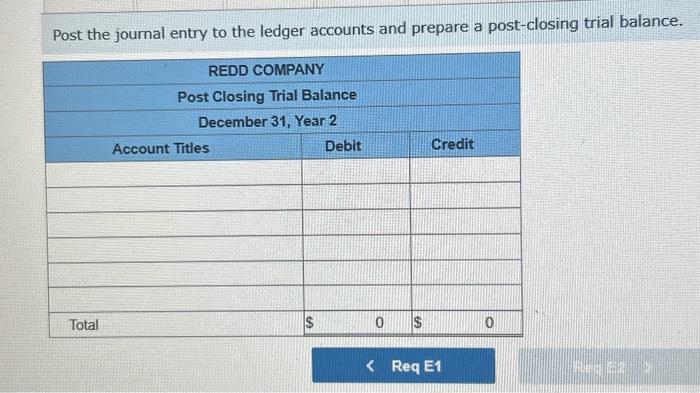

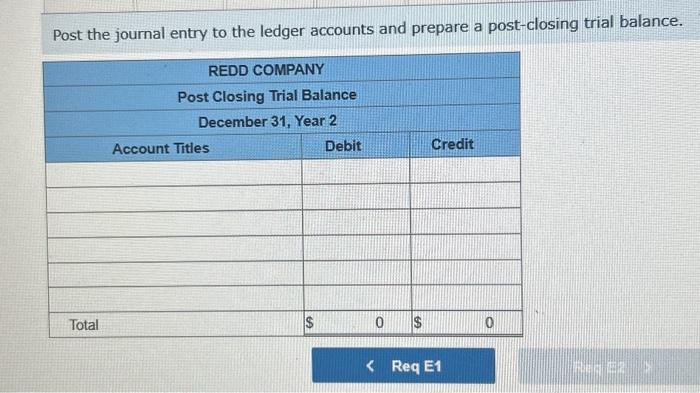

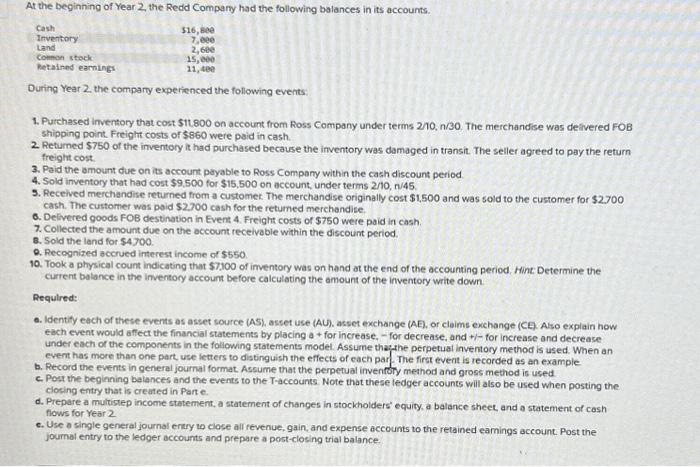

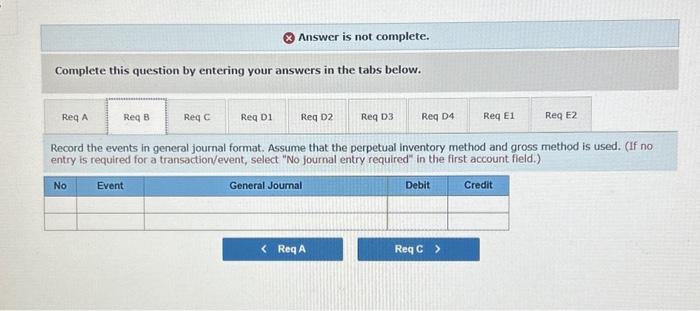

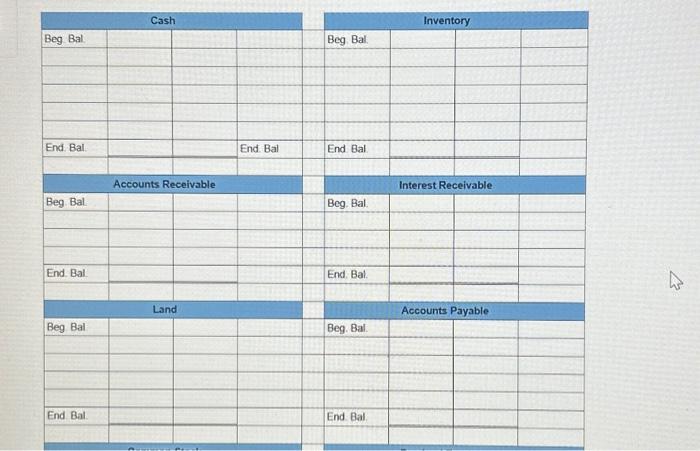

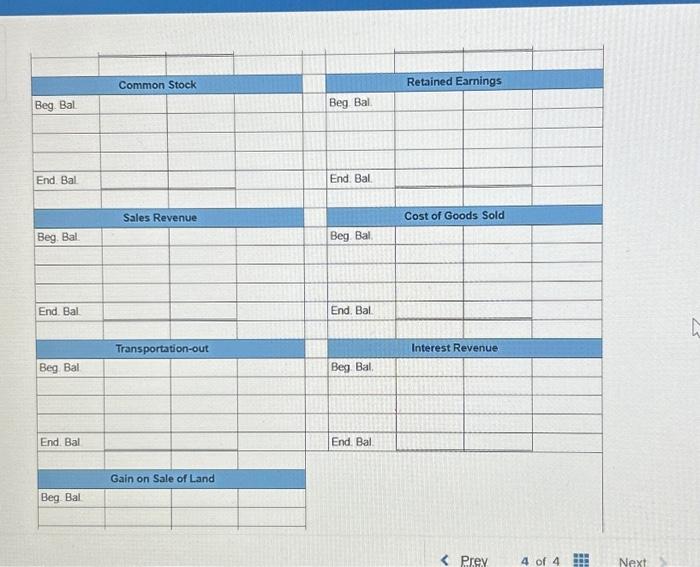

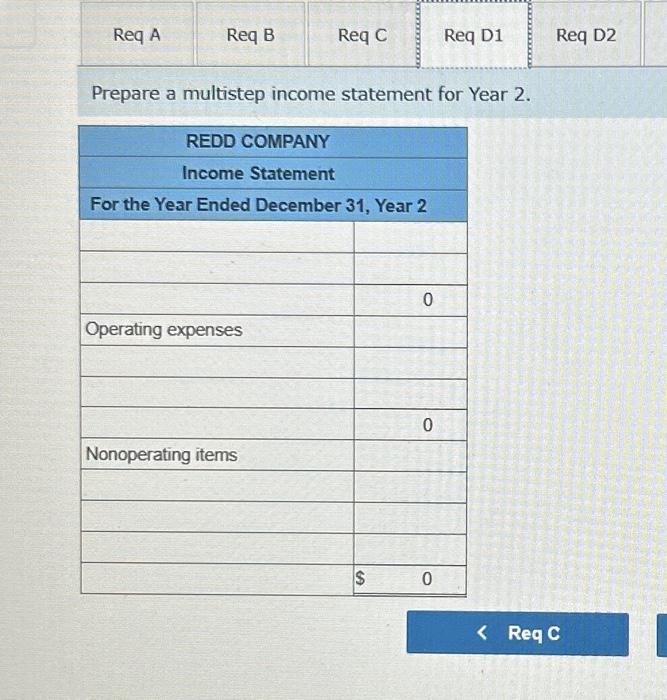

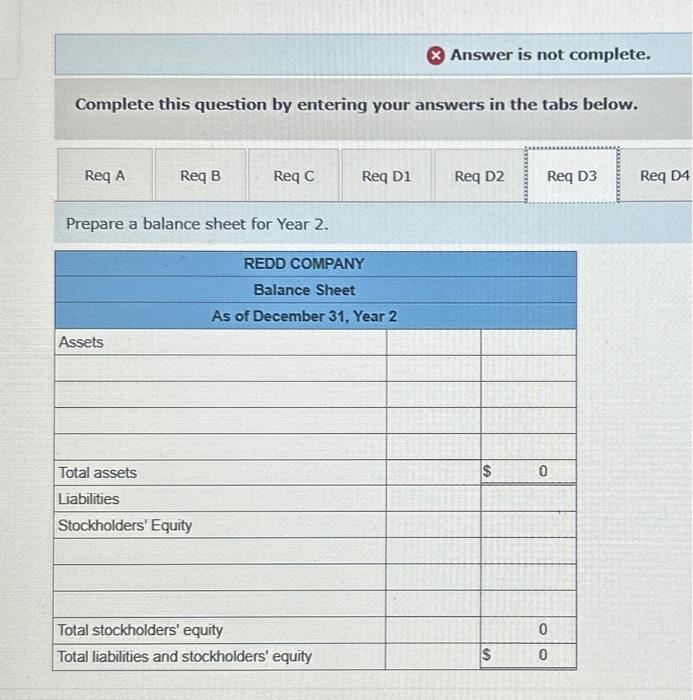

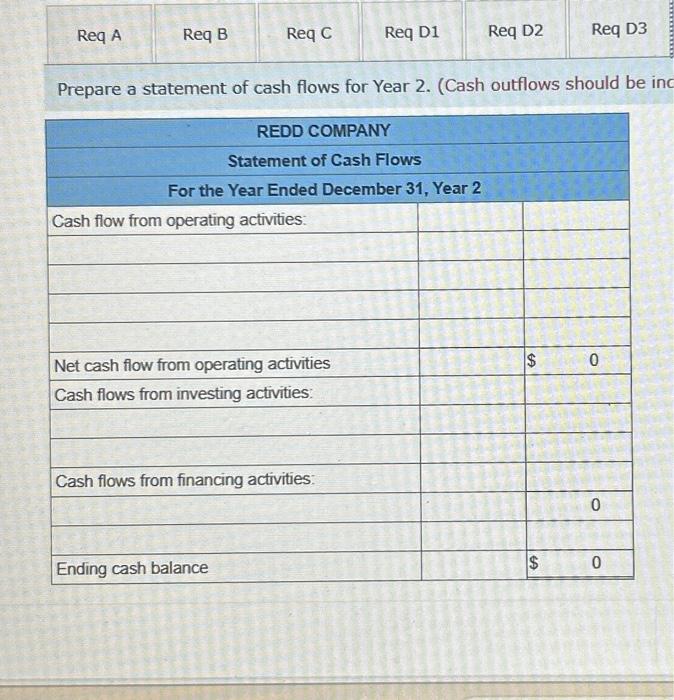

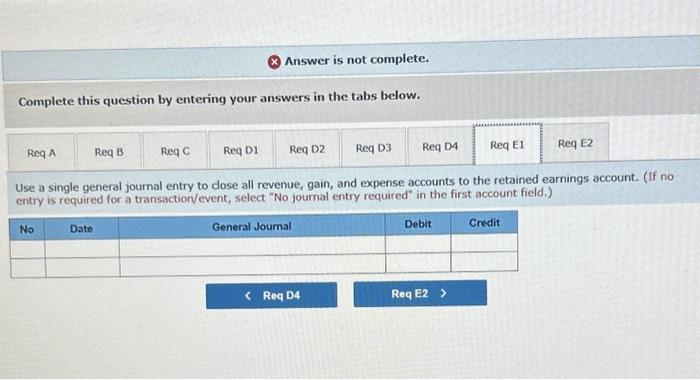

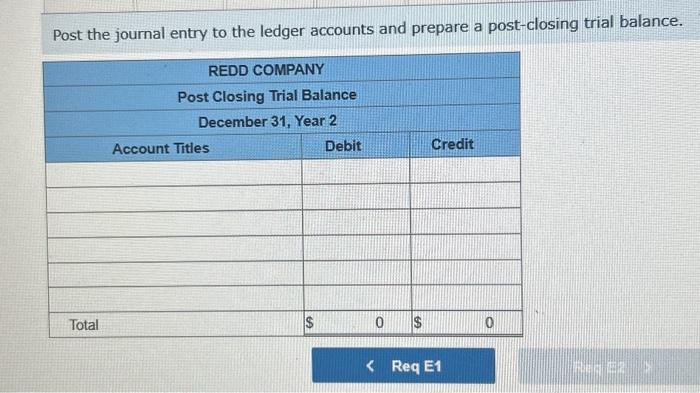

( Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare a balance sheet for Year 2. ( Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare a balance sheet for Year 2. Answer is not complete. Complete this question by entering your answers in the tabs below. Record the events in general journal format. Assume that the perpetual inventory method and gross method is used. (If no entry is required for a transactionvevent, select "No journal entry required" in the first account field.) ( Answer is not complete. Complete this question by entering your answers in the tabs below. Prepare a balance sheet for Year 2. Answer is not complete. Complete this question by entering your answers in the tabs below. Use a single general journal entry to dose all revenue, gain, and expense accounts to the retained earnings account. (If no entry is required for a transaction/event, select "No joumal entry required" in the first account field.) Prepare a multistep income statement for Year 2. Post the journal entry to the ledger accounts and prepare a post-closing trial balance. Post the journal entry to the ledger accounts and prepare a post-closing trial balance. Answer is not complete. Complete this question by entering your answers in the tabs below. Record the events in general journal format. Assume that the perpetual inventory method and gross method is used. (If no entry is required for a transactionvevent, select "No journal entry required" in the first account field.) At the beginhing of Year 2, the Redd Company had the following balances in its accounts. During Year 2, the compary experienced the following events: 1. Purchased imventory that cost $11800 on account from Ross Company under terms 2/10, n/30. The merchandise was defivered FOB shipping point. Freight costs of $860 were paid in cash. 2. Returned $750 of the inventory it had purchased because the imventory was damaged in transit. The seller agreed to pay the return freight cost. 3. Paid the amount due on its account payable to Ross Company within the cash discount period 4. Sold inventory that had cost $9,500 for $15,500 on account, under terms 2/10,n/45. 3. Recelved merchandise returned from a customet. The merchandise originally cost $1,500 and was sold to the customer for $2700 cash. The customer was paid \$2700 cash for the retumed merchandite. a. Delivered goods FOB destination in Event 4. Freight costs of $750 were paid in cash. 7. Collected the amount due on the account recelvable within the discount period. B. Sold the lend for $4700. Q. Recognized accrued interest income of $550. 10. Took a physical count indicating that $7,100 of imventory was on hand at the end of the accounting period. Hint: Determine the current balance in the inventory account before calculating the amount of the inventory write down. Required: a. Identify each of these events as asset source (AS), asset use (AU), asset exchange (AE), or claims exchange (CE) Also expiain how each event would affect the financial statements by placing a+ for increase, - for decrease, and +1 for increase and decrease under each of the components in the following statements model. Assume thaithe perpetuat inventory method is used. When an evert has more than one part, use letters to distinguish the effects of each par. The first event is recorded as an example b. Record the events in general journal format. Assume that the perpetual invenfory method and gross method is used. c. Post the beginning balances and the events to the T-accounts. Note that these ledger accounts will also be used when posting the clocing entry that is created in Parte. d. Prepare a multistep income statement, a statement of changes in stockholders' equity, a balance sheet, and a statement of cesh flows for Year 2 e. Use a single general journal enty to close all fevenue, gain, and expense accounts to the retained eamings account. Post the journal entry to the ledger accounts and prepare a post-closing trial balance. Prepare a multistep income statement for Year 2. Prepare a statement of cash flows for Year 2. (Cash outflows should be Prepare a statement of cash flows for Year 2. (Cash outflows should be Answer is not complete. Complete this question by entering your answers in the tabs below. Use a single general journal entry to dose all revenue, gain, and expense accounts to the retained earnings account. (If no entry is required for a transaction/event, select "No joumal entry required" in the first account field.) At the beginhing of Year 2, the Redd Company had the following balances in its accounts. During Year 2, the compary experienced the following events: 1. Purchased imventory that cost $11800 on account from Ross Company under terms 2/10, n/30. The merchandise was defivered FOB shipping point. Freight costs of $860 were paid in cash. 2. Returned $750 of the inventory it had purchased because the imventory was damaged in transit. The seller agreed to pay the return freight cost. 3. Paid the amount due on its account payable to Ross Company within the cash discount period 4. Sold inventory that had cost $9,500 for $15,500 on account, under terms 2/10,n/45. 3. Recelved merchandise returned from a customet. The merchandise originally cost $1,500 and was sold to the customer for $2700 cash. The customer was paid \$2700 cash for the retumed merchandite. a. Delivered goods FOB destination in Event 4. Freight costs of $750 were paid in cash. 7. Collected the amount due on the account recelvable within the discount period. B. Sold the lend for $4700. Q. Recognized accrued interest income of $550. 10. Took a physical count indicating that $7,100 of imventory was on hand at the end of the accounting period. Hint: Determine the current balance in the inventory account before calculating the amount of the inventory write down. Required: a. Identify each of these events as asset source (AS), asset use (AU), asset exchange (AE), or claims exchange (CE) Also expiain how each event would affect the financial statements by placing a+ for increase, - for decrease, and +1 for increase and decrease under each of the components in the following statements model. Assume thaithe perpetuat inventory method is used. When an evert has more than one part, use letters to distinguish the effects of each par. The first event is recorded as an example b. Record the events in general journal format. Assume that the perpetual invenfory method and gross method is used. c. Post the beginning balances and the events to the T-accounts. Note that these ledger accounts will also be used when posting the clocing entry that is created in Parte. d. Prepare a multistep income statement, a statement of changes in stockholders' equity, a balance sheet, and a statement of cesh flows for Year 2 e. Use a single general journal enty to close all fevenue, gain, and expense accounts to the retained eamings account. Post the journal entry to the ledger accounts and prepare a post-closing trial balance

accounting hw.

accounting hw.