Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hydrangea Metals is a mining company that had been renting out an old sluice box to other small mining operations in the area. However,

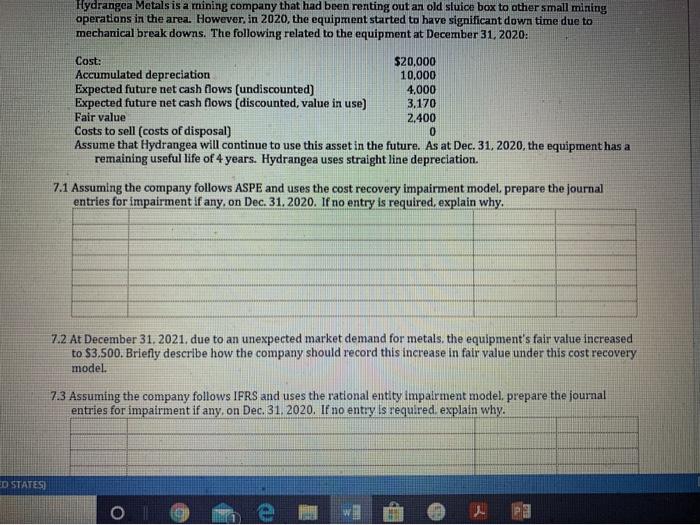

Hydrangea Metals is a mining company that had been renting out an old sluice box to other small mining operations in the area. However, in 2020, the equipment started to have significant down time due to mechanical break downs. The following related to the equipment at December 31, 2020: Cost: Accumulated depreciation Expected future net cash flows (undiscounted) Expected future net cash flows (discounted, value in use) Fair value Costs to sell (costs of disposal) Assume that Hydrangea will continue to use this asset in the future. As at Dec. 31, 2020, the equipment has a remaining useful life of 4 years. Hydrangea uses straight line depreciation. $20,000 10,000 4,000 3,170 2.400 0. 7.1 Assuming the company follows ASPE and uses the cost recovery impairment model, prepare the journal entries for impairment if any, on Dec. 31. 2020. If no entry is required, explain why. 7.2 At December 31, 2021, due to an unexpected market demand for metals, the equipment's fair value increased to $3.500. Briefly describe how the company should record this increase in fair value under this cost recovery model. 7.3 Assuming the company follows IFRS and uses the rational entity impalrment model, prepare the journal entries for impairment if any, on Dec. 31. 2020. If no entry is required. explain why. ED STATES)

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started