Answered step by step

Verified Expert Solution

Question

1 Approved Answer

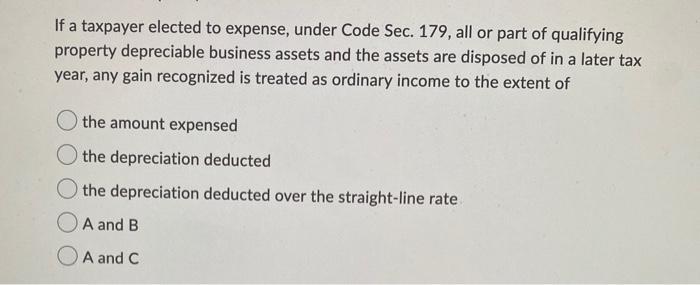

If a taxpayer elected to expense, under Code Sec. 179, all or part of qualifying property depreciable business assets and the assets are disposed

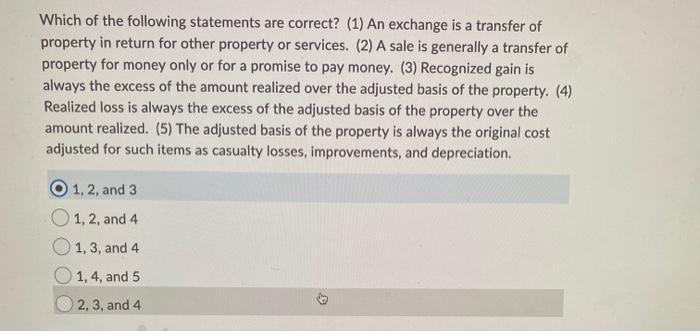

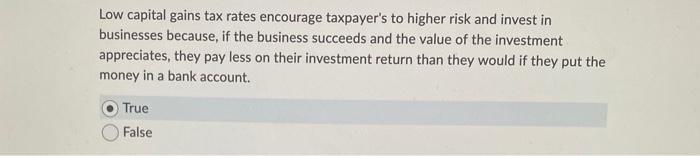

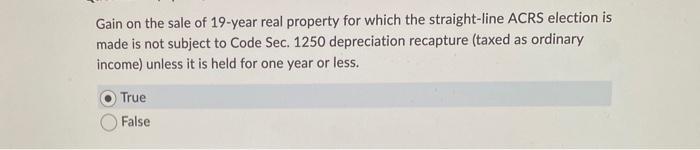

If a taxpayer elected to expense, under Code Sec. 179, all or part of qualifying property depreciable business assets and the assets are disposed of in a later tax year, any gain recognized is treated as ordinary income to the extent of the amount expensed the depreciation deducted O the depreciation deducted over the straight-line rate A and B A and C Which of the following statements are correct? (1) An exchange is a transfer of property in return for other property or services. (2) A sale is generally a transfer of property for money only or for a promise to pay money. (3) Recognized gain is always the excess of the amount realized over the adjusted basis of the property. (4) Realized loss is always the excess of the adjusted basis of the property over the amount realized. (5) The adjusted basis of the property is always the original cost adjusted for such items as casualty losses, improvements, and depreciation. 1, 2, and 3 1, 2, and 4 1, 3, and 4. 1, 4, and 5 2, 3, and 4 Low capital gains tax rates encourage taxpayer's to higher risk and invest in businesses because, if the business succeeds and the value of the investment appreciates, they pay less on their investment return than they would if they put the money in a bank account. True False Gain on the sale of 19-year real property for which the straight-line ACRS election is made is not subject to Code Sec. 1250 depreciation recapture (taxed as ordinary income) unless it is held for one year or less. True False

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 The answer is e A and C The amount expensed is the amount of the deduction taken in the year the p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started