Answered step by step

Verified Expert Solution

Question

1 Approved Answer

? ? Husky Sports Inc. started its business in January 2018. At the beginning of its 2020 calendar-year accounting period, Husky, Inc. had retained earnings

?

?

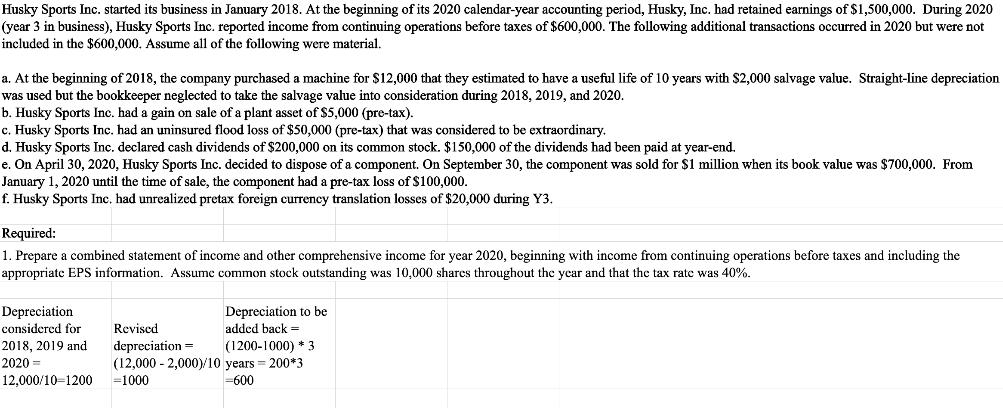

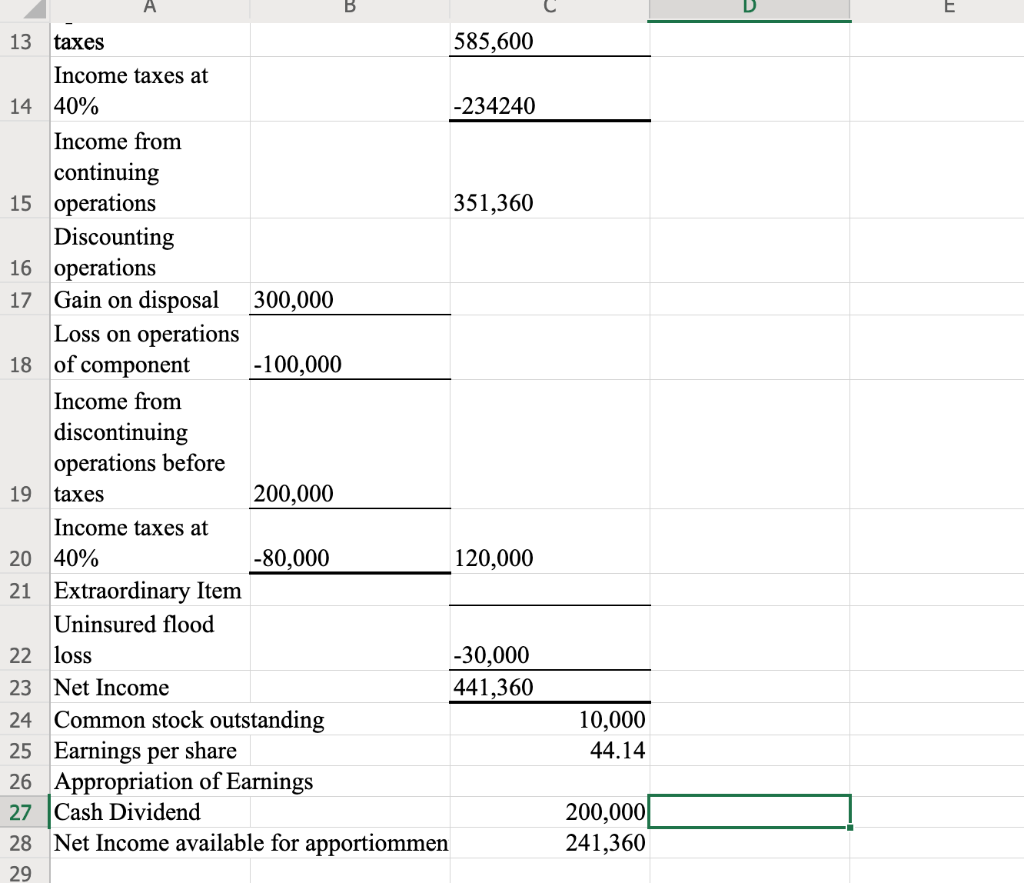

Husky Sports Inc. started its business in January 2018. At the beginning of its 2020 calendar-year accounting period, Husky, Inc. had retained earnings of $1,500,000. During 2020 (year 3 in business), Husky Sports Inc. reported income from continuing operations before taxes of $600,000. The following additional transactions occurred in 2020 but were not included in the $600,000. Assume all of the following were material. a. At the beginning of 2018, the company purchased a machine for $12,000 that they estimated to have a useful life of 10 years with $2,000 salvage value. Straight-line depreciation was used but the bookkeeper neglected to take the salvage value into consideration during 2018, 2019, and 2020. b. Husky Sports Inc. had a gain on sale of a plant asset of $5,000 (pre-tax). c. Husky Sports Inc. had an uninsured flood loss of $50,000 (pre-tax) that was considered to be extraordinary. d. Husky Sports Inc. declared cash dividends of $200,000 on its common stock. $150,000 of the dividends had been paid at year-end. e. On April 30, 2020, Husky Sports Inc. decided to dispose of a component. On September 30, the component was sold for $1 million when its book value was $700,000. From January 1, 2020 until the time of sale, the component had a pre-tax loss of $100,000. f. Husky Sports Inc. had unrealized pretax foreign currency translation losses of $20,000 during Y3. Required: 1. Prepare a combined statement of income and other comprehensive income for year 2020, beginning with income from continuing operations before taxes and including the appropriate EPS information. Assume common stock outstanding was 10,000 shares throughout the year and that the tax rate was 40%. Depreciation considered for 2018, 2019 and 2020 = 12,000/10-1200 Depreciation to be Revised added back = depreciation = (1200-1000) * 3 (12,000 - 2,000)/10 years = 200*3 -1000 -600 13 taxes Income taxes at 14 40% Income from continuing 15 operations Discounting 16 operations 17 Gain on disposal Loss on operations 18 of component Income from discontinuing operations before 19 taxes Income taxes at 20 40% 21 Extraordinary Item Uninsured flood 300,000 -100,000 200,000 -80,000 B 22 loss 23 Net Income 24 25 Earnings per share 26 Appropriation of Earnings 27 Cash Dividend 28 Net Income available for apportiommen 29 Common stock outstanding 585,600 -234240 351,360 120,000 -30,000 441,360 10,000 44.14 200,000 241,360 E 2. Prepare a statement of retained earnings for Husky Sports Inc. for the year ending December 31, 2020. (Hint: Other comprehensive income should not be included in Retained Earnings.)

Step by Step Solution

★★★★★

3.39 Rating (183 Votes )

There are 3 Steps involved in it

Step: 1

Answer Statement of income and other comprehensive income ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started