Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting Information System. Page 1: Page 2: Question: kindly answer question C,d &e. Based on internal control. In your recent assignment, you have approached Sulaman

Accounting Information System.

Page 1:

Page 2:

Question:

kindly answer question C,d &e. Based on internal control.

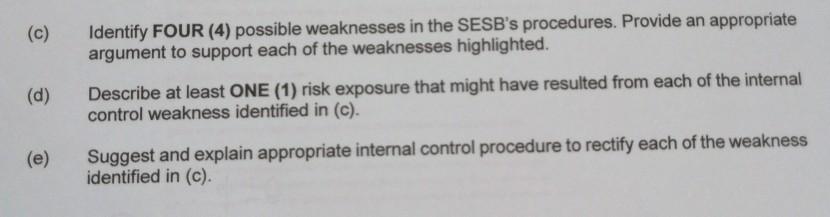

In your recent assignment, you have approached Sulaman Emas Sdn Bhd (SESB) to establish a better understanding of the business processes and the applications of internal control procedures in the business. Your team intended to document and assess applications of internal controls on its sales as well as purchasing activities. For that purpose, you and your team members managed to discuss with Hashim, SESB's general manager. He described the SESB operation as follows: SESB is a direct selling business that focuses on supplying health food and drinks products nationwide. The company has been operating in Alor Setar, Kedah since 2017. The company supplies the products to the company's resellers located in various districts of Kedah. The company currently employs 15 full-time employees to manage its business operation and administration. Meanwhile, the resellers comprise of an individual who has registered with the head office and agreed to order the minimum value of stocks every month. After three years in operation, SESB resellers currently stood at 300 individuals. The reseller places orders to the SESB's office on two to three weeks interval in which SESB will make necessary arrangement for delivery to the respective resellers. The reseller may also drop by to the head office for collecting the orders. Each reseller is granted 30-day credit terms with a varying credit limit, depending on their previous credit performance as well as the value of their monthly order As a trading business, SESB secures the inventories for its business from selected manufacturers. The suppliers produce the products based on the company's specifications and brand name. Similarly, the company also granted 60 days credit term by the suppliers. For more detail description of the procedures, Hashim granted permission for your team to interview the respective person-in-charge of the business procedures. Sales Order To understand this procedure, your team first met with Azlina, the sales officer. She first explained the nature of SESB sales operation. The sales are made to the resellers that have registered with SESB. Each reseller receives a pre-numbered purchase order booklet from SESB office upon its registration. Periodically, the reseller completes the purchase order form for reordering purpose. The reseller specifies the description of the ordered products and the quantity, respectively. The purchase order form is faxed/e-mailed to SESB's head office for processing. The reseller may also bring the purchase order form directly to the head office for ordering purpose. Your team further asked about the process of handling the customer's order. The following description was provided by Azlina: As a sales officer, she is responsible to review and to approve the order made by a reseller. Upon receiving the pre-printed purchase order copy from the reseller, she then checks the reseller's account status by referring to the customer's weekly report file. The accounts unit prepares the customer account's summary report weekly for the sales officer reference. Based on the customer's account record, she approves the reseller's order and transfers the order details into 1 the sales order form (prepared in duplicate carbon copies). She then forwards the original sales order copy to a store executive. Meanwhile, the second sales order copy is filed together with the pre-printed purchase order by the reseller's name. In case of the customer exceeds its credit limit, Azlina remarks the customer's order as 'on hold' and files the customer's purchase order copy into 'Pending Customer's Order' file. She then notifies the customer to clear the pending payment before the order being processed. Your team then met Selamat, the store executive who is responsible for managing inventory and delivery related tasks. As he mentioned, he has two operation employees to help him in his unit. As your team observed, the storeroom area is securely locked and only accessible by the authorised employees. You also noticed that the 2,000 square feet storage area is also equipped with the fire extinguishers and smoke detectors When requested to elaborate further on his responsibilities, he described as follows: Upon receiving the reseller's sales order details, he first checks the inventory card for the current inventory balances. If all the ordered products are available, he then requests the operation employee to pick up the ordered goods from the store shelves based on the verified sales order copy. He then instructs the operation employee to complete a duplicate copy of the delivery note by specifying the sales order details and the delivery agent. The employee also attaches the sales order copy to the packaging. The packed order is kept in the collection area while waiting for the delivery. Selamat's description of the existing delivery procedures are summarised as below: The appointed delivery agent comes to the head office three times a week to collect the packed goods and deliver to the respective reseller. The agent picks up the packed inventories from the operation employee and signs on the delivery note prepared earlier. While the delivery agent retains the second copy of the delivery notes, the operation employee provides the original copy of an annotated delivery note to Selamat for recording purpose. He is responsible to update the respective inventory cards based on the number of units delivered. He then signs the completed delivery note and forwards it to the account officer. Accounts Unit Accounts unit is responsible for handling all cash collection from resellers and processing of cash payment to the vendors. As Hashim indicated, in early last year, the accounts unit has adopted accounting software for managing and accounting records related to purchase and sales transactions. The company, however, uses the software to manage accounting records only. The company is considering extending the use of accounting software for inventory management and payroll in the next few years. You and your team were then introduced to two accounts officers in-charged, Shima and Lissa. The interview has accumulated the following information with regards to cash collection and cash payment procedures as currently practised in SESB. Accounts Receivable and Cash Collection You first met up with Shima, an account officer in-charged for cash collection. As she explained, she administers all accounts receivable related matters. The summarised processes are illustrated as follows: Using accounting software in her office, Shima enters the delivery details into the respective customer's account. She keys in customer details, the product codes and quantity delivered. Upon saving the sales invoice details, the system automatically records the transactions into the sales journal and updates accounts receivable and general ledger master files, respectively. Upon saving the transactions, she requests the accounting system to print two copies of sales invoices. The sales invoice is then mailed to the respective reseller. Finally, she attaches the delivery note with the second copy of the sales invoice and temporarily files the copy into the 'Issued Sales Invoice' file. When further asked of how the customer's payment was processed, Shima responses were summarised as below: The reseller makes payment either via postal cheque or bank transfer on the name of SESB. For payment by postal cheque, the postal cheques first reach Sandra, SESB's front office executive. Sandra sorts out all incoming mails and set aside all cheques received from the incoming mails. She then opens all the mailed cheques, prepares a batch total that summarises the number of 3 cheques and the total amount. The batch total and the compiled cheques are forwarded to Shima for book-keeping purpose. Upon receiving the batch total and cheques from Sandra, she recomputes total cheques received with the amount stated in the batch total to ensure its accuracy. She then matches the cheque with the respective invoice copy from 'Issued Sales invoice' file. As for the customer payment made via bank transfer/online banking, she prints the customer notification e-mail/faxed and identifies the invoice to be knocked-off for the payment made from the same file. Next, she logs in to SESB's accounting system and records the cash collection into cash receipt module of the system. Upon keying in the customer number, the system lists all pending sales invoices for the customer. Shima selects the applicable sales invoice to knock-off the payment received and enters all the details of the payment received. Upon saving the cash receipt transactions, the accounting system automatically records the transactions into the cash receipt file, updates the respective customer master file and posts the transactions onto the applicable general ledger master files. Finally, Shima prints the cash collection report for the day and compares the amount recorded with the batch total summary. She then crosses the sales invoice as PAID and files it together with the batch total and the report) into the 'Paid Sales Invoice' file by date. One of the team members asked about how the unit handles the cheque deposit. Shima further indicated that she passes the collected cheques to Asyilla, an account officer, for depositing the collection into the company's bank account. On every Thursday, Asyilla fills in the pre-printed cash deposit slip in three copies) for each cheque received and brings the cheques and deposit slips to the bank. Upon depositing the cheques, she keeps the deposit slip (customer's copy) into a 'bank deposit' file. When asked whether any reports produced at the end of the month concerning resellers transactions, Shima highlighted that she prints out the sales order summary report, cash receipt report and customer ageing report at the end of the month and forwards the reports to the general manager. (c) Identify FOUR (4) possible weaknesses in the SESB's procedures. Provide an appropriate argument to support each of the weaknesses highlighted. (d) Describe at least ONE (1) risk exposure that might have resulted from each of the internal control weakness identified in (c). Suggest and explain appropriate internal control procedure to rectify each of the weakness identified in (c) In your recent assignment, you have approached Sulaman Emas Sdn Bhd (SESB) to establish a better understanding of the business processes and the applications of internal control procedures in the business. Your team intended to document and assess applications of internal controls on its sales as well as purchasing activities. For that purpose, you and your team members managed to discuss with Hashim, SESB's general manager. He described the SESB operation as follows: SESB is a direct selling business that focuses on supplying health food and drinks products nationwide. The company has been operating in Alor Setar, Kedah since 2017. The company supplies the products to the company's resellers located in various districts of Kedah. The company currently employs 15 full-time employees to manage its business operation and administration. Meanwhile, the resellers comprise of an individual who has registered with the head office and agreed to order the minimum value of stocks every month. After three years in operation, SESB resellers currently stood at 300 individuals. The reseller places orders to the SESB's office on two to three weeks interval in which SESB will make necessary arrangement for delivery to the respective resellers. The reseller may also drop by to the head office for collecting the orders. Each reseller is granted 30-day credit terms with a varying credit limit, depending on their previous credit performance as well as the value of their monthly order As a trading business, SESB secures the inventories for its business from selected manufacturers. The suppliers produce the products based on the company's specifications and brand name. Similarly, the company also granted 60 days credit term by the suppliers. For more detail description of the procedures, Hashim granted permission for your team to interview the respective person-in-charge of the business procedures. Sales Order To understand this procedure, your team first met with Azlina, the sales officer. She first explained the nature of SESB sales operation. The sales are made to the resellers that have registered with SESB. Each reseller receives a pre-numbered purchase order booklet from SESB office upon its registration. Periodically, the reseller completes the purchase order form for reordering purpose. The reseller specifies the description of the ordered products and the quantity, respectively. The purchase order form is faxed/e-mailed to SESB's head office for processing. The reseller may also bring the purchase order form directly to the head office for ordering purpose. Your team further asked about the process of handling the customer's order. The following description was provided by Azlina: As a sales officer, she is responsible to review and to approve the order made by a reseller. Upon receiving the pre-printed purchase order copy from the reseller, she then checks the reseller's account status by referring to the customer's weekly report file. The accounts unit prepares the customer account's summary report weekly for the sales officer reference. Based on the customer's account record, she approves the reseller's order and transfers the order details into 1 the sales order form (prepared in duplicate carbon copies). She then forwards the original sales order copy to a store executive. Meanwhile, the second sales order copy is filed together with the pre-printed purchase order by the reseller's name. In case of the customer exceeds its credit limit, Azlina remarks the customer's order as 'on hold' and files the customer's purchase order copy into 'Pending Customer's Order' file. She then notifies the customer to clear the pending payment before the order being processed. Your team then met Selamat, the store executive who is responsible for managing inventory and delivery related tasks. As he mentioned, he has two operation employees to help him in his unit. As your team observed, the storeroom area is securely locked and only accessible by the authorised employees. You also noticed that the 2,000 square feet storage area is also equipped with the fire extinguishers and smoke detectors When requested to elaborate further on his responsibilities, he described as follows: Upon receiving the reseller's sales order details, he first checks the inventory card for the current inventory balances. If all the ordered products are available, he then requests the operation employee to pick up the ordered goods from the store shelves based on the verified sales order copy. He then instructs the operation employee to complete a duplicate copy of the delivery note by specifying the sales order details and the delivery agent. The employee also attaches the sales order copy to the packaging. The packed order is kept in the collection area while waiting for the delivery. Selamat's description of the existing delivery procedures are summarised as below: The appointed delivery agent comes to the head office three times a week to collect the packed goods and deliver to the respective reseller. The agent picks up the packed inventories from the operation employee and signs on the delivery note prepared earlier. While the delivery agent retains the second copy of the delivery notes, the operation employee provides the original copy of an annotated delivery note to Selamat for recording purpose. He is responsible to update the respective inventory cards based on the number of units delivered. He then signs the completed delivery note and forwards it to the account officer. Accounts Unit Accounts unit is responsible for handling all cash collection from resellers and processing of cash payment to the vendors. As Hashim indicated, in early last year, the accounts unit has adopted accounting software for managing and accounting records related to purchase and sales transactions. The company, however, uses the software to manage accounting records only. The company is considering extending the use of accounting software for inventory management and payroll in the next few years. You and your team were then introduced to two accounts officers in-charged, Shima and Lissa. The interview has accumulated the following information with regards to cash collection and cash payment procedures as currently practised in SESB. Accounts Receivable and Cash Collection You first met up with Shima, an account officer in-charged for cash collection. As she explained, she administers all accounts receivable related matters. The summarised processes are illustrated as follows: Using accounting software in her office, Shima enters the delivery details into the respective customer's account. She keys in customer details, the product codes and quantity delivered. Upon saving the sales invoice details, the system automatically records the transactions into the sales journal and updates accounts receivable and general ledger master files, respectively. Upon saving the transactions, she requests the accounting system to print two copies of sales invoices. The sales invoice is then mailed to the respective reseller. Finally, she attaches the delivery note with the second copy of the sales invoice and temporarily files the copy into the 'Issued Sales Invoice' file. When further asked of how the customer's payment was processed, Shima responses were summarised as below: The reseller makes payment either via postal cheque or bank transfer on the name of SESB. For payment by postal cheque, the postal cheques first reach Sandra, SESB's front office executive. Sandra sorts out all incoming mails and set aside all cheques received from the incoming mails. She then opens all the mailed cheques, prepares a batch total that summarises the number of 3 cheques and the total amount. The batch total and the compiled cheques are forwarded to Shima for book-keeping purpose. Upon receiving the batch total and cheques from Sandra, she recomputes total cheques received with the amount stated in the batch total to ensure its accuracy. She then matches the cheque with the respective invoice copy from 'Issued Sales invoice' file. As for the customer payment made via bank transfer/online banking, she prints the customer notification e-mail/faxed and identifies the invoice to be knocked-off for the payment made from the same file. Next, she logs in to SESB's accounting system and records the cash collection into cash receipt module of the system. Upon keying in the customer number, the system lists all pending sales invoices for the customer. Shima selects the applicable sales invoice to knock-off the payment received and enters all the details of the payment received. Upon saving the cash receipt transactions, the accounting system automatically records the transactions into the cash receipt file, updates the respective customer master file and posts the transactions onto the applicable general ledger master files. Finally, Shima prints the cash collection report for the day and compares the amount recorded with the batch total summary. She then crosses the sales invoice as PAID and files it together with the batch total and the report) into the 'Paid Sales Invoice' file by date. One of the team members asked about how the unit handles the cheque deposit. Shima further indicated that she passes the collected cheques to Asyilla, an account officer, for depositing the collection into the company's bank account. On every Thursday, Asyilla fills in the pre-printed cash deposit slip in three copies) for each cheque received and brings the cheques and deposit slips to the bank. Upon depositing the cheques, she keeps the deposit slip (customer's copy) into a 'bank deposit' file. When asked whether any reports produced at the end of the month concerning resellers transactions, Shima highlighted that she prints out the sales order summary report, cash receipt report and customer ageing report at the end of the month and forwards the reports to the general manager. (c) Identify FOUR (4) possible weaknesses in the SESB's procedures. Provide an appropriate argument to support each of the weaknesses highlighted. (d) Describe at least ONE (1) risk exposure that might have resulted from each of the internal control weakness identified in (c). Suggest and explain appropriate internal control procedure to rectify each of the weakness identified in (c)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started