Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the recession in mid - 2 0 0 9 , homebuilder KB Home had outstanding 6 - year bonds with a yield to maturity

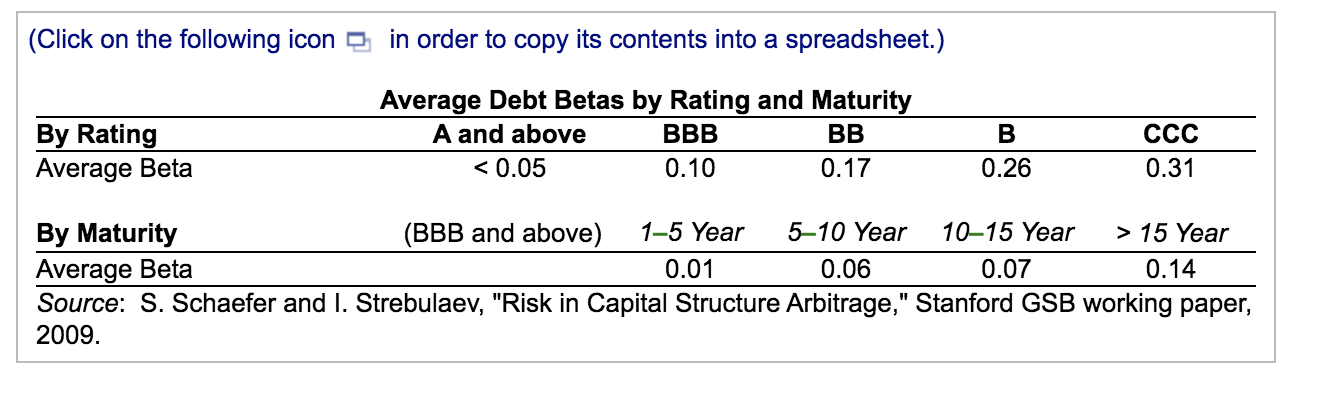

During the recession in mid homebuilder KB Home had outstanding year bonds with a yield to maturity of and a BB rating. If corresponding riskfree rates were and the market risk premium was estimate the expected return of KB Home's debt using two different methods. How do your results compare? Click on the following icon in order to copy its contents into a spreadsheet.

Annual Default Rates by Debt Rating

Source: "Corporate Defaults and Recovery Rates, Moody's Global Credit Policy, February

Note: the average loss rate for unsecured debt is about See annual default rates by debt rating here LOADING... and average debt betas by rating and maturity here LOADING....

Question content area bottom

Part

Considering the probability of default, the expected return of the bond is

enter your response hereRound to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started