Answered step by step

Verified Expert Solution

Question

1 Approved Answer

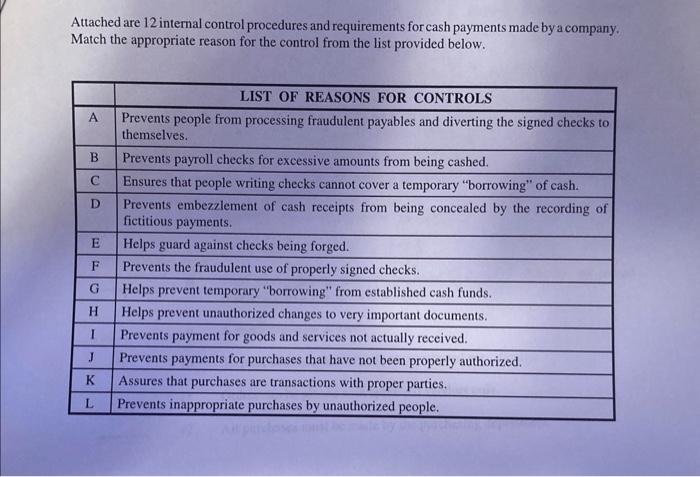

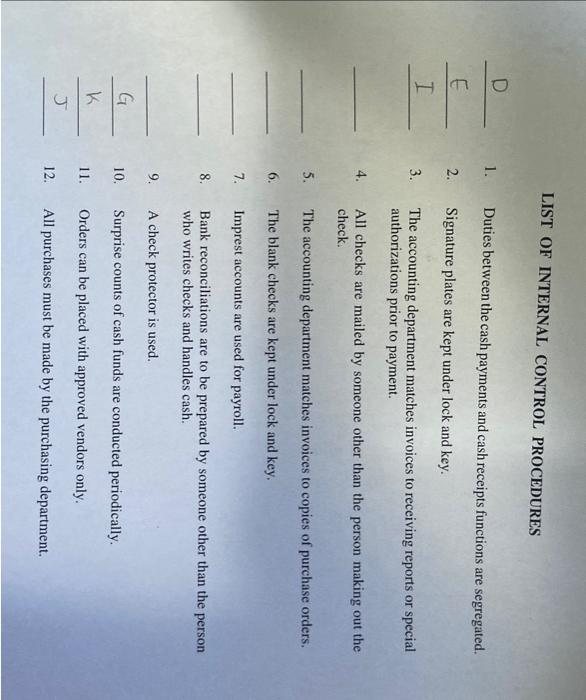

Accounting information systems Attached are 12 internal control procedures and requirements for cash payments made by a company. Match the appropriate reason for the control

Accounting information systems

Attached are 12 internal control procedures and requirements for cash payments made by a company. Match the appropriate reason for the control from the list provided below. LIST OF INTERNAL CONTROL PROCEDURES 1. Duties between the cash payments and cash receipts functions are segregated. E 2. Signature plates are kept under lock and key. I 3. The accounting department matches invoices to receiving reports or special authorizations prior to payment. 4. All checks are mailed by someone other than the person making out the check. 5. The accounting department matches invoices to copies of purchase orders. 6. The blank checks are kept under lock and key. 7. Imprest accounts are used for payroll. 8. Bank reconciliations are to be prepared by someone other than the person who writes checks and handles cash. 9. A check protector is used. G 10. Surprise counts of cash funds are conducted periodically. K 11. Orders can be placed with approved vendors only. 12. All purchases must be made by the purchasing department

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started