Answered step by step

Verified Expert Solution

Question

1 Approved Answer

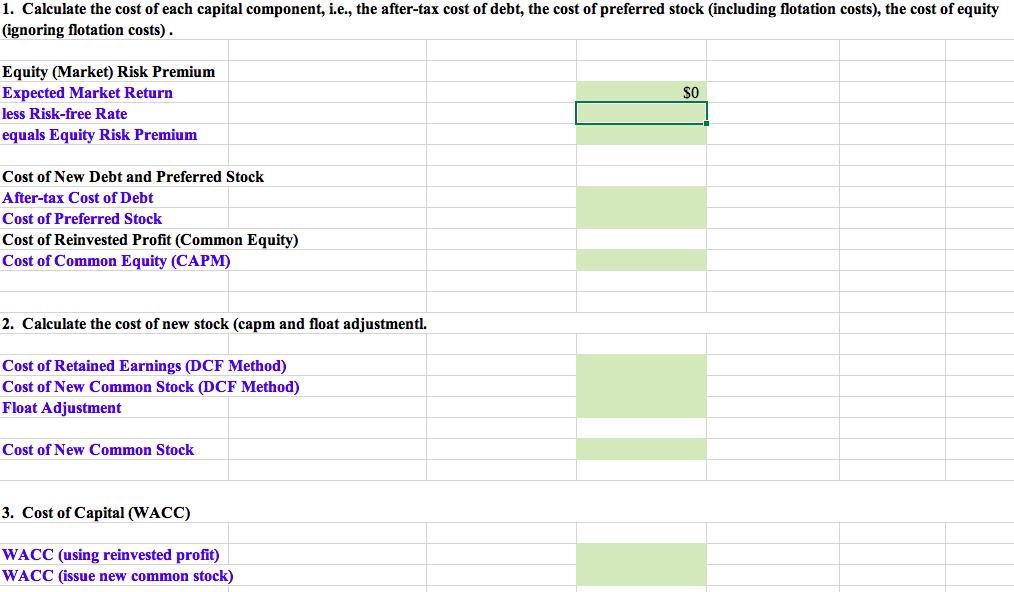

1. Calculate the cost of each capital component, i.e., the after-tax cost of debt, the cost of preferred stock (including flotation costs), the cost

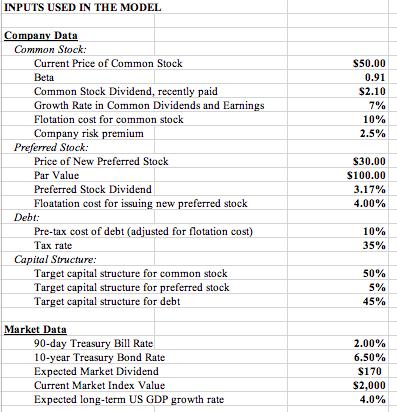

1. Calculate the cost of each capital component, i.e., the after-tax cost of debt, the cost of preferred stock (including flotation costs), the cost of equity (ignoring flotation costs). Equity (Market) Risk Premium Expected Market Return less Risk-free Rate equals Equity Risk Premium Cost of New Debt and Preferred Stock After-tax Cost of Debt Cost of Preferred Stock Cost of Reinvested Profit (Common Equity) Cost of Common Equity (CAPM) 2. Calculate the cost of new stock (capm and float adjustmentl. Cost of Retained Earnings (DCF Method) Cost of New Common Stock (DCF Method) Float Adjustment Cost of New Common Stock 3. Cost of Capital (WACC) WACC (using reinvested profit) WACC (issue new common stock) SO INPUTS USED IN THE MODEL Company Data Common Stock: Current Price of Common Stock Beta Common Stock Dividend, recently paid Growth Rate in Common Dividends and Earnings Flotation cost for common stock Company risk premium Preferred Stock: Price of New Preferred Stock Par Value Preferred Stock Dividend Floatation cost for issuing new preferred stock Debt: Pre-tax cost of debt (adjusted for flotation cost) Tax rate Capital Structure: Target capital structure for common stock Target capital structure for preferred stock Target capital structure for debt Market Data 90-day Treasury Bill Rate) 10-year Treasury Bond Rate Expected Market Dividend. Current Market Index Value Expected long-term US GDP growth rate $50.00 0.91 $2.10 7% 10% 2.5% $30.00 $100.00 3.17% 4.00% 10% 35% 50% 5% 45% 2.00% 6.50% $170 $2,000 4.0%

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Cost of New Debt The aftertax cost of debt is calculated by taking the pretax cost of debt 10 and subtracting the tax shield benefit of interest payments 35 yielding an aftertax cost of debt of 65 Cos...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started