Question

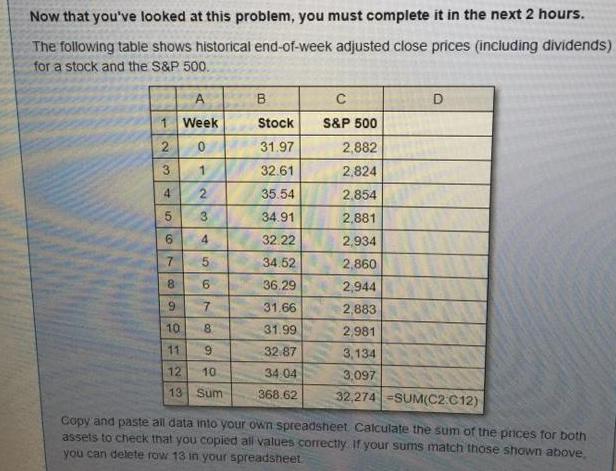

What is the standard deviation of weekly returns for such a portfolio if you rebalanced every week? Now that you've looked at this problem, you

What is the standard deviation of weekly returns for such a portfolio if you rebalanced every week?

Now that you've looked at this problem, you must complete it in the next 2 hours. The following table shows historical end-of-week adjusted close prices (inciuding dividends) for a stock and the S&P 500. A B 1 Week Stock S&P 500 31.97 2,882 3. 32.61 2,824 4 2 35.54 2.854 3. 34.91 2,881 6. 4 32.22 2,934 34.52 2,860 8. 6. 36.29 2,944 9. 31.66 2,883 10 8. 31.99 2,981 11 32.87 3,134 12 10 34.04 3.097 13 Sum 32,274 =SUM(C2 C12) 368.62 Copy'and paste all data into your own spreadsheet Calculate the sum of the prices for both assets to check that you copied all values correctly if your sums match those shown above you can delete row 13 in your spreadsheet 700 5. 7.

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Organic Chemistry

Authors: Paula Yurkanis Bruice

4th edition

131407481, 978-0131407480

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App