Answered step by step

Verified Expert Solution

Question

1 Approved Answer

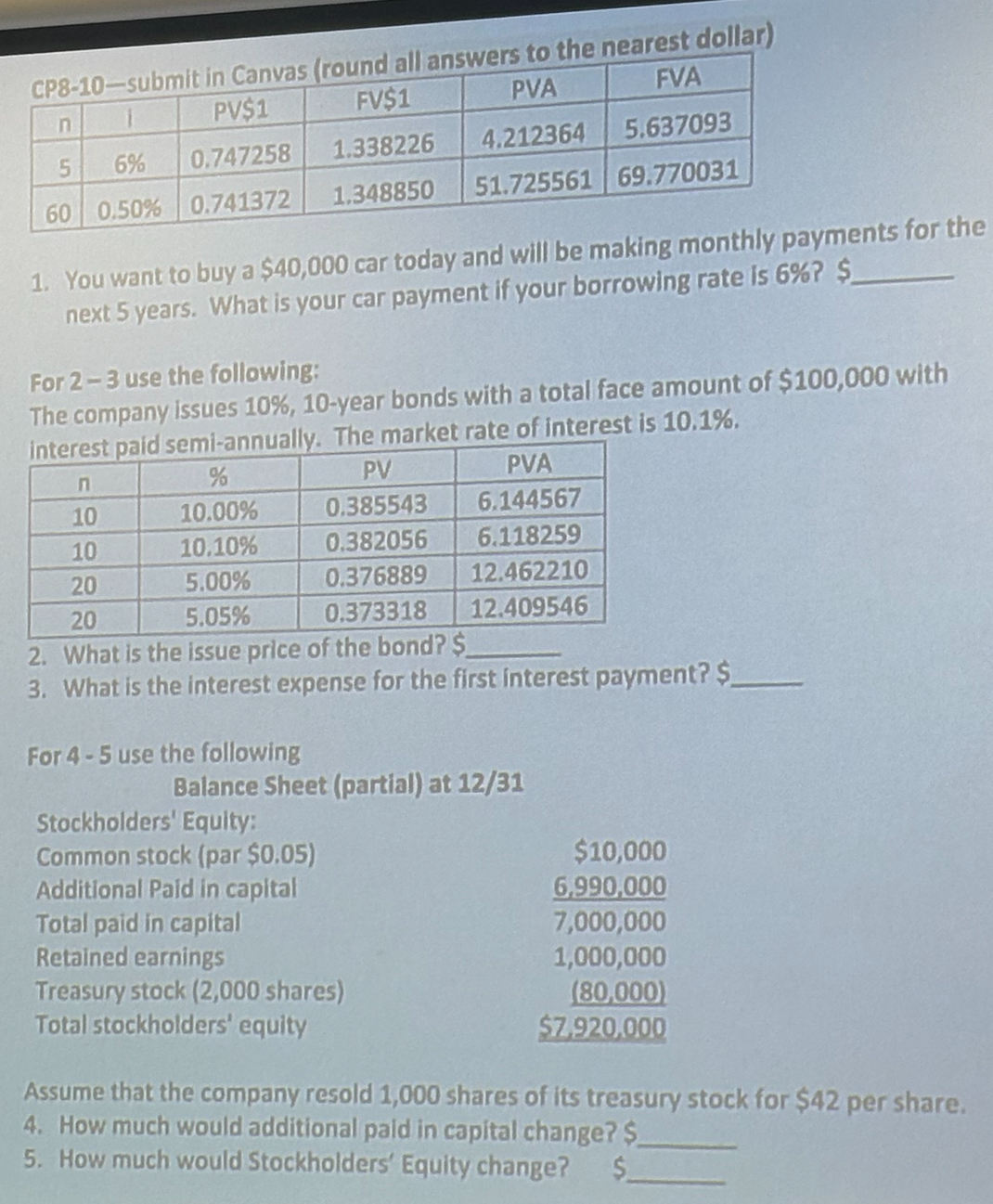

CP8-10-submit in Canvas (round all answers to the nearest dollar) n PV$1 FV$1 PVA FVA 5 6% 0.747258 4.212364 1.338226 5.637093 60 0.50% 0.741372

CP8-10-submit in Canvas (round all answers to the nearest dollar) n PV$1 FV$1 PVA FVA 5 6% 0.747258 4.212364 1.338226 5.637093 60 0.50% 0.741372 1.348850 51.725561 69.770031 1. You want to buy a $40,000 car today and will be making monthly payments for the next 5 years. What is your car payment if your borrowing rate is 6%? $ For 2-3 use the following: The company issues 10%, 10-year bonds with a total face amount of $100,000 with interest paid semi-annually. The market rate of interest is 10.1%. n % PV PVA 10 10.00% 0.385543 6.144567 10 10.10% 0.382056 6.118259 20 5.00% 0.376889 12.462210 20 5.05% 0.373318 12.409546 2. What is the issue price of the bond? $ 3. What is the interest expense for the first interest payment? $ For 4-5 use the following Balance Sheet (partial) at 12/31 Stockholders' Equity: Common stock (par $0.05) Additional Paid in capital Total paid in capital Retained earnings Treasury stock (2,000 shares) $10,000 6,990,000 7,000,000 1,000,000 (80,000) $7,920,000 Total stockholders' equity Assume that the company resold 1,000 shares of its treasury stock for $42 per share. 4. How much would additional paid in capital change? $ 5. How much would Stockholders' Equity change? $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 The formula to calculate the monthly payment for a loan is P r PV 1 1 rn where P monthly payment r monthly interest rate annual interest rate 12 PV present value loan amount n number of payments In ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started