On 1 July 2014, Robert plc acquired 80% of the ordinary share capital of Plant Limited by way of a share exchange. Robert plc

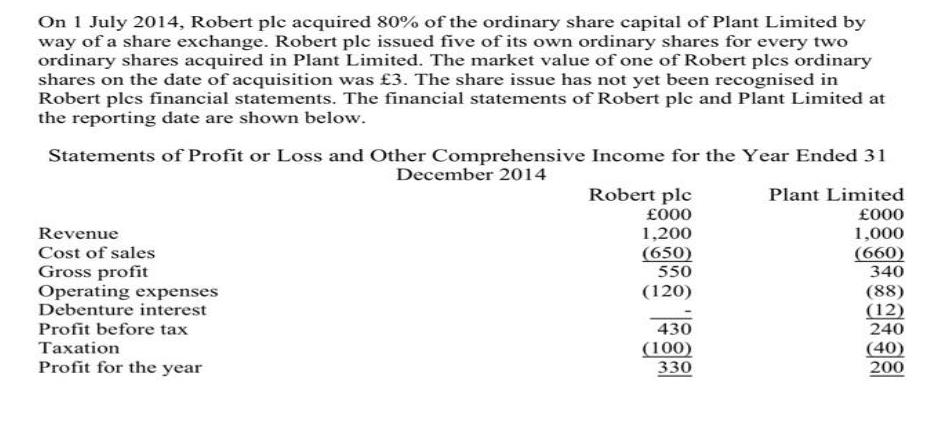

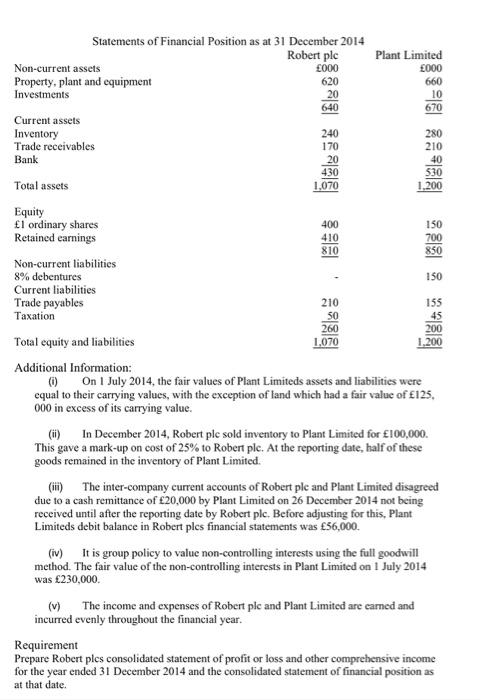

On 1 July 2014, Robert plc acquired 80% of the ordinary share capital of Plant Limited by way of a share exchange. Robert plc issued five of its own ordinary shares for every two ordinary shares acquired in Plant Limited. The market value of one of Robert plcs ordinary shares on the date of acquisition was 3. The share issue has not yet been recognised in Robert plcs financial statements. The financial statements of Robert plc and Plant Limited at the reporting date are shown below. Statements of Profit or Loss and Other Comprehensive Income for the Year Ended 31 December 2014 Robert plc 000 Plant Limited 000 Revenue 1,200 (650) 550 1,000 (660) 340 Cost of sales Gross profit Operating expenses Debenture interest (120) Profit before tax Taxation Profit for the year 430 (100) 330 (88) (12) 240 (40) 200 Statements of Financial Position as at 31 December 2014 Robert ple Plant Limited Non-current assets 000 000 Property, plant and equipment Investments 620 20 660 10 670 640 Current assets Inventory Trade receivables Bank 240 280 170 210 20 430 40 530 Total assets 1,070 1.200 Equity l ordinary shares Retained earnings 400 150 700 410 810 850 Non-current liabilities 8% debentures Current liabilities 150 Trade payables Taxation 210 155 50 260 1070 45 200 1,200 Total equity and liabilities Additional Information: 0 On I July 2014, the fair values of Plant Limiteds assets and liabilities were equal to their carrying values, with the exception of land which had a fair value of 125, 000 in excess of its carrying value. (i) In December 2014, Robert ple sold inventory to Plant Limited for 100,000. This gave a mark-up on cost of 25% to Robert ple. At the reporting date, half of these goods remained in the inventory of Plant Limited. (ii) The inter-company current accounts of Robert ple and Plant Limited disagreed due to a cash remittance of 20,000 by Plant Limited on 26 December 2014 not being received until after the reporting date by Robert ple. Before adjusting for this, Plant Limiteds debit balance in Robert ples financial statements was 56,000. (iv) It is group policy to value non-controlling interests using the full goodwill method. The fair value of the non-controlling interests in Plant Limited on 1 July 2014 was 230,000. (v) The income and expenses of Robert ple and Plant Limited are carmed and incurred evenly throughout the financial year. Requirement Prepare Robert plcs consolidated statement of profit or loss and other comprehensive income for the year ended 31 December 2014 and the consolidated statement of financial position as at that date.

Step by Step Solution

3.52 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The Consolidated Statement of Profit or Loss and Other Comprehensive Income will show the results derived from operations with parties external to the group of entities The effects of all the intra gr...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started