Question

ACCOUNTING Jason Jones wants to start his own business providing computer security to small businesses. He is an experienced IT professional who has written several

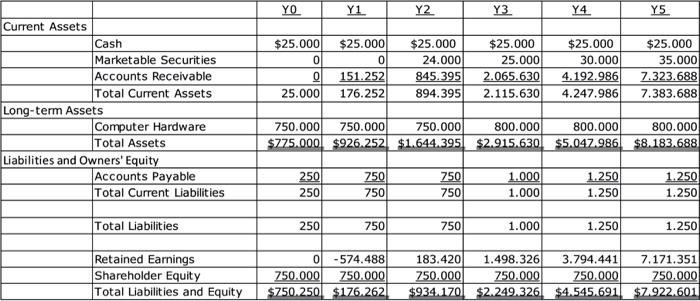

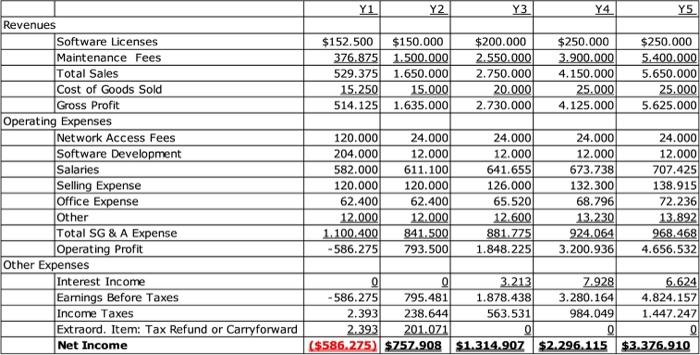

Jason Jones wants to start his own business providing computer security to small businesses. He is an experienced IT professional who has written several software programs that offer digital protection for small networks. Jones plans to license his current software and hire programmers to develop related network security products. He has prepared a business plan with the pro forma financials liste below.

Balance Sheet

He has called you to help him because his balance sheet does not balance.

ANALYZE Jasons strategic business plan as reflected in his pro forma financials by identifying the expected growth in Jasons forecast income and expense.

RELATE this growth to the capital he expects to invest.

EXPLAIN what he needs to do to get his balance sheet to balance.

IDENTIFY any other problems you see with his financials.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started