Question

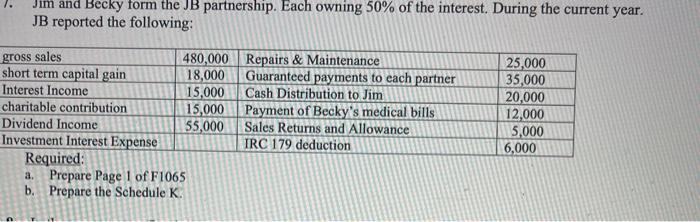

and Becky form the JB partnership. Each owning 50% of the interest. During the current year. JB reported the following: gross sales short term

and Becky form the JB partnership. Each owning 50% of the interest. During the current year. JB reported the following: gross sales short term capital gain Interest Income charitable contribution Dividend Income Investment Interest Expense Required: 480,000 18,000 15,000 15,000 55,000 a. Prepare Page 1 of F1065 b. Prepare the Schedule K. Repairs & Maintenance Guaranteed payments to each partner Cash Distribution to Jim Payment of Becky's medical bills Sales Returns and Allowance IRC 179 deduction 25,000 35,000 20,000 12,000 5,000 6,000

Step by Step Solution

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a JB Partnership Part I Summary of Partnership IncomeLoss Gross sales 480000 Repairs Maintenance 250...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Taxation For Decision Makers 2014

Authors: Shirley Dennis Escoffier, Karen Fortin

6th Edition

978-1118654545

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App