Answered step by step

Verified Expert Solution

Question

1 Approved Answer

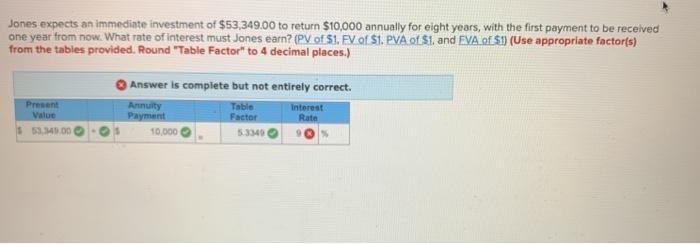

Jones expects an immediate investment of $53,349.00 to return $10,000 annually for eight years, with the first payment to be received one year from

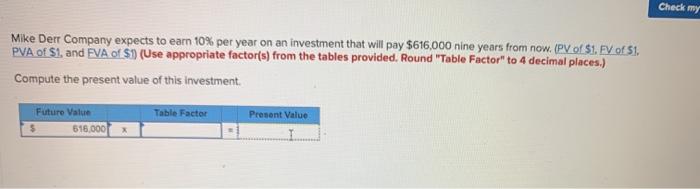

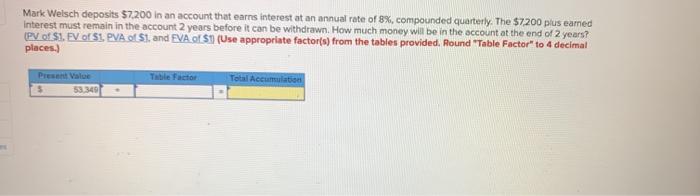

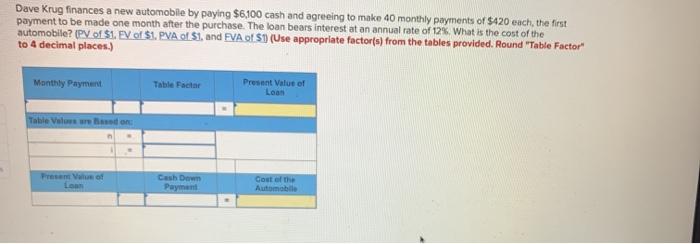

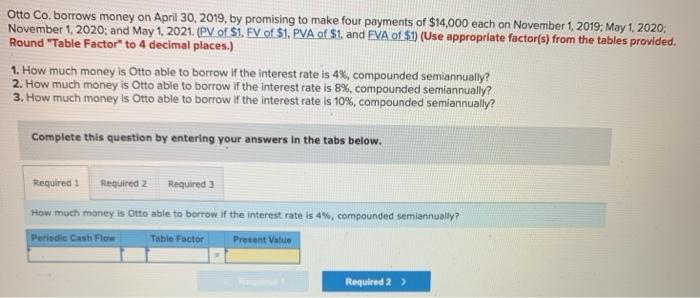

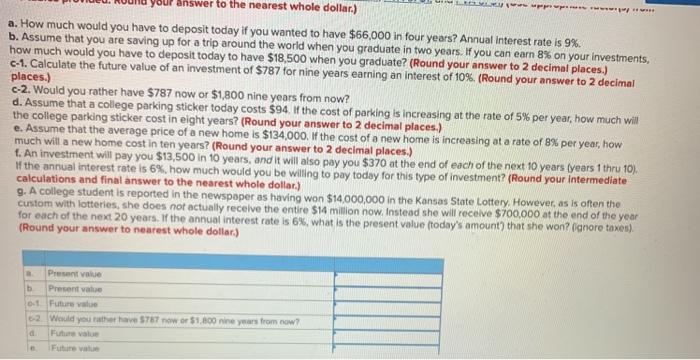

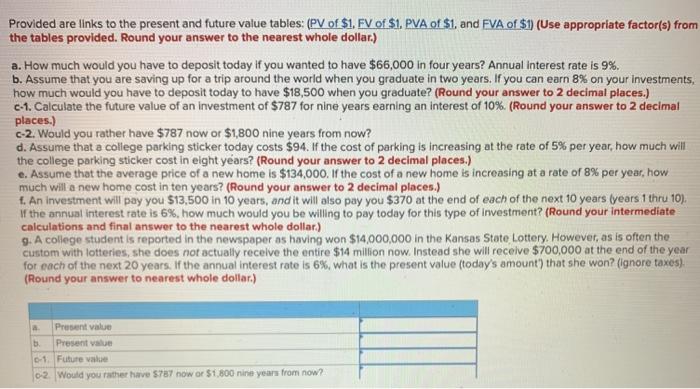

Jones expects an immediate investment of $53,349.00 to return $10,000 annually for eight years, with the first payment to be received one year from now. What rate of interest must Jones earn? (PV of $1. FV of $1. PVA of $1. and EVA of $1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) Present Value $ 53.349.00 Answer is complete but not entirely correct. Table Factor Annuity Payment 10,000 5.3349 Interest Rate Mike Derr Company expects to earn 10% per year on an investment that will pay $616,000 nine years from now. (PV of $1. FV of $1, PVA of $1, and EVA of $1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) Compute the present value of this investment. Future Value 616,000 X Table Factor Present Value Check my Mark Welsch deposits $7,200 in an account that earns interest at an annual rate of 8%, compounded quarterly. The $7,200 plus earned interest must remain in the account 2 years before it can be withdrawn. How much money will be in the account at the end of 2 years? (PV of $1. FV of $1. PVA of $1. and EVA of $1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) Present Value 53,349 Table Factor Total Accumulation Dave Krug finances a new automobile by paying $6,100 cash and agreeing to make 40 monthly payments of $420 each, the first payment to be made one month after the purchase. The loan bears interest at an annual rate of 12%. What is the cost of the automobile? (PV of $1. EV of $1. PVA of $1, and EVA of $1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) Monthly Payment Table Values are Based on: n Present Value of Loan . Table Factor Cash Down Present Value of Loon Cost of the Automobile Otto Co. borrows money on April 30, 2019, by promising to make four payments of $14,000 each on November 1, 2019; May 1, 2020; November 1, 2020; and May 1, 2021. (PV of $1. FV of $1. PVA of $1. and EVA of $1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) 1. How much money is Otto able to borrow if the interest rate is 4%, compounded semiannually? 2. How much money is Otto able to borrow if the interest rate is 8%, compounded semiannually? 3. How much money is Otto able to borrow if the interest rate is 10%, compounded semiannually? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 How much money is Otto able to borrow if the interest rate is 4%, compounded semiannually? Periodic Cash Flow Table Factor Present Value Required 2 > our answer to the nearest whole dollar.) a. How much would you have to deposit today if you wanted to have $66,000 in four years? Annual interest rate is 9%. b. Assume that you are saving up for a trip around the world when you graduate in two years. If you can earn 8% on your investments, how much would you have to deposit today to have $18,500 when you graduate? (Round your answer to 2 decimal places.) c-1. Calculate the future value of an investment of $787 for nine years earning an interest of 10%. (Round your answer to 2 decimal places.) Le paper per ww c-2. Would you rather have $787 now or $1,800 nine years from now? d. Assume that a college parking sticker today costs $94. If the cost of parking is increasing at the rate of 5% per year, how much will the college parking sticker cost in eight years? (Round your answer to 2 decimal places.) R. Present value b Present value 0-1 Future value 6-2 Would you rather have $787 now or $1,800 nine years from now? d Future value e Future value e. Assume that the average price of a new home is $134,000. If the cost of a new home is increasing at a rate of 8% per year, how much will a new home cost in ten years? (Round your answer to 2 decimal places.) f. An investment will pay you $13,500 in 10 years, and it will also pay you $370 at the end of each of the next 10 years (years 1 thru 10). If the annual interest rate is 6%, how much would you be willing to pay today for this type of investment? (Round your intermediate calculations and final answer to the nearest whole dollar.) g. A college student is reported in the newspaper as having won $14,000,000 in the Kansas State Lottery. However, as is often the custom with lotteries, she does not actually receive the entire $14 million now. Instead she will receive $700,000 at the end of the year for each of the next 20 years. If the annual interest rate is 6%, what is the present value (today's amount) that she won? (ignore taxes). (Round your answer to nearest whole dollar.) Provided are links to the present and future value tables: (PV of $1, FV of $1. PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your answer to the nearest whole dollar.) a. How much would you have to deposit today if you wanted to have $66,000 in four years? Annual interest rate is 9%. b. Assume that you are saving up for a trip around the world when you graduate in two years. If you can earn 8% on your investments, how much would you have to deposit today to have $18,500 when you graduate? (Round your answer to 2 decimal places.) c-1. Calculate the future value of an investment of $787 for nine years earning an interest of 10%. (Round your answer to 2 decimal places.) c-2. Would you rather have $787 now or $1,800 nine years from now? d. Assume that a college parking sticker today costs $94. If the cost of parking is increasing at the rate of 5% per year, how much will the college parking sticker cost in eight years? (Round your answer to 2 decimal places.) e. Assume that the average price of a new home is $134,000. If the cost of a new home is increasing at a rate of 8% per year, how much will a new home cost in ten years? (Round your answer to 2 decimal places.) f. An investment will pay you $13,500 in 10 years, and it will also pay you $370 at the end of each of the next 10 years (years 1 thru 10). If the annual interest rate is 6%, how much would you be willing to pay today for this type of investment? (Round your intermediate calculations and final answer to the nearest whole dollar.) g. A college student is reported in the newspaper as having won $14,000,000 in the Kansas State Lottery. However, as is often the custom with lotteries, she does not actually receive the entire $14 million now. Instead she will receive $700,000 at the end of the year. for each of the next 20 years. If the annual interest rate is 6%, what is the present value (today's amount) that she won? (ignore taxes). (Round your answer to nearest whole dollar.) Present value b. Present value 0-1. Future value 0-2 Would you rather have $787 now or $1,800 nine years from now? A

Step by Step Solution

★★★★★

3.56 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started