Question

South Texas Frackers has an incremental borrowing rate of 5%. South Texas Frackers is considering the following lease to acquire a standard drill with

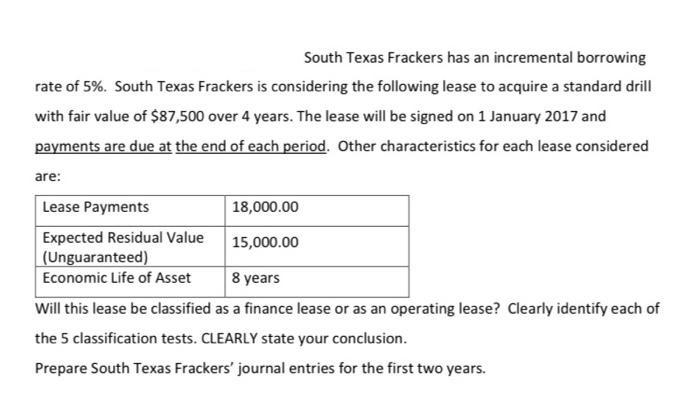

South Texas Frackers has an incremental borrowing rate of 5%. South Texas Frackers is considering the following lease to acquire a standard drill with fair value of $87,500 over 4 years. The lease will be signed on 1 January 2017 and payments are due at the end of each period. Other characteristics for each lease considered are: Lease Payments 18,000.00 Expected Residual Value |(Unguaranteed) Economic Life of Asset 15,000.00 8 years Will this lease be classified as a finance lease or as an operating lease? Clearly identify each of the 5 classification tests. CLEARLY state your conclusion. Prepare South Texas Frackers' journal entries for the first two years.

Step by Step Solution

3.57 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

31Dec17 Lease Liability 18000 Bank 18000 Lease Liabilit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting And Analysis Using Financial Accounting Information

Authors: Charles H Gibson

12th Edition

1439080607, 978-1439080603

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App