Answered step by step

Verified Expert Solution

Question

1 Approved Answer

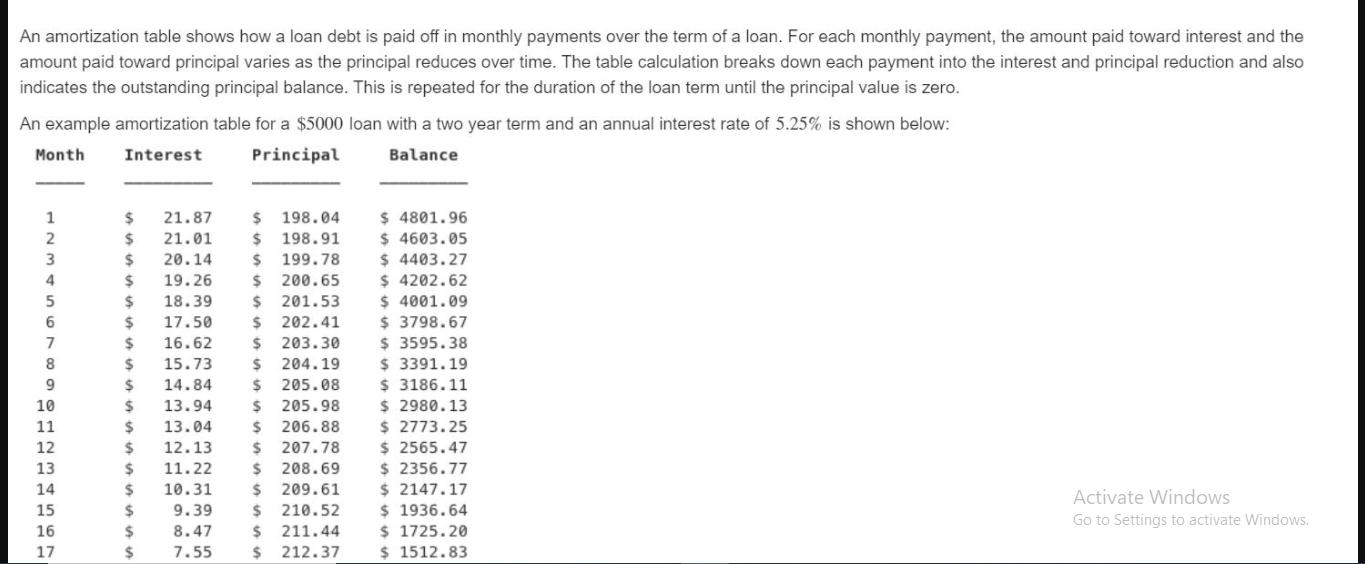

An amortization table shows how a loan debt is paid off in monthly payments over the term of a loan. For each monthly payment,

![Function > 1 function [Payment, Interest, Principal, Balance] = amortization (LoanAmount, AnnualInterest](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/01/61ea5dfc91369_1642749435681.jpg)

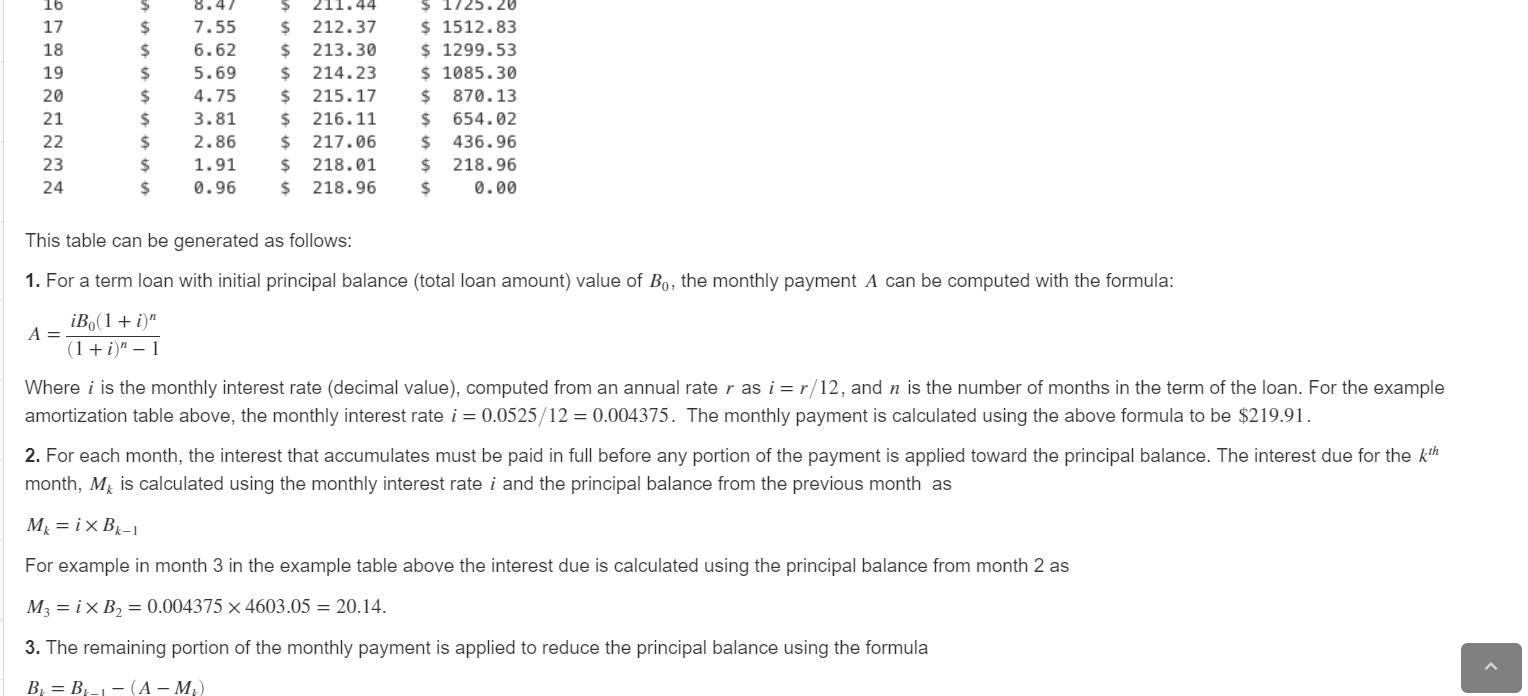

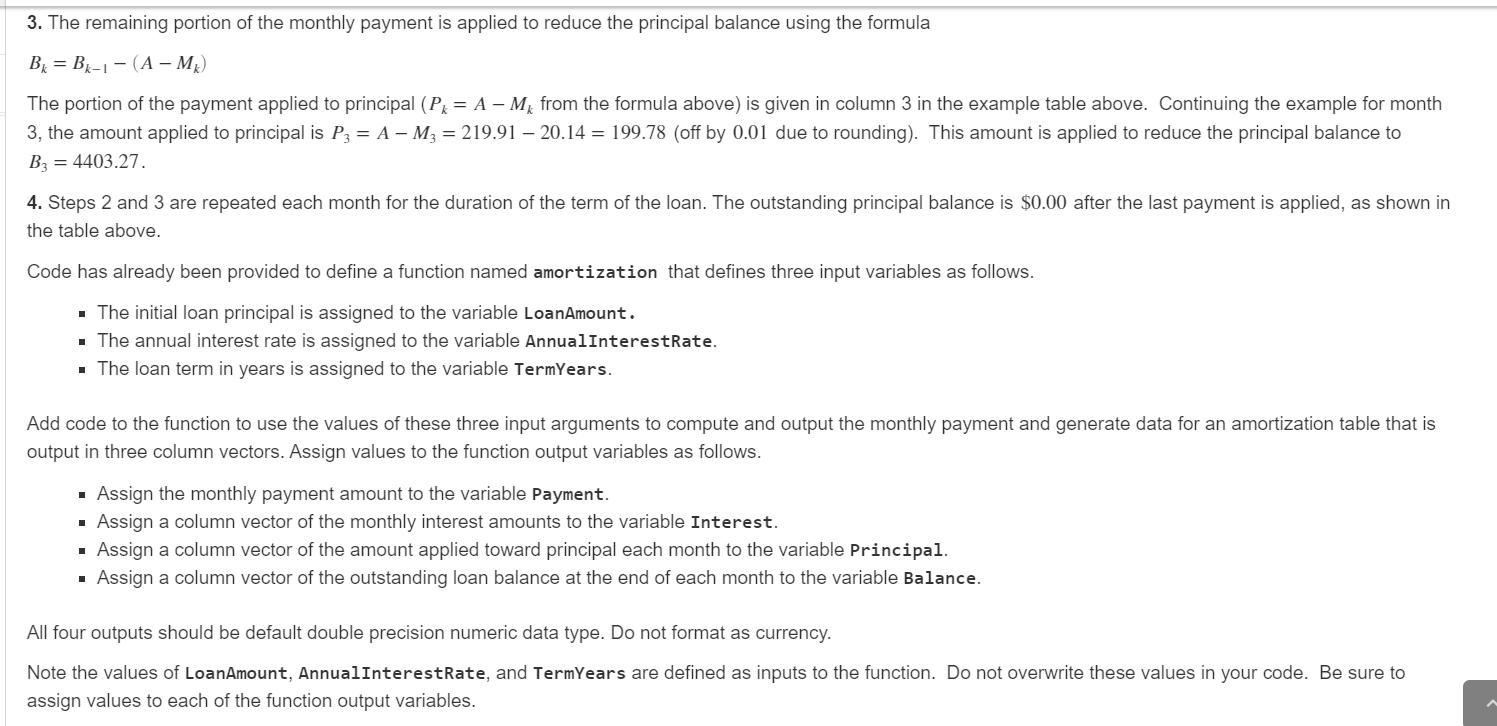

An amortization table shows how a loan debt is paid off in monthly payments over the term of a loan. For each monthly payment, the amount paid toward interest and the amount paid toward principal varies as the principal reduces over time. The table calculation breaks down each payment into the interest and principal reduction and also indicates the outstanding principal balance. This is repeated for the duration of the loan term until the principal value is zero. An example amortization table for a $5000 loan with a two year term and an annual interest rate of 5.25% is shown below: Month Interest Principal Balance 1 2 3 4 5 6 7 8 9 10 112 13 14 15 16 17 $ 21.87 $ 21.01 $ 20.14 $ 19.26 18.39 $ 17.50 $ $198.04 $198.91 $ 199.78 $ 200.65 $201.53 $ 202.41 $ 203.30 $ 204.19 205.08 $ 205.98 $ 206.88 $ 16.62 $15.73 $ 14.84 $ 13.94 $ 13.04 $ $ 12.13 $ 207.78 $11.22 $ 208.69 $ 10.31 $ 209.61 $ 9.39 $ 8.47 $ 7.55 $ 210.52 $ 211.44 $ 212.37 $ 4801.96 $ 4603.05 $ 4403.27 $ 4202.62 $ 4001.09 $ 3798.67 $ 3595.38 $ 3391.19 $ 3186.11 $ 2980.13 $ 2773.25 $ 2565.47 $ 2356.77 $ 2147.17 $ 1936.64 $ 1725.20 $ 1512.83 Activate Windows Go to Settings to activate Windows. HABAAN222 16 17 18 19 20 21 23 24 $ 1725.20 $ 1512.83 $ 1299.53 A = $ 211.44 8.47 7.55 $ 212.37 $ $ 6.62 $ 213.30 $ $ 215.17 $ 5.69 $ 214.23 4.75 3.81 2.86 $ $ 216.11 $ $ 1.91 $ 0.96 $ 218.96 $ $ 1085.30 $ 870.13 $ 654.02 $ 217.06 $ 436.96 $ 218.01 $ 218.96 0.00 This table can be generated as follows: 1. For a term loan with initial principal balance (total loan amount) value of Bo, the monthly payment A can be computed with the formula: iBo(1+i)n (1 + i)" - 1 Where i is the monthly interest rate (decimal value), computed from an annual rate r as i = r/12, and n is the number of months in the term of the loan. For the example amortization table above, the monthly interest rate i = 0.0525/12 = 0.004375. The monthly payment is calculated using the above formula to be $219.91. 2. For each month, the interest that accumulates must be paid in full before any portion of the payment is applied toward the principal balance. The interest due for the kth month, M is calculated using the monthly interest rate i and the principal balance from the previous month as M = ix Bk-1 For example in month 3 in the example table above the interest due is calculated using the principal balance from month 2 as M3 ix B = 0.004375 x 4603.05 = 20.14. 3. The remaining portion of the monthly payment is applied to reduce the principal balance using the formula B B-1(A-M) = 3. The remaining portion of the monthly payment is applied to reduce the principal balance using the formula Bk=Bk-1-(A - M) The portion of the payment applied to principal (P = A - M from the formula above) is given in column 3 in the example table above. Continuing the example for month 3, the amount applied to principal is P3 = A - M3 = 219.9120.14 = 199.78 (off by 0.01 due to rounding). This amount is applied to reduce the principal balance to B3 = 4403.27. 4. Steps 2 and 3 are repeated each month for the duration of the term of the loan. The outstanding principal balance is $0.00 after the last payment is applied, as shown in the table above. Code has already been provided to define a function named amortization that defines three input variables as follows. The initial loan principal is assigned to the variable LoanAmount. The annual interest rate is assigned to the variable AnnualInterestRate. The loan term in years is assigned to the variable TermYears. Add code to the function to use the values of these three input arguments to compute and output the monthly payment and generate data for an amortization table that is output in three column vectors. Assign values to the function output variables as follows. Assign the monthly payment amount to the variable Payment. Assign a column vector of the monthly interest amounts to the variable Interest. Assign a column vector of the amount applied toward principal each month to the variable Principal. Assign a column vector of the outstanding loan balance at the end of each month to the variable Balance. All four outputs should be default double precision numeric data type. Do not format as currency. Note the values of LoanAmount, AnnualInterest Rate, and TermYears are defined as inputs to the function. Do not overwrite these values in your code. Be sure to assign values to each of the function output variables. Function > 1 function [Payment, Interest, Principal, Balance] = amortization (LoanAmount, AnnualInterest Rate, TermYears) 2 %Write the commands for your function here. 3 Code to call your function > C Reset 1 LoanAmount = 10000;%dollars 2 InterestRate = 0.05;%annual 3 TermYears = 5;% years 4 [Payment, Interest, Principal, Balance] = amortization (LoanAmount, InterestRate, TermYears); MATLAB Documentation C Reset

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started