Accounting major experts! Please solve and explain this to me!

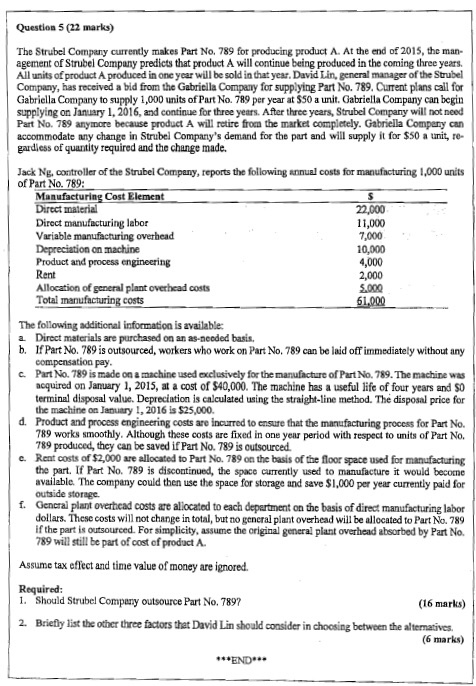

The Strubel Company currently makes Part No. 789 for producing product A. At the end of 2015, the management of Strubel Company predicts that product. A will continue bring produced in the coming three years. All units of product A produced in one year will be sold in that year. David Lin, general manager of the Strubel Company, has received a bid from the Gabriella Company for supplying Part No. 789. Current plans call for Gabriella Company to supply 1,000 units of Part No. 789 per year at $50 a unit. Gabriella Company can begin supplying on January 1, 2016, and continue for three years. After three yean, Strubel Company will not need Pan No. 789 anymore because product A will retire from the market completely. Gabriella Company can accommodate any change in Strubel Company's demand for the port and will supply it for $50 a unit, regardless of quantity required and the change made. Jack Ng, controller of the Strubel Company, reports the fo1lowing annual costs for manufacturing 1,000 units of Part No. 789: The following additional information is available: Direct materials are purchased on an as-needed basis. If Part No. 769 is outsourced, workers who work on Hart No. 789 can be laid off immediately without any compensation pay. Part No. 789 is made on a machine used exclusively for the manufacture of Part No. 789. The machine was acquired on January 1, 2015, at a cost of $40,000. The machine has a useful life of four years and $0 terminal disposal value. Depredation is calculated using the straight-line method. The disposal price for the machine the January 1, 2016 is $25,000. Product and process engineering costs arc incurred to ensure that the manufacturing process for Part No. 789 works smoothly. Although these costs are fixed in one year period with respect to units of Part No. 789 produced, they can be saved if Part No. 789 is outsourced Rent costs of $2,000 are allocated to Part No. 719 on the basis of the floor space used for manufacturing the part. If Part No. 789 is discontinued, the space currently used to manufacture it would become available. The company could then use the space for storage and save $1,000 per year currently paid for outside storage. General plant overhead costs are allocated to each department on the basis of direct manufacturing labor dollars. These costs will not change in total, but no general plant overhead will be allocated to Part No. 789 if the par: is outsourced. For simplicity, assume the original genera: plant overhead absorbed by Part No. 789 will still be part of cost of product A. Assume tax effect and time value of money are ignored. Required: Should Strubel Company outsource Part No. 789? Briefly list the other three factors that David Lin should consider in choosing between the alternatives