Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting Management Decisions Please answer both questions NEED HELP REALLY STRUGGLING THANK YOU Lucas Industries uses departmental overhead rates to allocate its manufacturing overhead to

Accounting Management Decisions

Please answer both questions

NEED HELP REALLY STRUGGLING

THANK YOU

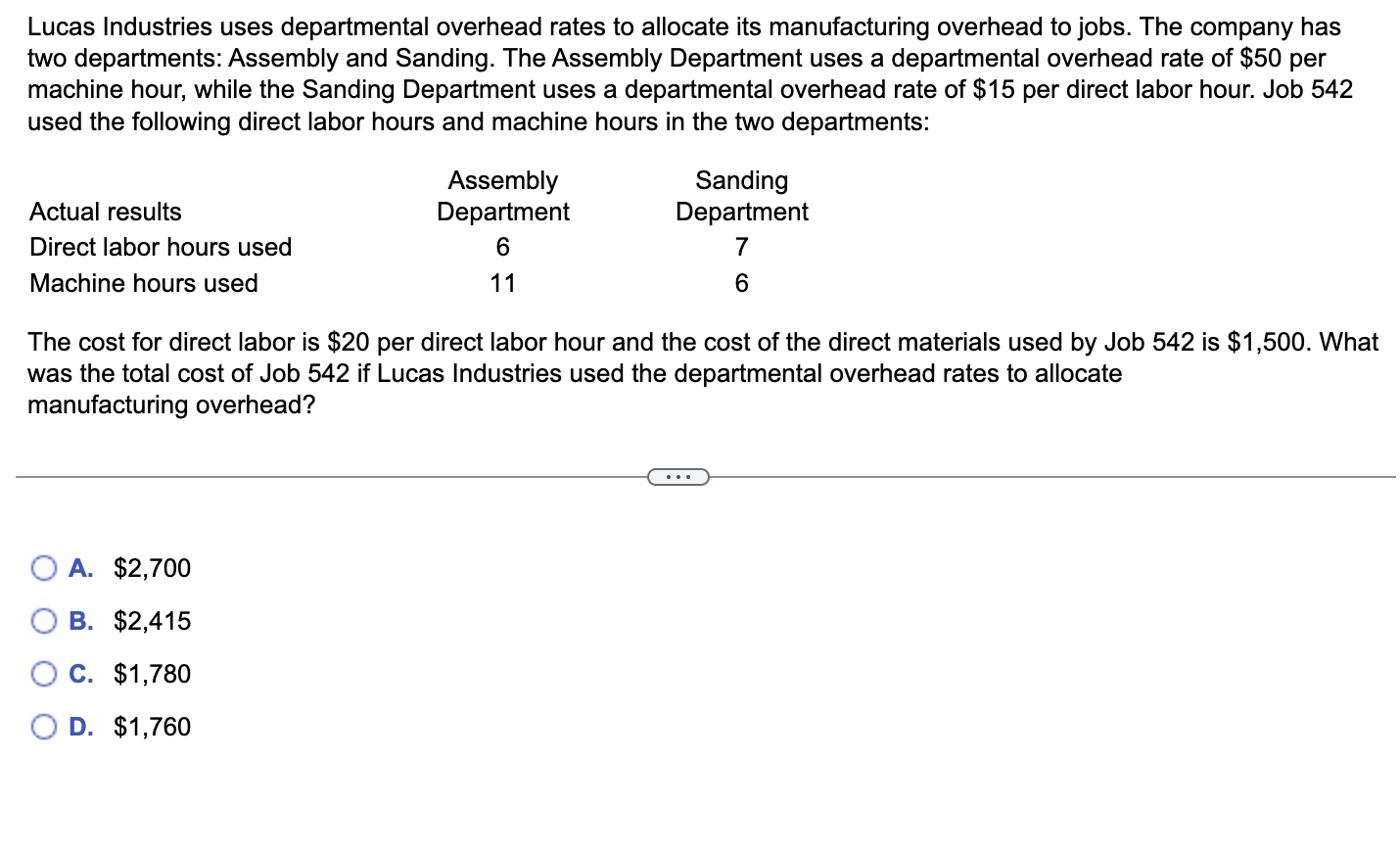

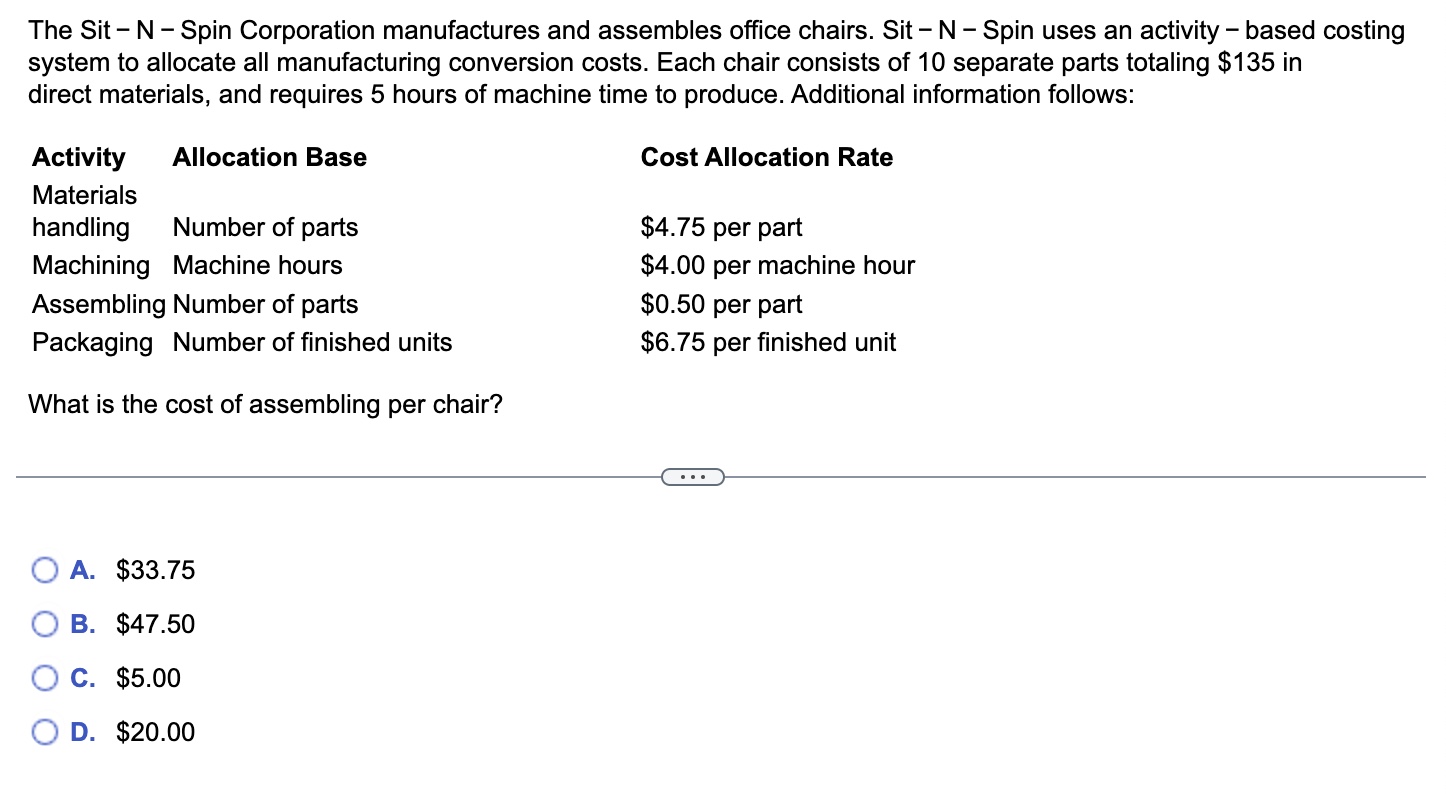

Lucas Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments: Assembly and Sanding. The Assembly Department uses a departmental overhead rate of $50 per machine hour, while the Sanding Department uses a departmental overhead rate of $15 per direct labor hour. Job 542 used the following direct labor hours and machine hours in the two departments: The cost for direct labor is $20 per direct labor hour and the cost of the direct materials used by Job 542 is $1,500. What was the total cost of Job 542 if Lucas Industries used the departmental overhead rates to allocate manufacturing overhead? A. $2,700 B. $2,415 C. $1,780 D. $1,760 The Sit - N - Spin Corporation manufactures and assembles office chairs. Sit - N - Spin uses an activity - based costing system to allocate all manufacturing conversion costs. Each chair consists of 10 separate parts totaling $135 in direct materials, and requires 5 hours of machine time to produce. Additional information follows: What is the cost of assembling per chair? A. $33.75 B. $47.50 C. $5.00 D. $20.00

Lucas Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments: Assembly and Sanding. The Assembly Department uses a departmental overhead rate of $50 per machine hour, while the Sanding Department uses a departmental overhead rate of $15 per direct labor hour. Job 542 used the following direct labor hours and machine hours in the two departments: The cost for direct labor is $20 per direct labor hour and the cost of the direct materials used by Job 542 is $1,500. What was the total cost of Job 542 if Lucas Industries used the departmental overhead rates to allocate manufacturing overhead? A. $2,700 B. $2,415 C. $1,780 D. $1,760 The Sit - N - Spin Corporation manufactures and assembles office chairs. Sit - N - Spin uses an activity - based costing system to allocate all manufacturing conversion costs. Each chair consists of 10 separate parts totaling $135 in direct materials, and requires 5 hours of machine time to produce. Additional information follows: What is the cost of assembling per chair? A. $33.75 B. $47.50 C. $5.00 D. $20.00 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started