Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Marginal tax rates Partner A, a single taxpayer, is one of two partners in a small business. As such, she receives pass-through income that

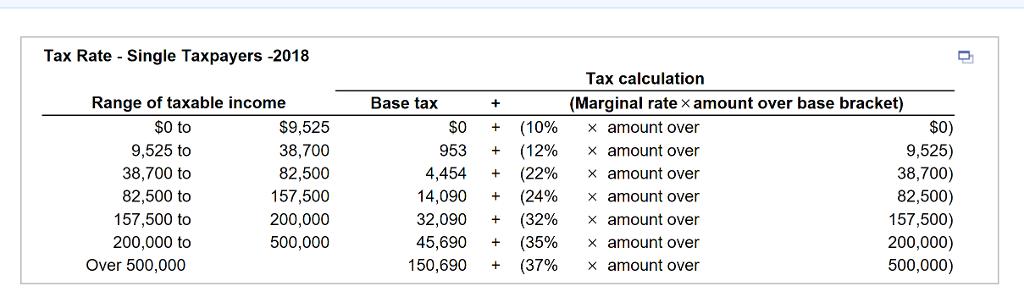

Marginal tax rates Partner A, a single taxpayer, is one of two partners in a small business. As such, she receives pass-through income that is taxed at her personal tax rates. After all adjustments and deductions have been made, including the 20% qualified business income deduction, she is preparing to calculate her taxes owed for the year. Using the tax rate schedule given here i, perform the following: a. Find the marginal tax rate for the following levels of sole proprietorship earnings before taxes: $13,800; $60,400; $88,000; $152,000; $246,000; $455,000; and $1.5 million. b. Plot the marginal tax rates (measured on the y-axis) against the pretax income levels (measured on the x-axis). Explain the relationship between these variables. Tax Rate Single Taxpayers -2018 Tax calculation Range of taxable income $0 to Base tax (Marginal ratex amount over base bracket) $9,525 (10% x amount over $0) 9,525) $0 9,525 to 38,700 953 (12% x amount over 38,700 to 82,500 4,454 (22% x amount over 38,700) 82,500 to 157,500 14,090 (24% x amount over 82,500) 157,500 to x amount over 200,000 500,000 32,090 (32% 157,500) 200,000) + 200,000 to 45,690 (35% x amount over Over 500,000 150,690 (37% x amount over 500,000)

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Tax rate schedule is missing in your question I have used the following schedule usually available f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started