Question: Grainy Goodness Company manufactures granola cereal by a series of three processes, beginning materials such as cats, sweeteners, and nuts being introduced in the

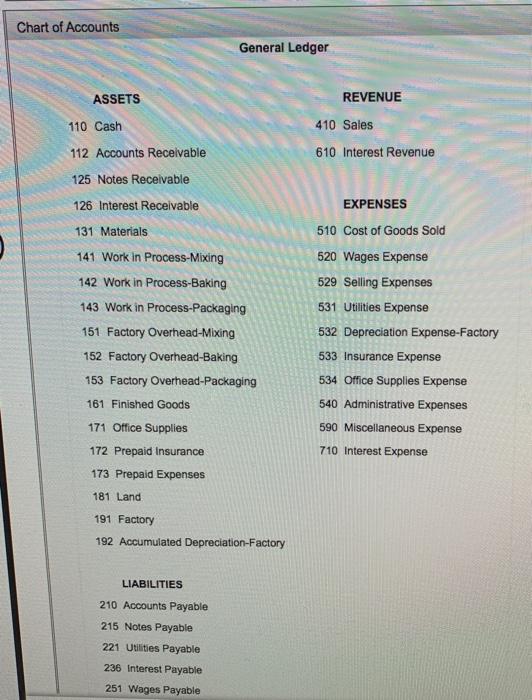

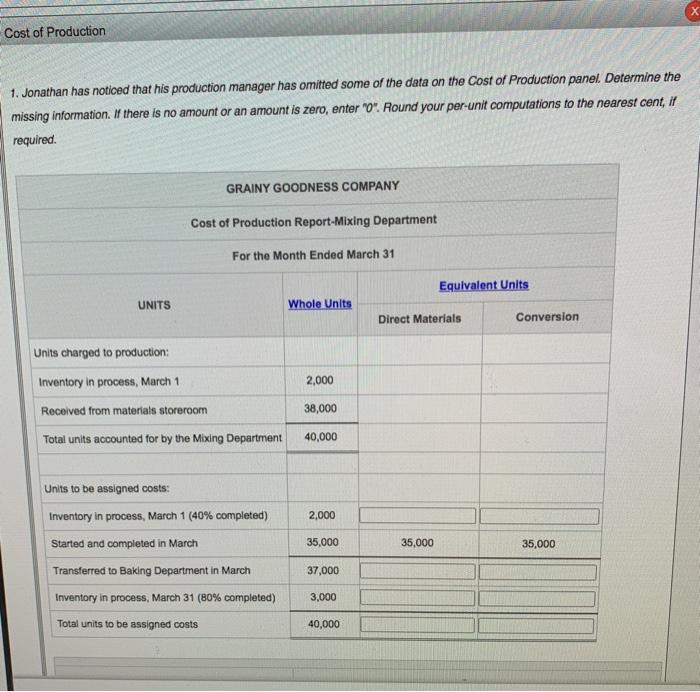

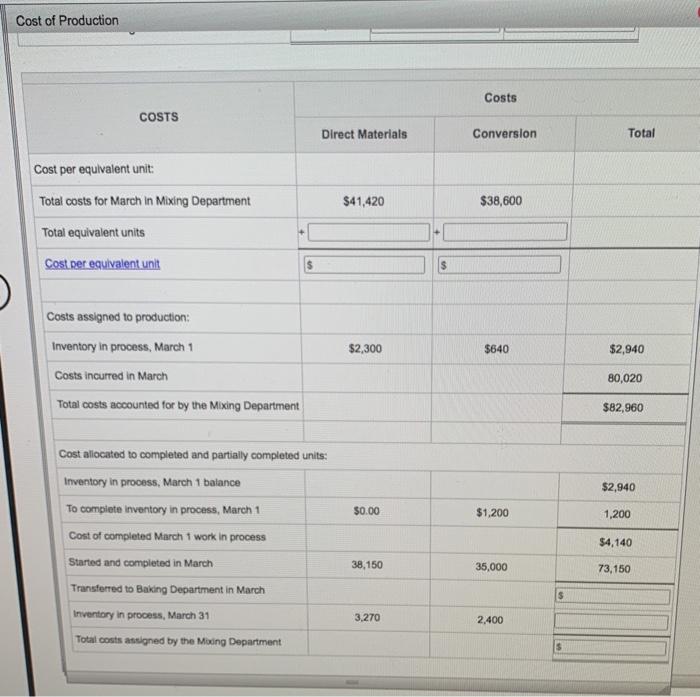

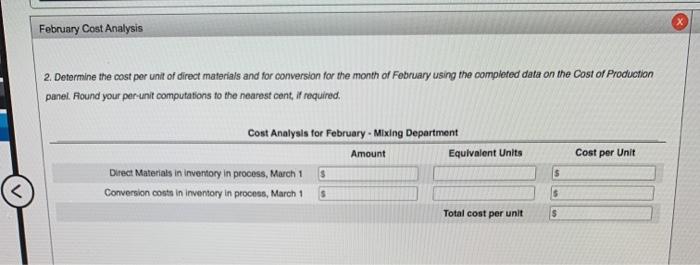

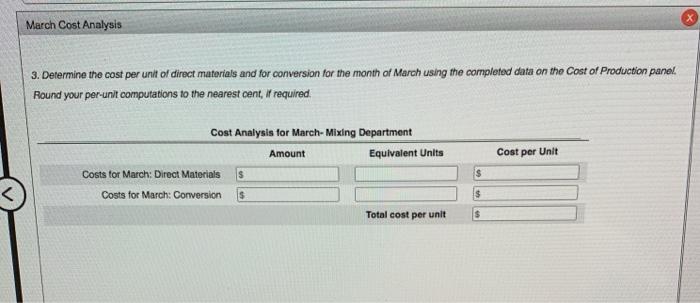

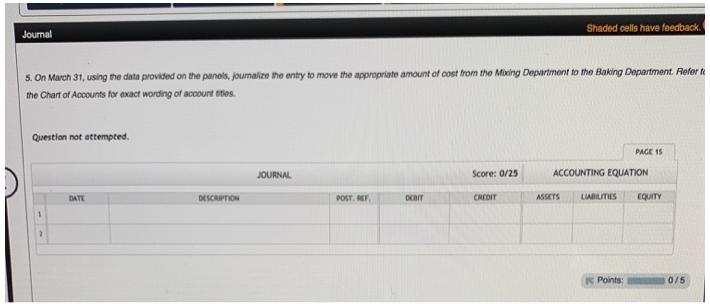

Grainy Goodness Company manufactures granola cereal by a series of three processes, beginning materials such as cats, sweeteners, and nuts being introduced in the Mixing Department. From the Mixing Department, the materials pass through the Baking and Packaging departments, emerging as boxed granola cereal ready for shipment to retail outfets. Direct materials are added at the beginning of each process, and conversion costs are incurred evenly throughout production in each department. During March, the President and sole stockholder, Jonathan Groat, reviewed the Cost of Production Report for the Mixing Department. He is concerned that the Mixing Department may not be operating etficiently, and asks for your help. Required: 1. Jonathan has noticed that his production manager has omitted some of the data on the Cost of Production panel. Determine the missing information. If there is no amount or an amount is zero, enter "0"* 2. On the February Cost Analysis panel, determine the cost per unit of direct materials and for conversion for the manth of February using the completed data on the Cost of Production panel. 3. On the March Cost Analysis panel, determine the cost per unit of direct materials and for conversion for the month of March using the completed data on the Cost of Production panel. 4. Ater reviewing your work on the Fobruary Cost Analysis and March Cost Analysis panels, asaist Jonathan Groat in evaluating the Mixing Department's performance by answering the questions on the Mixing Dept. Evaluation panel. 5. On March 31, using the data provided on the panels, journalize the entry to move the appropriate amount of cost from the Mixing Department to the Baking Department. Refer to the Chart of Accounts for exact wording of account titles. *Round your per-unit computations to the nearest cent, if required. Chart of Accounts General Ledger ASSETS REVENUE 110 Cash 410 Sales 112 Accounts Receivable 610 Interest Revenue 125 Notes Receivable 126 Interest Receivable EXPENSES 131 Materials 510 Cost of Goods Sold 141 Work in Process-Mixing 520 Wages Expense 142 Work in Process-Baking 529 Selling Expenses 143 Work in Process-Packaging 531 Utilities Expense 151 Factory Overhead-Mixing 532 Depreciation Expense-Factory 152 Factory Overhead-Baking 533 Insurance Expense 153 Factory Overhead-Packaging 534 Office Supplies Expense 161 Finished Goods 540 Administrative Expenses 171 Office Supplies 590 Miscellaneous Expense 172 Prepaid Insurance 710 Interest Expense 173 Prepaid Expenses 181 Land 191 Factory 192 Accumulated Depreciation-Factory LIABILITIES 210 Accounts Payable 215 Notes Payable 221 Utilities Payable 236 Interest Payable 251 Wages Payable Cost of Production 1. Jonathan has noticed that his production manager has omitted some of the data on the Cost of Production panel. Determine the missing information. If there is no amount or an amount is zero, enter "0". Round your per-unit computations to the nearest cent, if required. GRAINY GOODNESS COMPANY Cost of Production Report-Mixing Department For the Month Ended March 31 Equivalent Units UNITS Whole Units Direct Materials Conversion Units charged to production: Inventory in process, March 1 2,000 Received from materials storeroom 38,000 Total units accounted for by the Mixing Department 40,000 Units to be assigned costs: Inventory in process, March 1 (40% completed) 2,000 Started and completed in March 35,000 35,000 35,000 Transferred to Baking Department in March 37,000 Inventory in process, March 31 (B0% completed) 3,000 Total units to be assigned costs 40,000 Cost of Production Costs COSTS Direct Materials Conversion Total Cost per equivalent unit: Total costs for March in Mixing Department $41,420 $38,600 Total equivalent units Cost per equivalent unit Costs assigned to production: Inventory in process, March 1 $2,300 $640 $2,940 Costs incurred in March 80,020 Total costs accounted for by the Mixing Department $82,960 Cost allocated to completed and partially completed units: Inventory in prooess, March 1 balance $2,940 To complete inventory in process, March 1 $0.00 $1,200 1,200 Cost of completed March 1 work in process $4,140 Started and completed in March 38,150 35,000 73,150 Transferred to Baking Department in March Inventory in process, March 31 3,270 2,400 Total costs ansigned by the Mixing Department February Cost Analysis 2. Determine the cost per unit of direct materials and for conversion for the month of February using the completed data on the Cost of Production panel. Round your per-unit computations to the nearest cent, if required. Cost Analysis for February - Mixing Department Amount Equivalent Units Cost per Unit Direct Materials in inventory in process, March 1S Conversion costs in inventory in process, March 1 Total cost per unit March Cost Analysis 3. Determine the cost per unit of direct materials and for conversion for the month of March using the completed data on the Cost of Production panel. Round your per-unit computations to the nearest cent, If required. Cost Analysis for March- Mixing Department Equivalent Units Cost per Unit Amount Costs for March: Direct Materials Costs for March: Conversion 24 Total cost per unit Shaded cells have feedback. Jounal 5. On March 31, using the data provided on the panels, joumalize the entry to move the appropriate amount of cost trom the Mixing Department to the Baking Department. Refer te the Chart of Accounts for exact wording of account enes. Question not attempted. PAGE 1S JOURNAL Score: 0/25 ACCOUNTING EQUATION DATE DESCRIPTION POST. MEF, DBIT CREDIT ASSETS LIABILITIES EQUITY K Points: 0/5

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts