Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Revenue Journal; Accounts Receivable subsidiary and General Ledgers Sage Learning Centers was established on July 20 to provide educational services. The services provided during

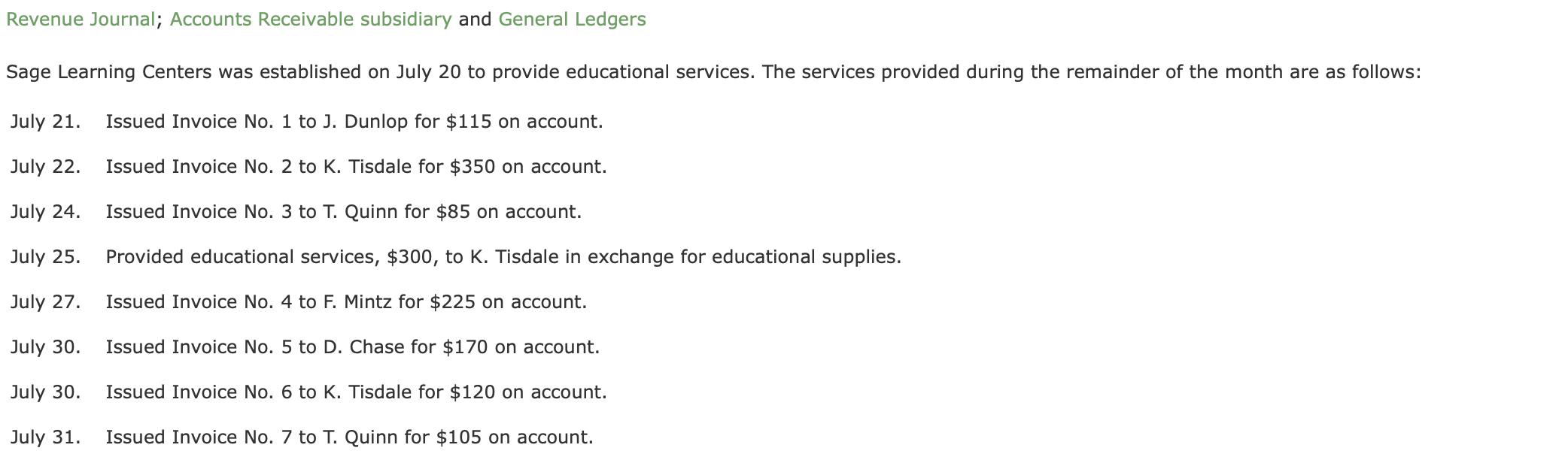

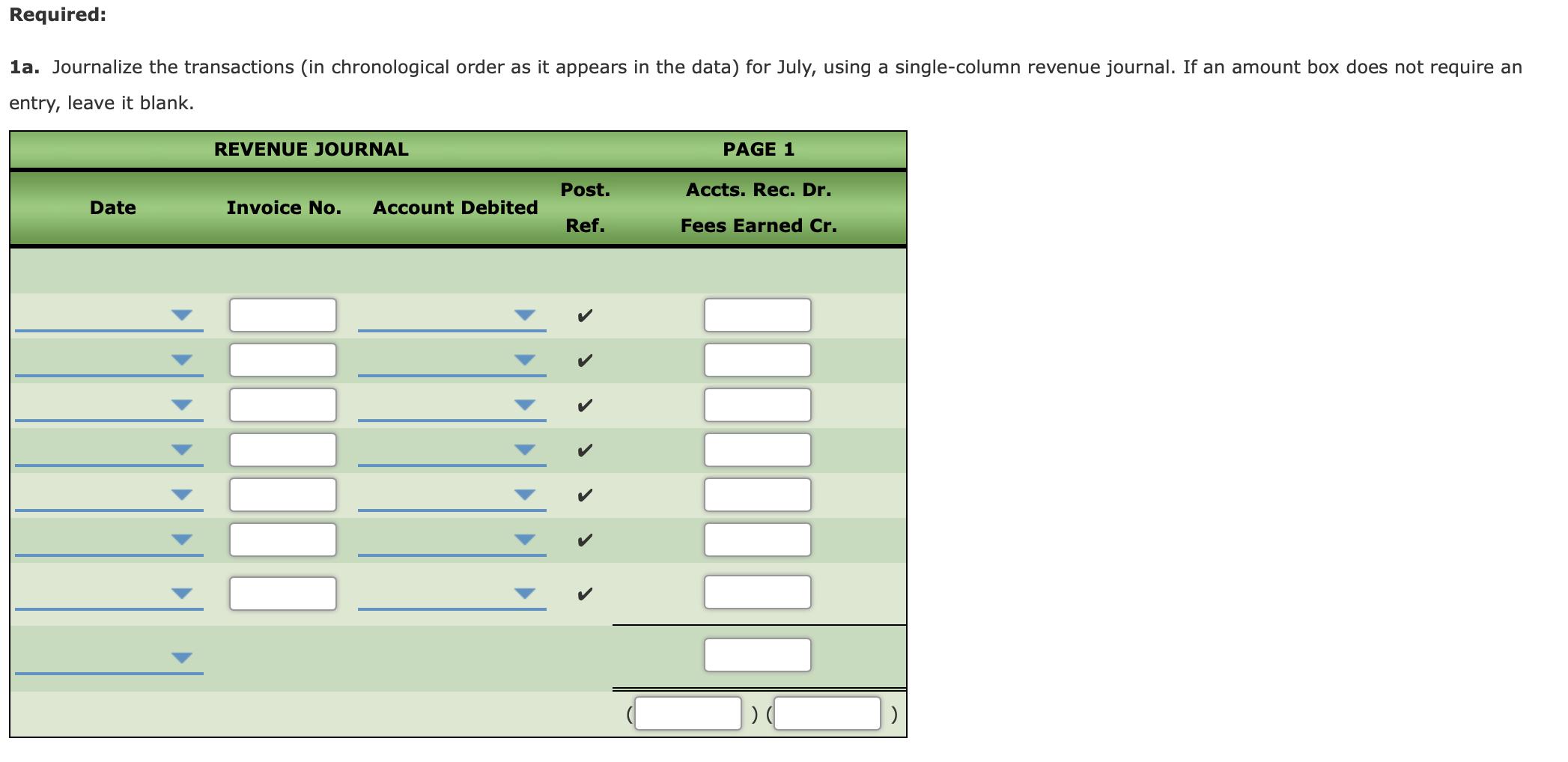

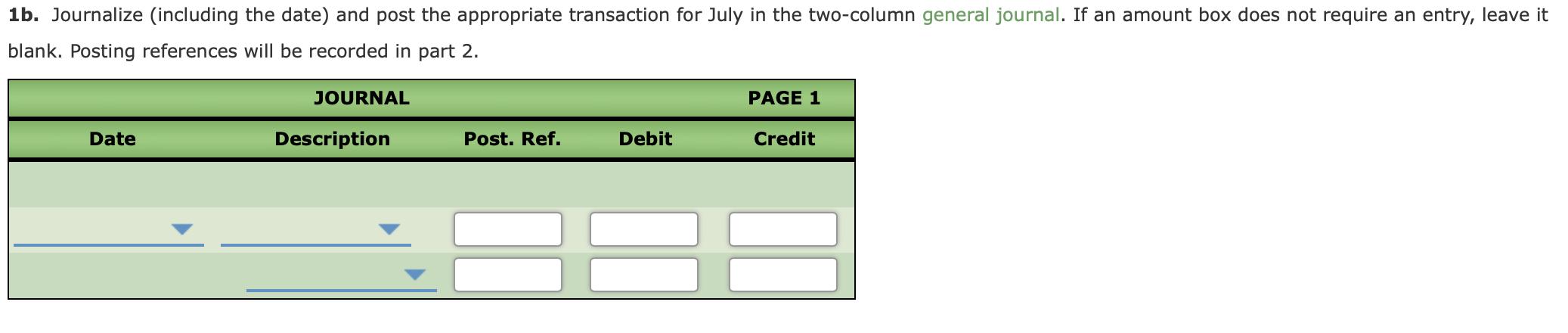

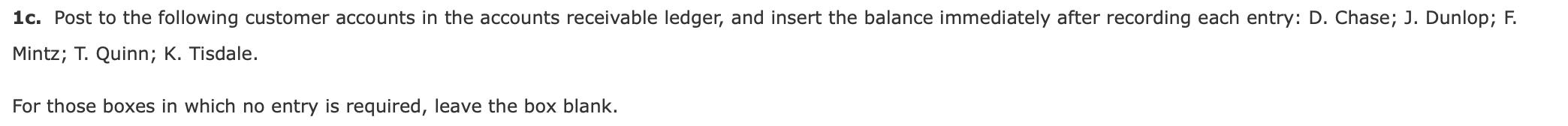

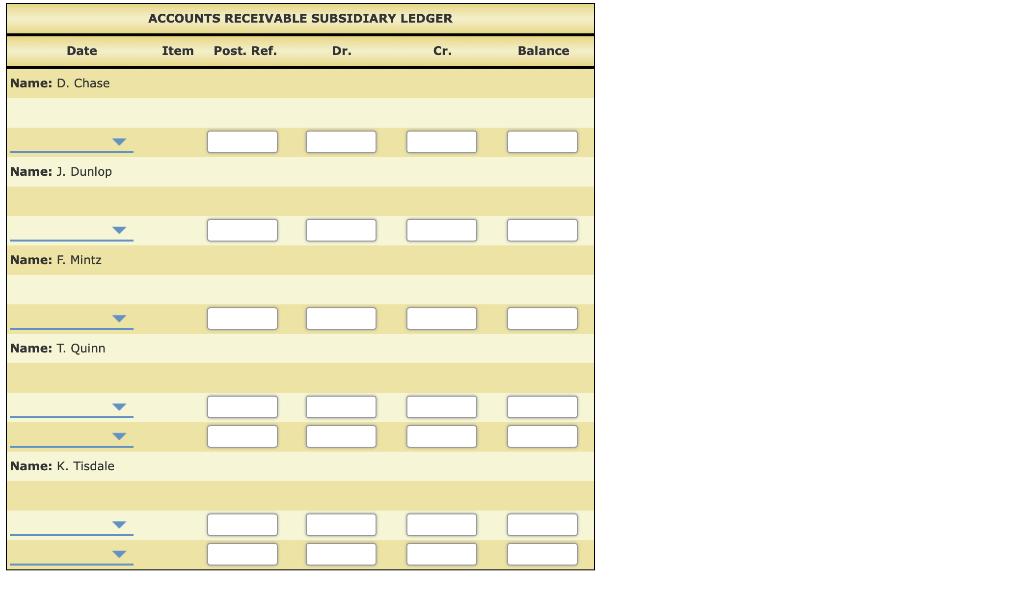

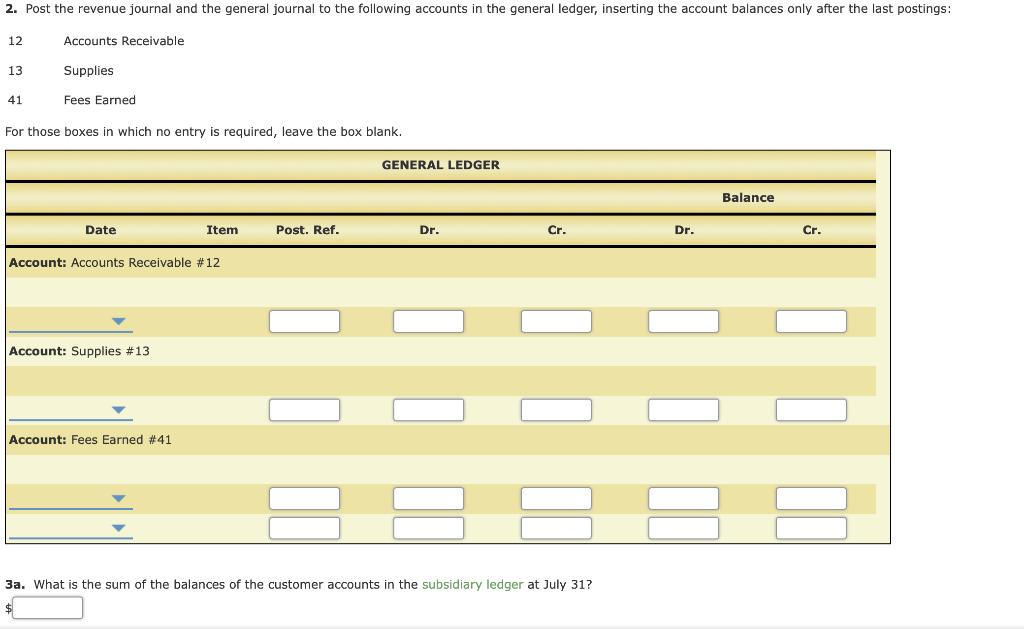

Revenue Journal; Accounts Receivable subsidiary and General Ledgers Sage Learning Centers was established on July 20 to provide educational services. The services provided during the remainder of the month are as follows: July 21. Issued Invoice No. 1 to J. Dunlop for $115 on account. July 22. Issued Invoice No. 2 to K. Tisdale for $350 on account. July 24. Issued Invoice No. 3 to T. Quinn for $85 on account. July 25. Provided educational services, $300, to K. Tisdale in exchange for educational supplies. July 27. Issued Invoice No. 4 to F. Mintz for $225 on account. July 30. Issued Invoice No. 5 to D. Chase for $170 on account. July 30. Issued Invoice No. 6 to K. Tisdale for $120 on account. July 31. Issued Invoice No. 7 to T. Quinn for $105 on account. Required: 1a. Journalize the transactions (in chronological order as it appears in the data) for July, using a single-column revenue journal. If an amount box does not require an entry, leave it blank. REVENUE JOURNAL PAGE 1 Post. Accts. Rec. Dr. Date Invoice No. Account Debited Ref. Fees Earned Cr. 1b. Journalize (including the date) and post the appropriate transaction for July in the two-column general journal. If an amount box does not require an entry, leave it blank. Posting references will be recorded in part 2. JOURNAL PAGE 1 Date Description Post. Ref. Debit Credit 1c. Post to the following customer accounts in the accounts receivable ledger, and insert the balance immediately after recording each entry: D. Chase; J. Dunlop; F. Mintz; T. Quinn; K. Tisdale. For those boxes in which no entry is required, leave the box blank. ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER Date Item Post. Ref. Dr. Cr. Balance Name: D. Chase Name: J. Dunlop Name: F. Mintz Name: T. Quinn Name: K. Tisdale BBB8 2. Post the revenue journal and the general journal to the following accounts in the general ledger, inserting the account balances only after the last postings: 12 Accounts Receivable 13 Supplies 41 Fees Earned For those boxes in which no entry is required, leave the box blank. GENERAL LEDGER Balance Date Item Post. Ref. Dr. Cr. Dr. Cr. Account: Accounts Receivable #12 Account: Supplies #13 Account: Fees Earned #41 3a. What is the sum of the balances of the customer accounts in the subsidiary ledger at July 31? 3b. What is the balance of the accounts receivable controlling account at July 31? 2$ 4. Assume Sage Learning Centers began using a computerized accounting system to record the sales transactions on August 1. All of the following are benefits of the computerized system over the manual system EXCEPT:

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answers 1a Revenue Journal Account Debited Post Ref Accounts Receivable Dr Sales Cr Date InvNo July2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started