Max is very happy with the work you have done in tidying up his inventory recording and valuation systems and is quite confident that

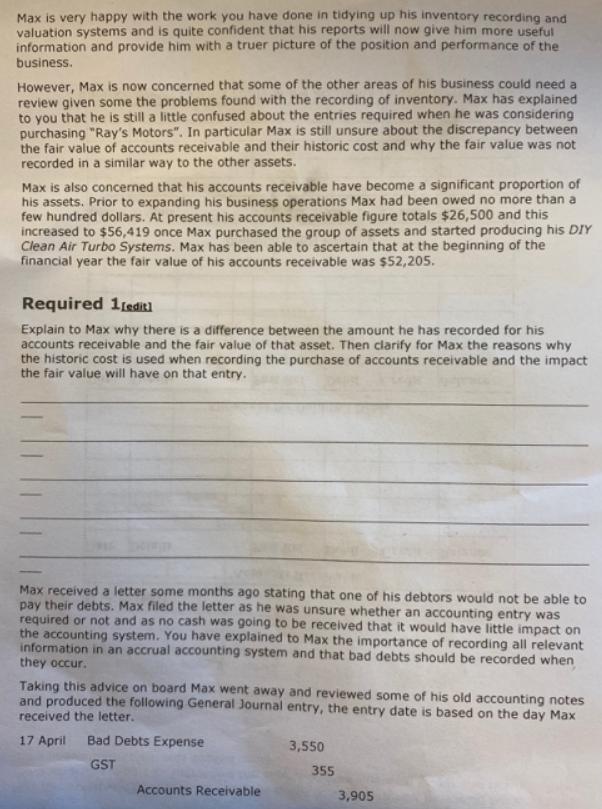

Max is very happy with the work you have done in tidying up his inventory recording and valuation systems and is quite confident that his reports will now give him more useful information and provide him with a truer picture of the position and performance of the business. However, Max is now concerned that some of the other areas of his business could need a review given some the problems found with the recording of inventory. Max has explained to you that he is still a little confused about the entries required when he was considering purchasing "Ray's Motors". In particular Max is still unsure about the discrepancy between the fair value of accounts receivable and their historic cost and why the fair value was not recorded in a similar way to the other assets. Max is also concerned that his accounts receivable have become a significant proportion of his assets. Prior to expanding his business operations Max had been owed no more than a few hundred dollars. At present his accounts receivable figure totals $26,500 and this increased to $56,419 once Max purchased the group of assets and started producing his DIY Clean Air Turbo Systems. Max has been able to ascertain that at the beginning of the financial year the fair value of his accounts receivable was $52,205. Required 1 ediRI Explain to Max why there is a difference between the amount he has recorded for his accounts receivable and the fair value of that asset. Then clarify for Max the reasons why the historic cost is used when recording the purchase of accounts receivable and the impact the fair value will have on that entry. Max received a letter some months ago stating that one of his debtors would not be able to pay their debts. Max filed the letter as he was unsure whether an accounting entry was required or not and as no cash was going to be received that it would have little impact on the accounting system. You have explained to Max the importance of recording all relevant information in an accrual accounting system and that bad debts should be recorded when they occur. Taking this advice on board Max went away and reviewed some of his old accounting notes and produced the following General Journal entry, the entry date is based on the day Max received the letter. 17 April Bad Debts Expense 3,550 GST 355 Accounts Receivable 3,905

Step by Step Solution

There are 3 Steps involved in it

Step: 1

In any business sales are sometimes made for cash most of the times on account or for creditthereby creating accounts receivables Some of the above cr...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started