Question

Zeus Ltd owns 100% of the issued capital of Ares Ltd. On 1 July 2015, Zeus Ltd purchased an item of equipment from Ares Ltd

Zeus Ltd owns 100% of the issued capital of Ares Ltd. On 1 July 2015, Zeus Ltd purchased an item of equipment from Ares Ltd for $800 000. Ares had owned the equipment for 2 years. It originally cost $890 000 and the accumulated depreciation was $178 000 at the time of sale. The equipment has been depreciated over this time, but not written down or revalued. The remaining useful life of the equipment at 1 July 2015 is estimated to be 8 years. Zeus Ltd expects the benefits to be obtained from the equipment to be evenly received over its useful life. The tax rate is 30%. What are the consolidation journal entries required for this inter-company transaction for the period ended 30 June 2016?

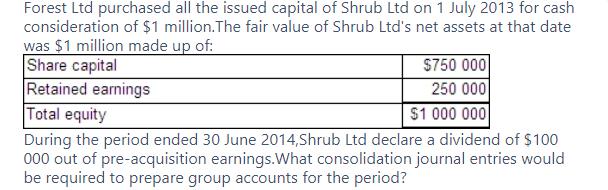

Forest Ltd purchased all the issued capital of Shrub Ltd on 1 July 2013 for cash consideration of $1 million.The fair value of Shrub Ltd's net assets at that date was $1 million made up of: Share capital Retained earnings Total equity $750 000 250 000 $1 000 000 During the period ended 30 June 2014,Shrub Ltd declare a dividend of $100 000 out of pre-acquisition earnings.What consolidation journal entries would be required to prepare group accounts for the period?

Step by Step Solution

3.39 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

an2 an3 Date Account Titles Debit Credit 30Jun15 Impairment of Goodwill 20000 Goodwill ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started