On 1 July 2018 Alto Ltd purchased land for $4 000 000, in cash. Alto Ltd uses the cost model to account for land.

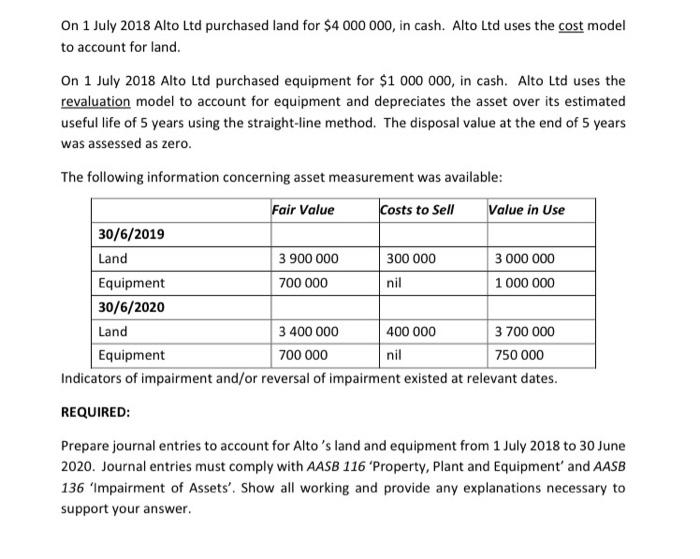

On 1 July 2018 Alto Ltd purchased land for $4 000 000, in cash. Alto Ltd uses the cost model to account for land. On 1 July 2018 Alto Ltd purchased equipment for $1 000 000, in cash. Alto Ltd uses the revaluation model to account for equipment and depreciates the asset over its estimated useful life of 5 years using the straight-line method. The disposal value at the end of 5 years was assessed as zero. The following information concerning asset measurement was available: Fair Value Costs to Sell Value in Use 30/6/2019 Land 3 900 000 300 000 3 000 000 Equipment 700 000 nil 1 000 000 30/6/2020 Land 3 400 000 400 000 3 700 000 Equipment 700 000 nil 750 000 Indicators of impairment and/or reversal of impairment existed at relevant dates. REQUIRED: Prepare journal entries to account for Alto 's land and equipment from 1 July 2018 to 30 June 2020. Journal entries must comply with AASB 116 'Property, Plant and Equipment' and AASB 136 'Impairment of Assets'. Show all working and provide any explanations necessary to support your answer.

Step by Step Solution

3.48 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started