Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On 1 July 2019, Bricks Ltd and Mortar Ltd signed a contractual agreement to form a joint operation to manufacture a new eco-brick with

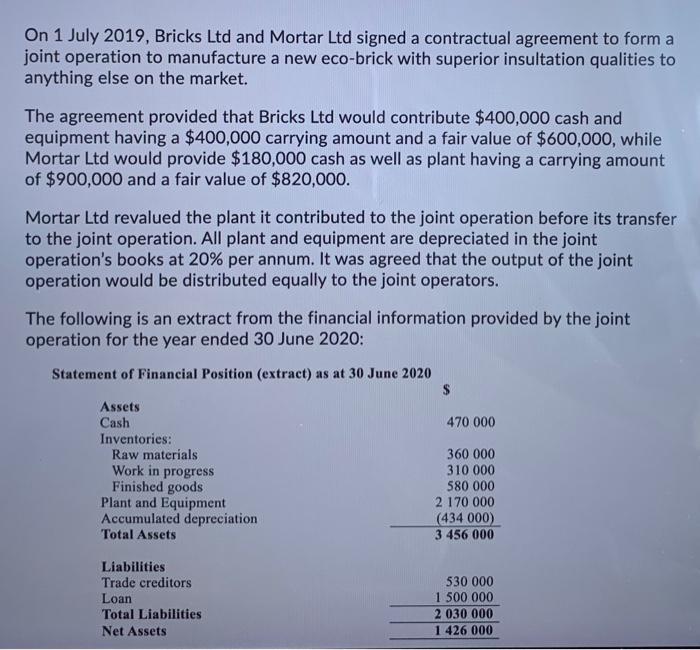

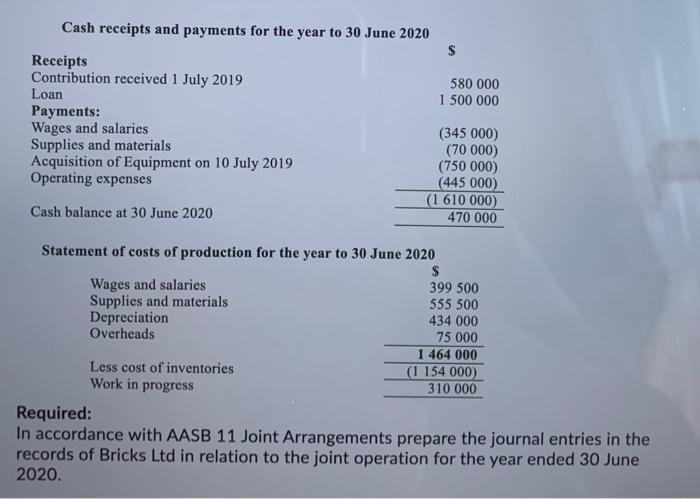

On 1 July 2019, Bricks Ltd and Mortar Ltd signed a contractual agreement to form a joint operation to manufacture a new eco-brick with superior insultation qualities to anything else on the market. The agreement provided that Bricks Ltd would contribute $400,000 cash and equipment having a $400,000 carrying amount and a fair value of $600,000, while Mortar Ltd would provide $180,000 cash as well as plant having a carrying amount of $900,000 and a fair value of $820,000. Mortar Ltd revalued the plant it contributed to the joint operation before its transfer to the joint operation. All plant and equipment are depreciated in the joint operation's books at 20% per annum. It was agreed that the output of the joint operation would be distributed equally to the joint operators. The following is an extract from the financial information provided by the joint operation for the year ended 30 June 2020: Statement of Financial Position (extract) as at 30 June 2020 Assets Cash Inventories: Raw materials Work in progress Finished goods Plant and Equipment Accumulated depreciation Total Assets Liabilities Trade creditors Loan Total Liabilities Net Assets 470 000 360 000 310 000 580 000 2 170 000 (434 000) 3 456 000 530 000 1 500 000 2 030 000 1 426 000 Cash receipts and payments for the year to 30 June 2020 Receipts Contribution received 1 July 2019 Loan Payments: Wages and salaries Supplies and materials Acquisition of Equipment on 10 July 2019 Operating expenses Cash balance at 30 June 2020 Wages and salaries Supplies and materials Depreciation Overheads S 580 000 1 500 000 Statement of costs of production for the year to 30 June 2020 $ 399 500 555 500 434 000 75 000 1 464 000 (1 154 000) 310 000 Less cost of inventories Work in progress (345 000) (70 000) (750 000) (445 000) (1 610 000) 470 000 Required: In accordance with AASB 11 Joint Arrangements prepare the journal entries in the records of Bricks Ltd in relation to the joint operation for the year ended 30 June 2020.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries 1 July 2019 Bricks Ltd Dr Cash 400000 Dr Plant and Equip...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started