Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting Methods & Estimates and Their Effects on Net Income Homework Two different companies were organized to sell gee-gaws to the public. Both companies expect

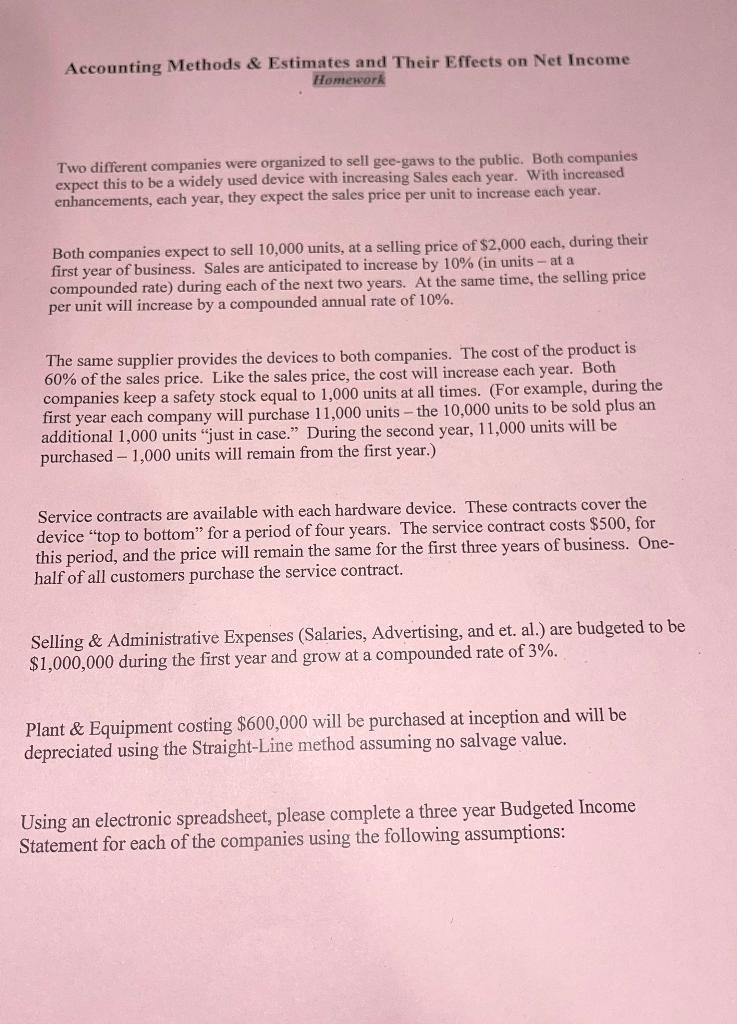

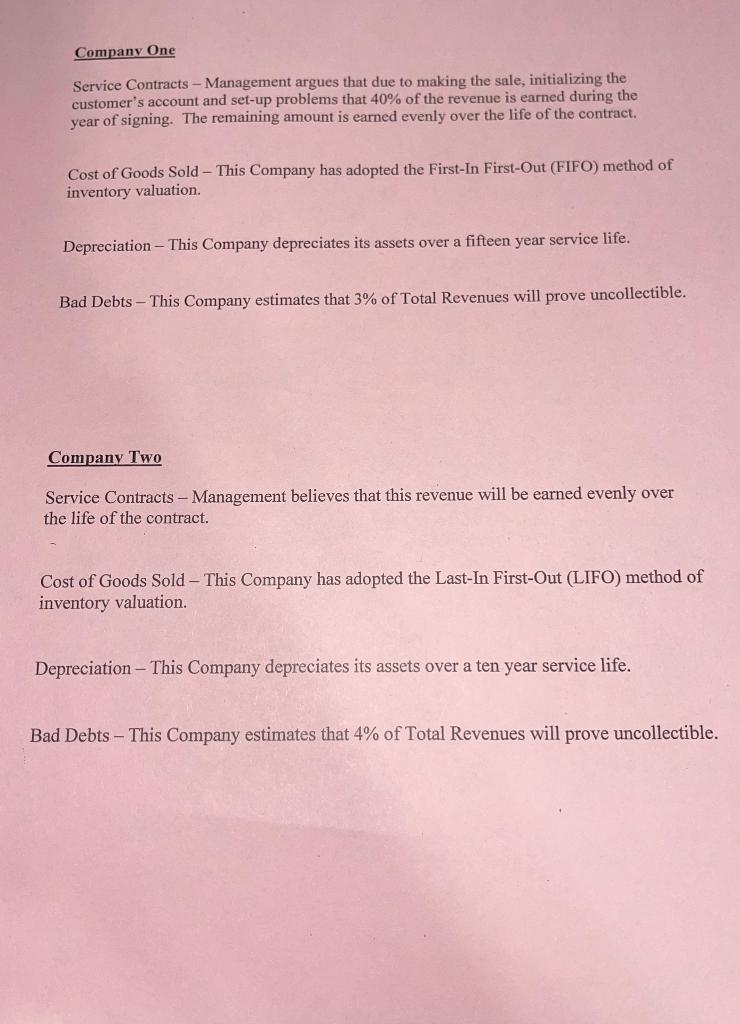

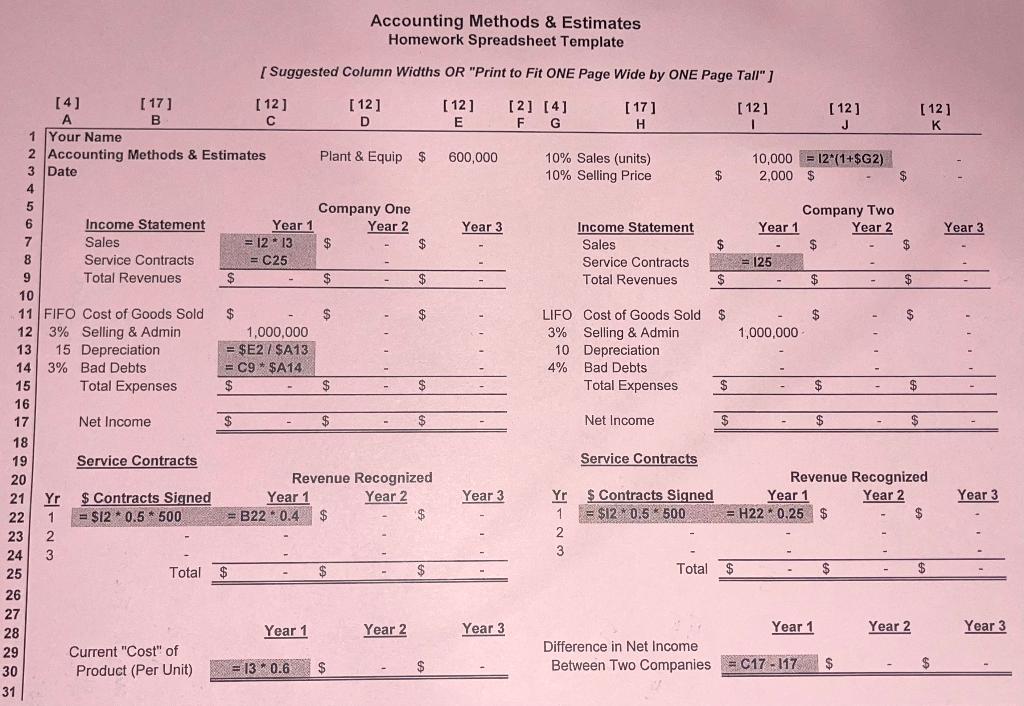

Accounting Methods \& Estimates and Their Effects on Net Income Homework Two different companies were organized to sell gee-gaws to the public. Both companies expect this to be a widely used device with increasing Sales each year. With increased enhancements, each year, they expect the sales price per unit to increase each year. Both companies expect to sell 10,000 units, at a selling price of $2,000each, during their first year of business. Sales are anticipated to increase by 10% (in units - at a compounded rate) during each of the next two years. At the same time, the selling price per unit will increase by a compounded annual rate of 10%. The same supplier provides the devices to both companies. The cost of the product is 60% of the sales price. Like the sales price, the cost will increase each year. Both companies keep a safety stock equal to 1,000 units at all times. (For example, during the first year each company will purchase 11,000 units - the 10,000 units to be sold plus an additional 1,000 units "just in case." During the second year, 11,000 units will be purchased 1,000 units will remain from the first year.) Service contracts are available with each hardware device. These contracts cover the device "top to bottom" for a period of four years. The service contract costs $500, for this period, and the price will remain the same for the first three years of business. Onehalf of all customers purchase the service contract. Selling \& Administrative Expenses (Salaries, Advertising, and et. al.) are budgeted to be $1,000,000 during the first year and grow at a compounded rate of 3%. Plant \& Equipment costing $600,000 will be purchased at inception and will be depreciated using the Straight-Line method assuming no salvage value. Using an electronic spreadsheet, please complete a three year Budgeted Income Statement for each of the companies using the following assumptions: Company One Service Contracts - Management argues that due to making the sale, initializing the customer's account and set-up problems that 40% of the revenue is earned during the year of signing. The remaining amount is earned evenly over the life of the contract. Cost of Goods Sold - This Company has adopted the First-In First-Out (FIFO) method of inventory valuation. Depreciation - This Company depreciates its assets over a fifteen year service life. Bad Debts - This Company estimates that 3% of Total Revenues will prove uncollectible. Company Two Service Contracts - Management believes that this revenue will be earned evenly over the life of the contract. Cost of Goods Sold - This Company has adopted the Last-In First-Out (LIFO) method of inventory valuation. Depreciation - This Company depreciates its assets over a ten year service life. Bad Debts - This Company estimates that 4% of Total Revenues will prove uncollectible. Accounting Methods \& Estimates Accounting Methods \& Estimates and Their Effects on Net Income Homework Two different companies were organized to sell gee-gaws to the public. Both companies expect this to be a widely used device with increasing Sales each year. With increased enhancements, each year, they expect the sales price per unit to increase each year. Both companies expect to sell 10,000 units, at a selling price of $2,000each, during their first year of business. Sales are anticipated to increase by 10% (in units - at a compounded rate) during each of the next two years. At the same time, the selling price per unit will increase by a compounded annual rate of 10%. The same supplier provides the devices to both companies. The cost of the product is 60% of the sales price. Like the sales price, the cost will increase each year. Both companies keep a safety stock equal to 1,000 units at all times. (For example, during the first year each company will purchase 11,000 units - the 10,000 units to be sold plus an additional 1,000 units "just in case." During the second year, 11,000 units will be purchased 1,000 units will remain from the first year.) Service contracts are available with each hardware device. These contracts cover the device "top to bottom" for a period of four years. The service contract costs $500, for this period, and the price will remain the same for the first three years of business. Onehalf of all customers purchase the service contract. Selling \& Administrative Expenses (Salaries, Advertising, and et. al.) are budgeted to be $1,000,000 during the first year and grow at a compounded rate of 3%. Plant \& Equipment costing $600,000 will be purchased at inception and will be depreciated using the Straight-Line method assuming no salvage value. Using an electronic spreadsheet, please complete a three year Budgeted Income Statement for each of the companies using the following assumptions: Company One Service Contracts - Management argues that due to making the sale, initializing the customer's account and set-up problems that 40% of the revenue is earned during the year of signing. The remaining amount is earned evenly over the life of the contract. Cost of Goods Sold - This Company has adopted the First-In First-Out (FIFO) method of inventory valuation. Depreciation - This Company depreciates its assets over a fifteen year service life. Bad Debts - This Company estimates that 3% of Total Revenues will prove uncollectible. Company Two Service Contracts - Management believes that this revenue will be earned evenly over the life of the contract. Cost of Goods Sold - This Company has adopted the Last-In First-Out (LIFO) method of inventory valuation. Depreciation - This Company depreciates its assets over a ten year service life. Bad Debts - This Company estimates that 4% of Total Revenues will prove uncollectible. Accounting Methods \& Estimates

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started