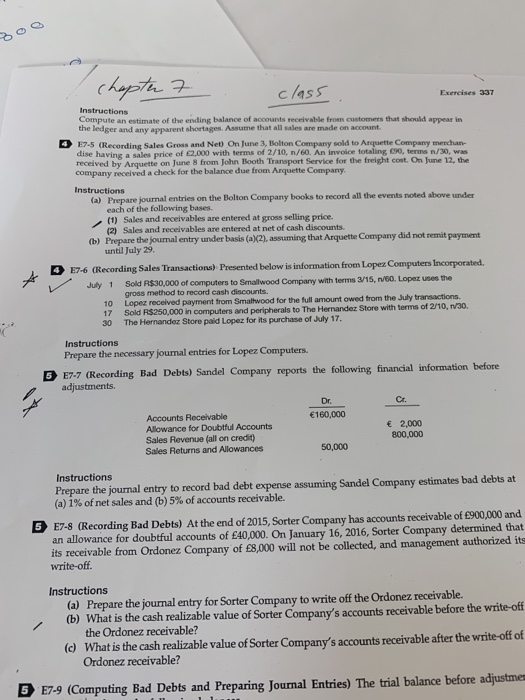

f C. 1455 Instructions Compute an estimate of the ending balance of accounts receivable from customers that should appear in the ledger and any apparent shortages. Assume that all sales are made on account 4 E7-5 (Recording Sales Gross and Net) On June 3, Bolton Company sold to Arquette Company merchan- dise having a sales price of 2,000 with terms of 2/10, n/60. An invoice totaling 90, terms n/30, was received by Arquette on June 8 from John Booth Transport Service for the freight cost. On June 12, the company received a check for the balance due from Arquette Company. Instructions entries on the Bolton Company books to record all the events noted above under each of the following bases. (1) Sales and receivables are entered at gross selling price. (2) Sales and receivables are entered at net of cash discounts. the journal entry under basis (aX2), assuming that Arquette Company did not remit payment until July 29. 4 E7-6 (Recording Sales Transactions) Presented below is information from Lopez Computers Incorporated. July 1 Sold A$30,000 of computers to Smalwood Company with terms 3/15, n/60. Lopez uses the gross method to record cash discounts 17 Sold R$250,000 computers 30 The Hernandez Store paid Lopez for its purchase of July 17 payment from Smaltwood for the full amount owed from the July transactions in computers and peripherals to The Hernandez Store with terms of 2/10, nv/30. Instructions Prepare the necessary journal entries for Lopez Computers D E77 Recording Bad Debs) Sandel Company reports the folowing financial information before Dr. Cr. Accounts Receivable Allowance for Doubtful Accounts Sales Revenue (all on credit) Sales Returns and Alowances 160,000 2,000 800,000 50,000 Instructions Prepare the journal entry to record bad debt expense assuming Sandel Company estimates bad debts at (a) 1% of net sales and (b) 5% of accounts receivable. ET-S (Recording Bad Debts) At the end of 2015 its receivable from Ordonez Company of 8,000 will not be collected, and management authorized its 5, Sorter Company has accounts receivable of 900,000 and an allowance for doubtful accounts of 40,000. On January 16, 2016, Sorter Company determined that write-off. Instructions (a) Prepare the journal entry for Sorter Company to write off the Ordonez receivable. (b) What is the cash realizable value of Sorter Company's accounts receivable before the write-off (d What is the cash realizable value of Sorter Company's accounts receivable after the write-off of the Ordonez receivable? Ordonez receivable? D E79 (Computing Bad Debhs and Preparing Journal Entrie) The trial balance before adustme f C. 1455 Instructions Compute an estimate of the ending balance of accounts receivable from customers that should appear in the ledger and any apparent shortages. Assume that all sales are made on account 4 E7-5 (Recording Sales Gross and Net) On June 3, Bolton Company sold to Arquette Company merchan- dise having a sales price of 2,000 with terms of 2/10, n/60. An invoice totaling 90, terms n/30, was received by Arquette on June 8 from John Booth Transport Service for the freight cost. On June 12, the company received a check for the balance due from Arquette Company. Instructions entries on the Bolton Company books to record all the events noted above under each of the following bases. (1) Sales and receivables are entered at gross selling price. (2) Sales and receivables are entered at net of cash discounts. the journal entry under basis (aX2), assuming that Arquette Company did not remit payment until July 29. 4 E7-6 (Recording Sales Transactions) Presented below is information from Lopez Computers Incorporated. July 1 Sold A$30,000 of computers to Smalwood Company with terms 3/15, n/60. Lopez uses the gross method to record cash discounts 17 Sold R$250,000 computers 30 The Hernandez Store paid Lopez for its purchase of July 17 payment from Smaltwood for the full amount owed from the July transactions in computers and peripherals to The Hernandez Store with terms of 2/10, nv/30. Instructions Prepare the necessary journal entries for Lopez Computers D E77 Recording Bad Debs) Sandel Company reports the folowing financial information before Dr. Cr. Accounts Receivable Allowance for Doubtful Accounts Sales Revenue (all on credit) Sales Returns and Alowances 160,000 2,000 800,000 50,000 Instructions Prepare the journal entry to record bad debt expense assuming Sandel Company estimates bad debts at (a) 1% of net sales and (b) 5% of accounts receivable. ET-S (Recording Bad Debts) At the end of 2015 its receivable from Ordonez Company of 8,000 will not be collected, and management authorized its 5, Sorter Company has accounts receivable of 900,000 and an allowance for doubtful accounts of 40,000. On January 16, 2016, Sorter Company determined that write-off. Instructions (a) Prepare the journal entry for Sorter Company to write off the Ordonez receivable. (b) What is the cash realizable value of Sorter Company's accounts receivable before the write-off (d What is the cash realizable value of Sorter Company's accounts receivable after the write-off of the Ordonez receivable? Ordonez receivable? D E79 (Computing Bad Debhs and Preparing Journal Entrie) The trial balance before adustme