Question

Middleton Store is a GST-registered business in Australia that sells mobile phone with one year warranty and maintenance services. The business uses a perpetual inventory

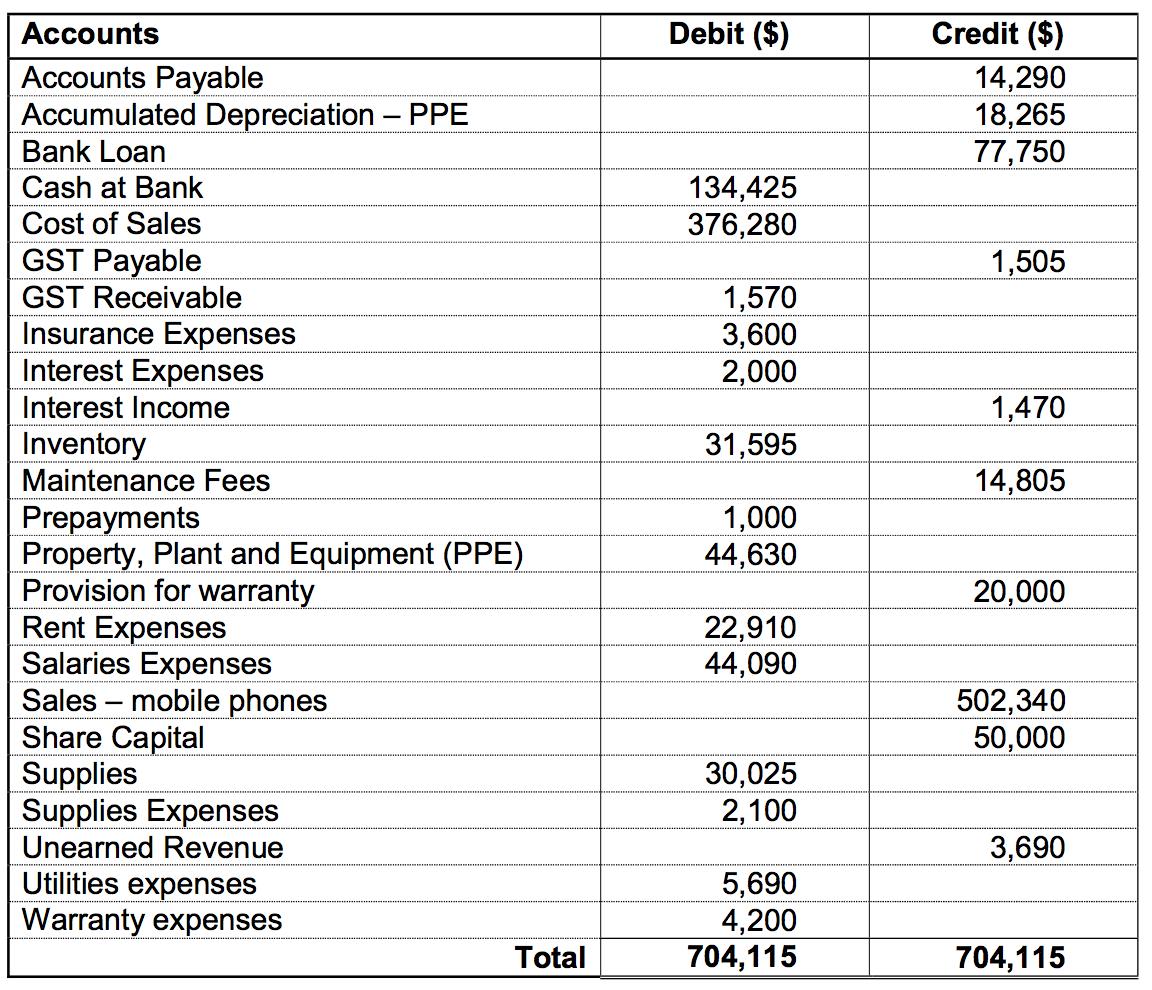

Middleton Store is a GST-registered business in Australia that sells mobile phone with one year warranty and maintenance services. The business uses a perpetual inventory system on accrual basis. Its unadjusted trial balance as at 30 November 2020 is as follows:

At 30 November 2020, the following transactions were found not recorded:

A refund of $16,775 inclusive GST received for a box of recalled mobile phones

returned to the manufacturer.

The bank statement also showed a monthly interest of $235 charged for the bank loan.

The monthly statement received from a service provider showed the amount of $15,840 inclusive GST for warranty claims for November to be paid in December 2020.

The following are additional information for month-end adjustment:- The closing balance of the Provision for warranty account to be adjusted to 5% of mobile phone sales after the warranty claims in transaction iii.

- A stock take on 30 November 2020 showed that physical inventory on hand reconciled with the inventory ledger balance but the physical supplies on hand were $27,000. The difference had been used but was not recorded.

- The “Insurance expenses” account is for a payment made earlier in the year for a policy covering 1 April 2020 to 31 March 2021.

Required:

a. Prepare the general journal entries to record all the above transactions. Narrations are NOT required.

Accounts Debit ($) Credit ($) Accounts Payable Accumulated Depreciation - PPE 14,290 18,265 77,750 Bank Loan 134,425 376,280 Cash at Bank Cost of Sales GST Payable 1,505 1,570 3,600 2,000 GST Receivable Insurance Expenses Interest Expenses Interest Income 1,470 Inventory 31,595 Maintenance Fees 14,805 Prepayments Property, Plant and Equipment (PPE) Provision for warranty Rent Expenses Salaries Expenses Sales mobile phones Share Capital Supplies Supplies Expenses Unearned Revenue Utilities expenses Warranty expenses 1,000 44,630 20,000 22,910 44,090 502,340 50,000 30,025 2,100 3,690 5,690 4,200 704,115 Total 704,115

Step by Step Solution

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries to Record the Missing Adjustment Entries 1Ref...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started