Answered step by step

Verified Expert Solution

Question

1 Approved Answer

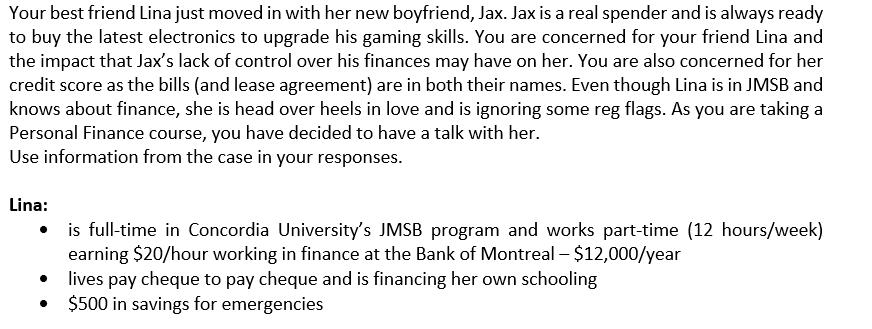

Your best friend Lina just moved in with her new boyfriend, Jax. Jax is a real spender and is always ready to buy the

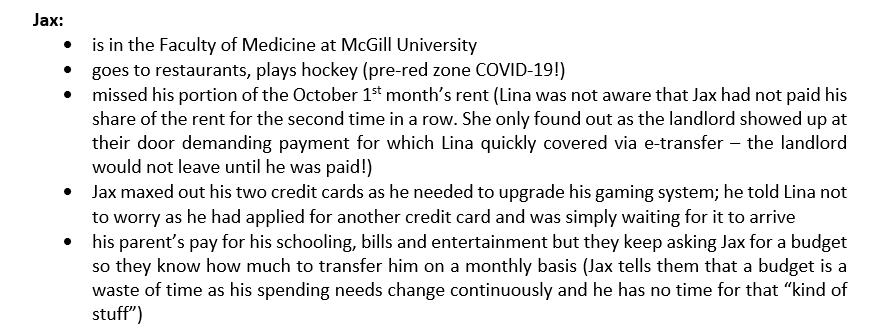

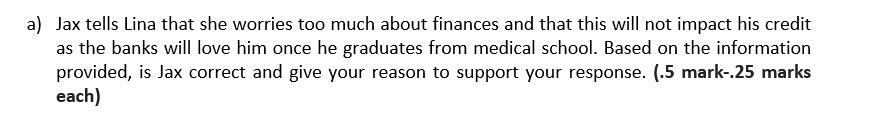

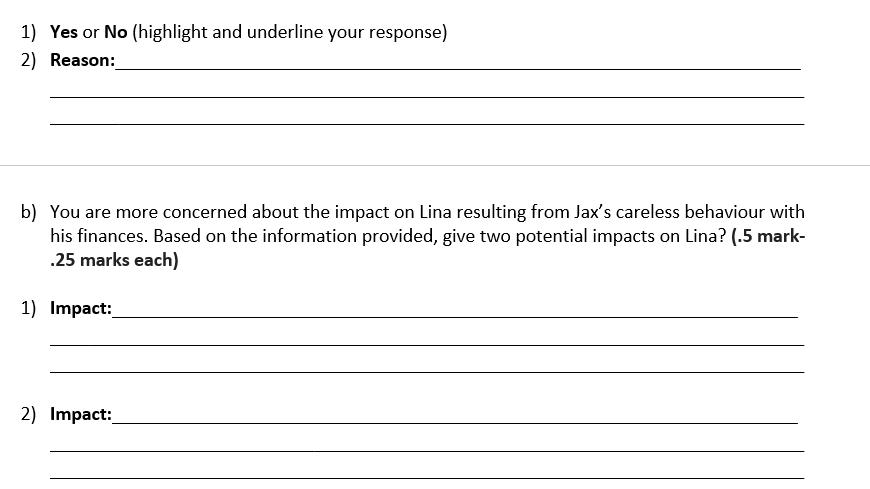

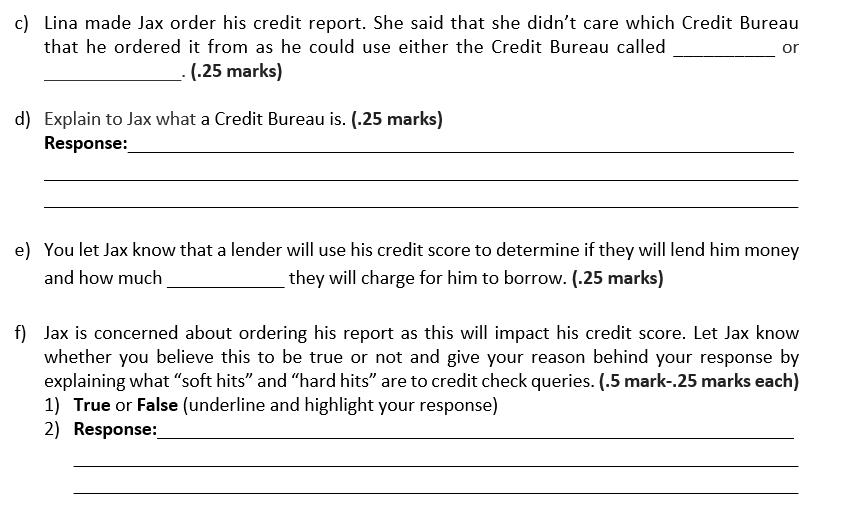

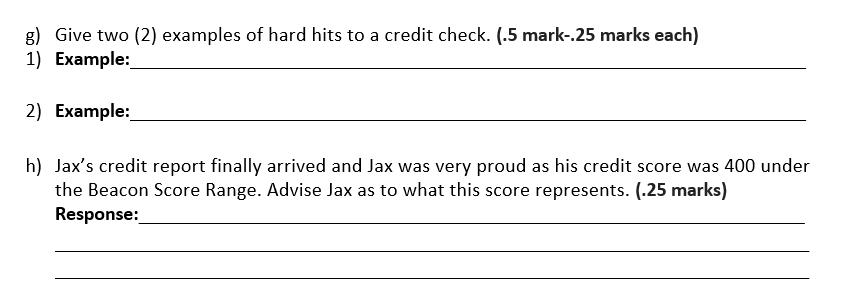

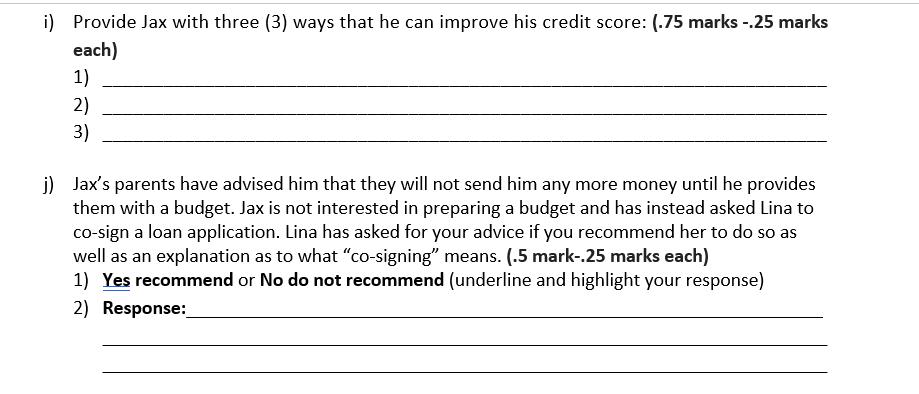

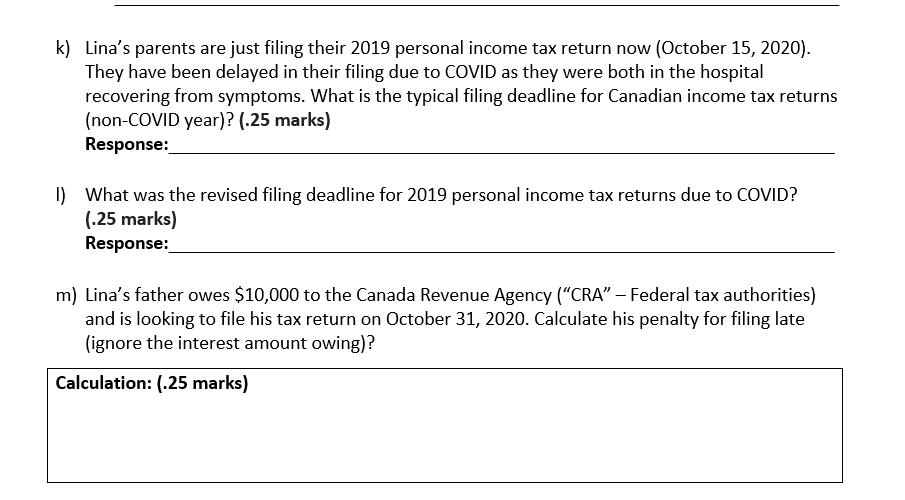

Your best friend Lina just moved in with her new boyfriend, Jax. Jax is a real spender and is always ready to buy the latest electronics to upgrade his gaming skills. You are concerned for your friend Lina and the impact that Jax's lack of control over his finances may have on her. You are also concerned for her credit score as the bills (and lease agreement) are in both their names. Even though Lina is in JMSB and knows about finance, she is head over heels in love and is ignoring some reg flags. As you are taking a Personal Finance course, you have decided to have a talk with her. Use information from the case in your responses. Lina: is full-time in Concordia University's JMSB program and works part-time (12 hours/week) earning $20/hour working in finance at the Bank of Montreal - $12,000/year lives pay cheque to pay cheque and is financing her own schooling $500 in savings for emergencies Jax: is in the Faculty of Medicine at McGill University goes to restaurants, plays hockey (pre-red zone COVID-19!) missed his portion of the October 1st month's rent (Lina was not aware that Jax had not paid his share of the rent for the second time in a row. She only found out as the landlord showed up at their door demanding payment for which Lina quickly covered via e-transfer - the landlord would not leave until he was paid!) Jax maxed out his two credit cards as he needed to upgrade his gaming system; he told Lina not to worry as he had applied for another credit card and was simply waiting for it to arrive his parent's pay for his schooling, bills and entertainment but they keep asking Jax for a budget so they know how much to transfer him on a monthly basis (Jax tells them that a budget is a waste of time as his spending needs change continuously and he has no time for that "kind of stuff") a) Jax tells Lina that she worries too much about finances and that this will not impact his credit as the banks will love him once he graduates from medical school. Based on the information provided, is Jax correct and give your reason to support your response. (.5 mark-.25 marks each) 1) Yes or No (highlight and underline your response) 2) Reason: b) You are more concerned about the impact on Lina resulting from Jax's careless behaviour with his finances. Based on the information provided, give two potential impacts on Lina? (.5 mark- .25 marks each) 1) Impact: 2) Impact:_ c) Lina made Jax order his credit report. She said that she didn't care which Credit Bureau that he ordered it from as he could use either the Credit Bureau called or _.(.25 marks) d) Explain to Jax what a Credit Bureau is. (.25 marks) Response: e) You let Jax know that a lender will use his credit score to determine if they will lend him money and how much they will charge for him to borrow. (.25 marks) f) Jax is concerned about ordering his report as this will impact his credit score. Let Jax know whether you believe this to be true or not and give your reason behind your response by explaining what "soft hits" and "hard hits" are to credit check queries. (.5 mark-.25 marks each) 1) True or False (underline and highlight your response) 2) Response: g) Give two (2) examples of hard hits to a credit check. (.5 mark-.25 marks each) 1) Example: 2) Example: h) Jax's credit report finally arrived and Jax was very proud as his credit score was 400 under the Beacon Score Range. Advise Jax as to what this score represents. (.25 marks) Response: i) Provide Jax with three (3) ways that he can improve his credit score: (.75 marks -.25 marks each) 1) 2) 3) j) Jax's parents have advised him that they will not send him any more money until he provides them with a budget. Jax is not interested in preparing a budget and has instead asked Lina to co-sign a loan application. Lina has asked for your advice if you recommend her to do so as well as an explanation as to what "co-signing" means. (.5 mark-.25 marks each) 1) Yes recommend or No do not recommend (underline and highlight your response) 2) Response: k) Lina's parents are just filing their 2019 personal income tax return now (October 15, 2020). They have been delayed in their filing due to COVID as they were both in the hospital recovering from symptoms. What is the typical filing deadline for Canadian income tax returns (non-COVID year)? (.25 marks) Response: 1) What was the revised filing deadline for 2019 personal income tax returns due to COVID? (.25 marks) Response: m) Lina's father owes $10,000 to the Canada Revenue Agency ("CRA" - Federal tax authorities) and is looking to file his tax return on October 31, 2020. Calculate his penalty for filing late (ignore the interest amount owing)? Calculation: (.25 marks)

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a Jax is not correct Jaxs careless behavior with his finances can have a negative impact on his credit score even if he graduates from medical school Credit scores are based on a variety of factors in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started