Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mary Lou Black, M.D., president of Narcolarm, Inc., was in the process of preparing a business plan, including some pro forma financial statements, for

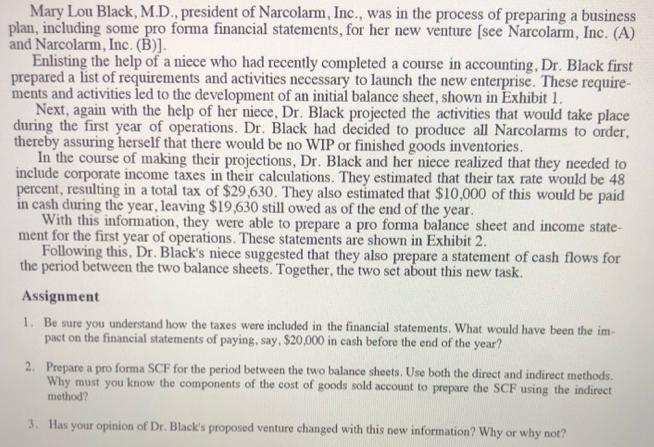

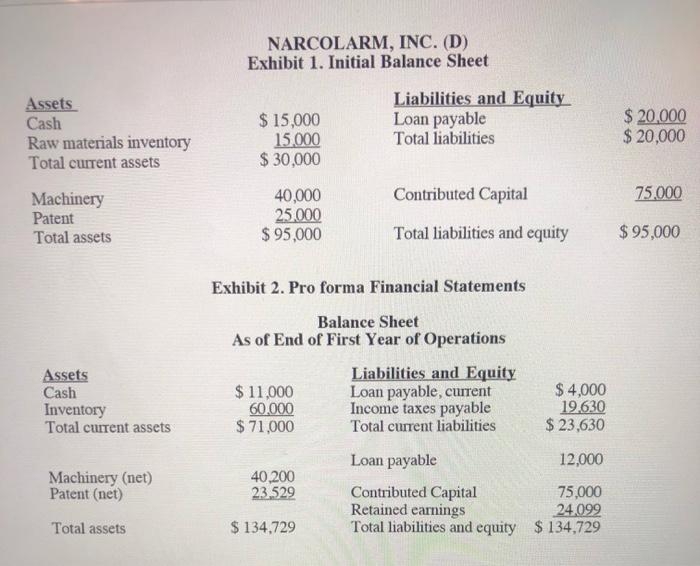

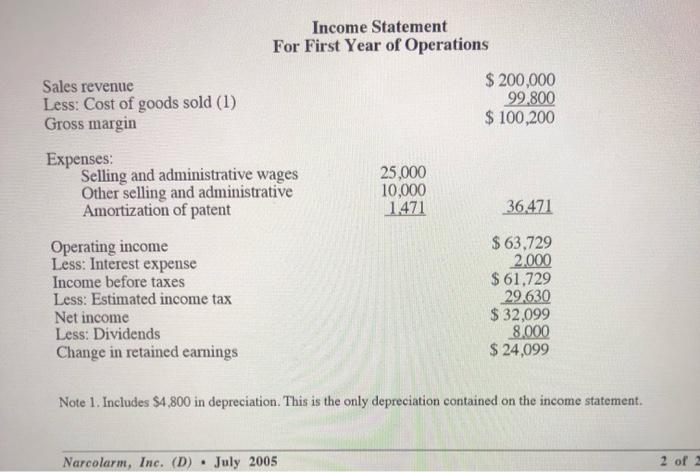

Mary Lou Black, M.D., president of Narcolarm, Inc., was in the process of preparing a business plan, including some pro forma financial statements, for her new venture [see Narcolarm, Inc. (A) and Narcolarm, Inc. (B)]. Enlisting the help of a niece who had recently completed a course in accounting, Dr. Black first prepared a list of requirements and activities necessary to launch the new enterprise. These require- ments and activities led to the development of an initial balance sheet, shown in Exhibit 1. Next, again with the help of her niece, Dr. Black projected the activities that would take place during the first year of operations. Dr. Black had decided to produce all Narcolarms to order, thereby assuring herself that there would be no WIP or finished goods inventories. In the course of making their projections, Dr. Black and her niece realized that they needed to include corporate income taxes in their calculations. They estimated that their tax rate would be 48 percent, resulting in a total tax of $29,630. They also estimated that $10,000 of this would be paid in cash during the year, leaving $19,630 still owed as of the end of the year. With this information, they were able to prepare a pro forma balance sheet and income state- ment for the first year of operations. These statements are shown in Exhibit 2. Following this, Dr. Black's niece suggested that they also prepare a statement of cash flows for the period between the two balance sheets. Together, the two set about this new task. Assignment 1. Be sure you understand how the taxes were included in the financial statements. What would have been the im- pact on the financial statements of paying, say, $20,000 in cash before the end of the year? 2. Prepare a pro forma SCF for the period between the two balance sheets. Use both the direct and indirect methods. Why must you know the components of the cost of goods sold account to prepare the SCF using the indirect method? 3. Has your opinion of Dr. Black's proposed venture changed with this new information? Why or why not? Assets Cash Raw materials inventory Total current assets Machinery Patent Total assets Assets Cash Inventory Total current assets Machinery (net) Patent (net) Total assets NARCOLARM, INC. (D) Exhibit 1. Initial Balance Sheet $ 15,000 15,000 $ 30,000 40,000 25,000 $ 95,000 $11,000 60,000 $71,000 Exhibit 2. Pro forma Financial Statements Balance Sheet As of End of First Year of Operations 40,200 23.529 Liabilities and Equity Loan payable Total liabilities $ 134,729 Contributed Capital Total liabilities and equity Liabilities and Equity Loan payable, current Income taxes payable Total current liabilities Loan payable $ 4,000 19,630 $ 23,630 12,000 75,000 24.099 Contributed Capital Retained earnings Total liabilities and equity $134,729 $20,000 $ 20,000 75,000 $ 95,000 Sales revenue Less: Cost of goods sold (1) Gross margin Expenses: Selling and administrative wages Other selling and administrative Amortization of patent Operating income Less: Interest expense Income before taxes Less: Estimated income tax Net income Less: Dividends Change in retained earnings Income Statement For First Year of Operations Narcolarm, Inc. (D) July 2005 . 25,000 10,000 1,471 $ 200,000 99,800 $ 100,200 36,471 $63,729 2,000 $ 61,729 29,630 $ 32,099 Note 1. Includes $4,800 in depreciation. This is the only depreciation contained on the income statement. 8.000 $ 24,099 2 of 2

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started