Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Professor Bess taught us that truckload (TL) rates per pound are lower than less-than- truckload (LTL) rates per pound. Jason replied. With LTL you

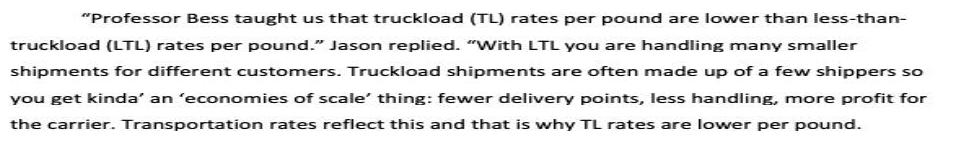

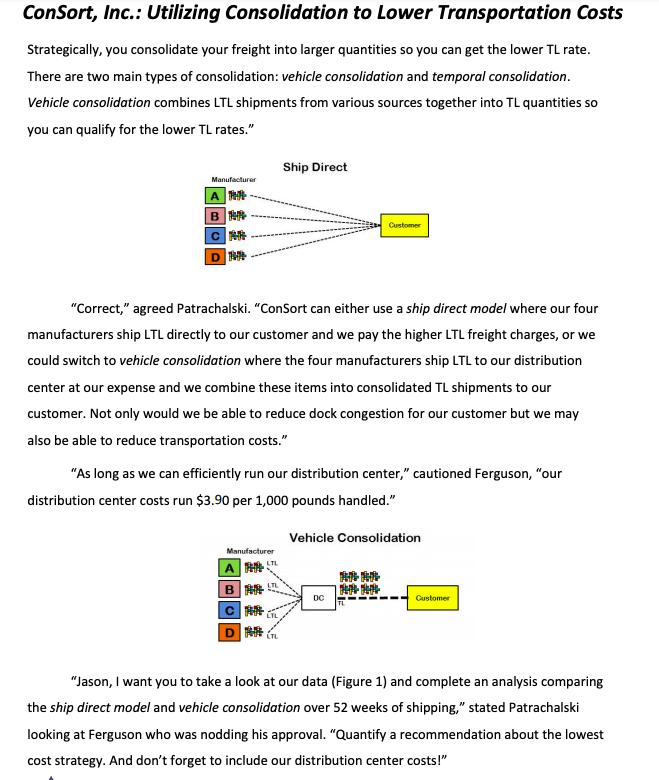

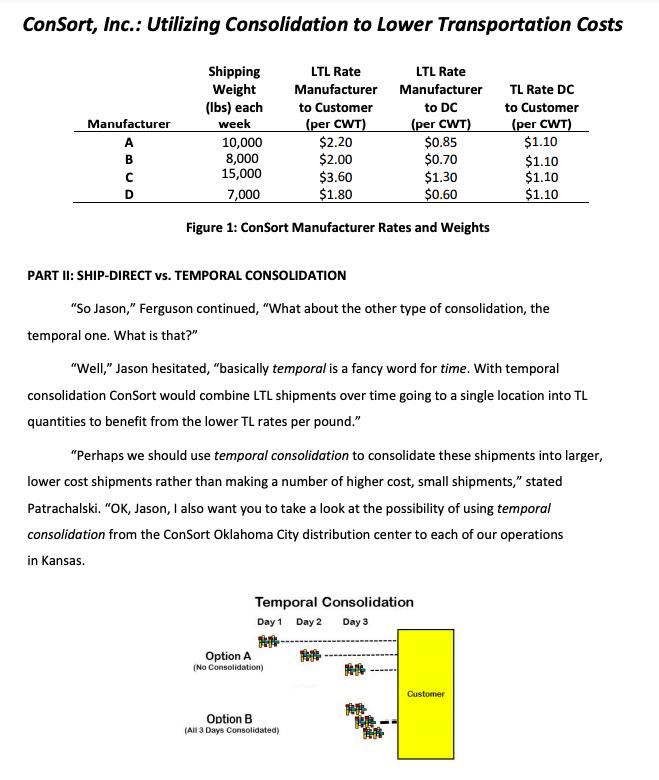

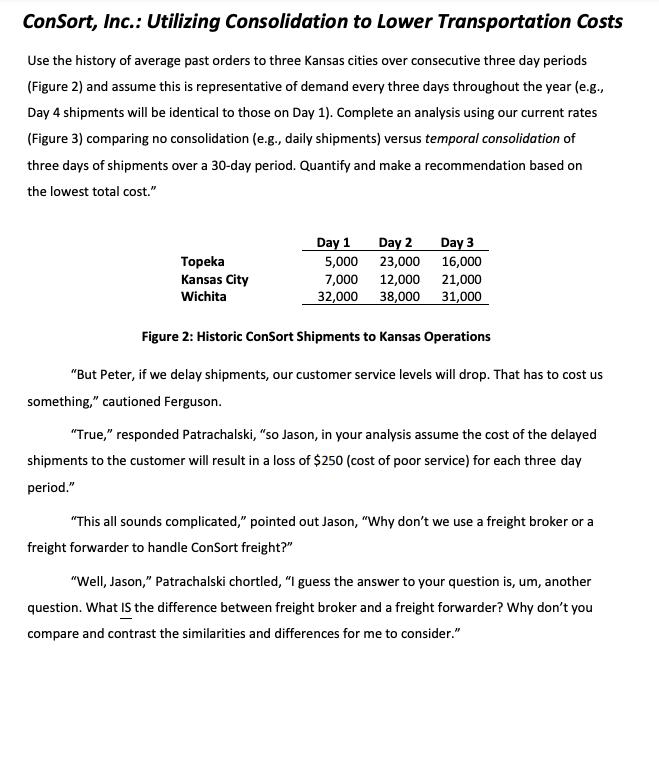

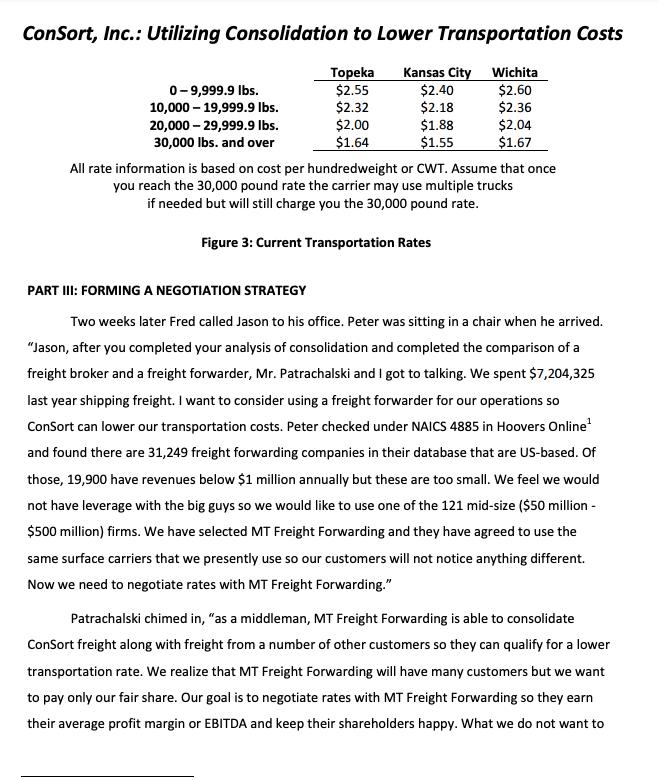

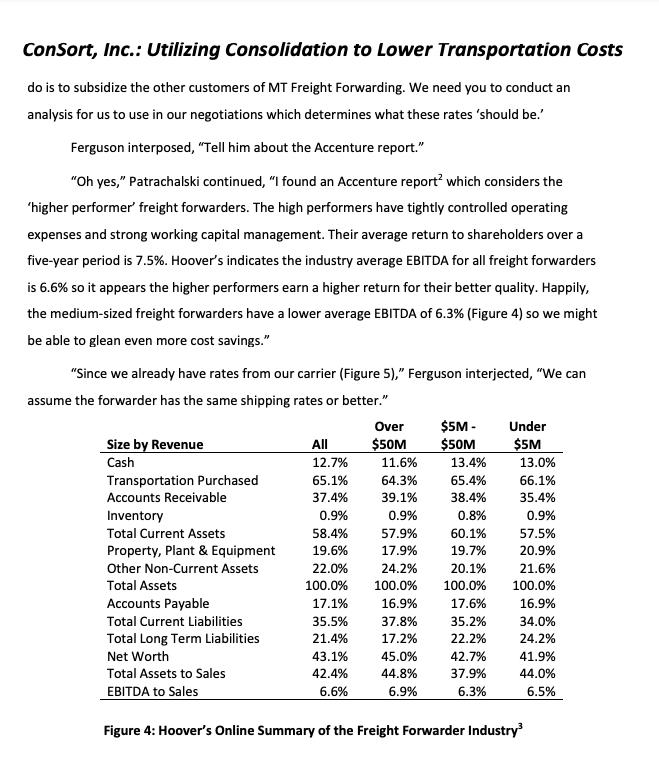

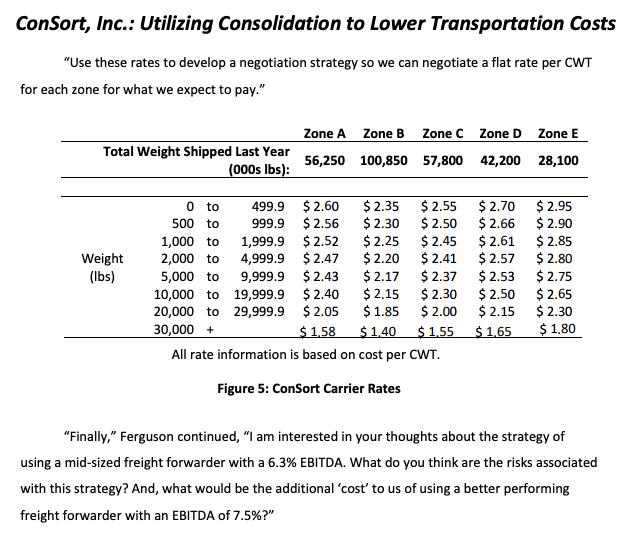

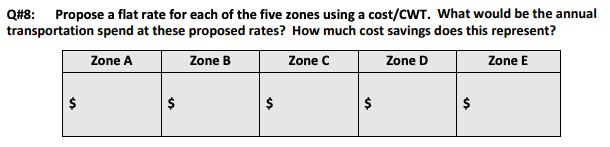

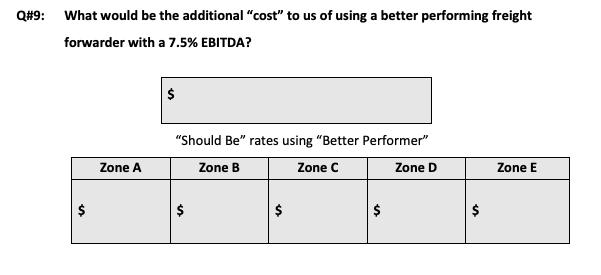

"Professor Bess taught us that truckload (TL) rates per pound are lower than less-than- truckload (LTL) rates per pound." Jason replied. "With LTL you are handling many smaller shipments for different customers. Truckload shipments are often made up of a few shippers so you get kinda' an 'economies of scale' thing: fewer delivery points, less handling, more profit for the carrier. Transportation rates reflect this and that is why TL rates are lower per pound. ConSort, Inc.: Utilizing Consolidation to Lower Transportation Costs Strategically, you consolidate your freight into larger quantities so you can get the lower TL rate. There are two main types of consolidation: vehicle consolidation and temporal consolidation. Vehicle consolidation combines LTL shipments from various sources together into TL quantities so you can qualify for the lower TL rates." Manufacturer A TH B C D "Correct," agreed Patrachalski. "ConSort can either use a ship direct model where our four manufacturers ship LTL directly to our customer and we pay the higher LTL freight charges, or we could switch to vehicle consolidation where the four manufacturers ship LTL to our distribution center at our expense and we combine these items into consolidated TL shipments to our customer. Not only would we be able to reduce dock congestion for our customer but we may also be able to reduce transportation costs." Manufacturer "As long as we can efficiently run our distribution center," cautioned Ferguson, "our distribution center costs run $3.90 per 1,000 pounds handled." B C D Ship Direct LTL LTL Customer Vehicle Consolidation DC ** Customer "Jason, I want you to take a look at our data (Figure 1) and complete an analysis comparing the ship direct model and vehicle consolidation over 52 weeks of shipping," stated Patrachalski looking at Ferguson who was nodding his approval. "Quantify a recommendation about the lowest cost strategy. And don't forget to include our distribution center costs!" Consort, Inc.: Utilizing Consolidation to Lower Transportation Costs LTL Rate Manufacturer to Customer (per CWT) Manufacturer A BU D Shipping Weight (lbs) each week 10,000 8,000 15,000 7,000 $2.20 $2.00 $3.60 $1.80 Figure 1: ConSort Manufacturer Rates and Weights LTL Rate Manufacturer to DC (per CWT) Option A (No Consolidation) $0.85 $0.70 $1.30 $0.60 PART II: SHIP-DIRECT vs. TEMPORAL CONSOLIDATION "So Jason," Ferguson continued, "What about the other type of consolidation, the temporal one. What is that?" Temporal Consolidation Day 1 Day 2 Day 3 Option B (All 3 Days Consolidated) "Well," Jason hesitated, "basically temporal is a fancy word for time. With temporal consolidation ConSort would combine LTL shipments over time going to a single location into TL quantities to benefit from the lower TL rates per pound." "Perhaps we should use temporal consolidation to consolidate these shipments into larger, lower cost shipments rather than making a number of higher cost, small shipments," stated Patrachalski. "OK, Jason, I also want you to take a look at the possibility of using temporal consolidation from the ConSort Oklahoma City distribution center to each of our operations in Kansas. BB TL Rate DC to Customer (per CWT) $1.10 $1.10 $1.10 $1.10 Customer ConSort, Inc.: Utilizing Consolidation to Lower Transportation Costs Use the history of average past orders to three Kansas cities over consecutive three day periods (Figure 2) and assume this is representative of demand every three days throughout the year (e.g., Day 4 shipments will be identical to those on Day 1). Complete an analysis using our current rates (Figure 3) comparing no consolidation (e.g., daily shipments) versus temporal consolidation of three days of shipments over a 30-day period. Quantify and make a recommendation based on the lowest total cost." Topeka Kansas City Wichita Day 2 5,000 23,000 7,000 12,000 32,000 38,000 Day 1 Day 3 16,000 21,000 31,000 Figure 2: Historic ConSort Shipments to Kansas Operations "But Peter, if we delay shipments, our customer service levels will drop. That has to cost us something," cautioned Ferguson. "True," responded Patrachalski, "so Jason, in your analysis assume the cost of the delayed shipments to the customer will result in a loss of $250 (cost of poor service) for each three day period." "This all sounds complicated," pointed out Jason, "Why don't we use a freight broker or a freight forwarder to handle ConSort freight?" "Well, Jason," Patrachalski chortled, "I guess the answer to your question is, um, another question. What Is the difference between freight broker and a freight forwarder? Why don't you compare and contrast the similarities and differences for me to consider." Consort, Inc.: Utilizing Consolidation to Lower Transportation Costs Topeka Kansas City Wichita $2.55 $2.60 $2.32 $2.36 $2.04 $1.67 0-9,999.9 lbs. 10,000 - 19,999.9 lbs. 20,000 - 29,999.9 lbs. 30,000 lbs. and over $2.00 $1.64 $2.40 $2.18 $1.88 $1.55 All rate information is based on cost per hundredweight or CWT. Assume that once you reach the 30,000 pound rate the carrier may use multiple trucks if needed but will still charge you the 30,000 pound rate. Figure 3: Current Transportation Rates PART III: FORMING A NEGOTIATION STRATEGY Two weeks later Fred called Jason to his office. Peter was sitting in a chair when he arrived. "Jason, after you completed your analysis of consolidation and completed the comparison of a freight broker and a freight forwarder, Mr. Patrachalski and I got to talking. We spent $7,204,325 last year shipping freight. I want to consider using a freight forwarder for our operations so ConSort can lower our transportation costs. Peter checked under NAICS 4885 in Hoovers Online and found there are 31,249 freight forwarding companies in their database that are US-based. Of those, 19,900 have revenues below $1 million annually but these are too small. We feel we would not have leverage with the big guys so we would like to use one of the 121 mid-size ($50 million - $500 million) firms. We have selected MT Freight Forwarding and they have agreed to use the same surface carriers that we presently use so our customers will not notice anything different. Now we need to negotiate rates with MT Freight Forwarding." Patrachalski chimed in, "as a middleman, MT Freight Forwarding is able to consolidate ConSort freight along with freight from a number of other customers so they can qualify for a lower transportation rate. We realize that MT Freight Forwarding will have many customers but we want to pay only our fair share. Our goal is to negotiate rates with MT Freight Forwarding so they earn their average profit margin or EBITDA and keep their shareholders happy. What we do not want to Consort, Inc.: Utilizing Consolidation to Lower Transportation Costs do is to subsidize the other customers of MT Freight Forwarding. We need you to conduct an analysis for us to use in our negotiations which determines what these rates 'should be.' Ferguson interposed, "Tell him about the Accenture report." "Oh yes," Patrachalski continued, "I found an Accenture report which considers the 'higher performer' freight forwarders. The high performers have tightly controlled operating expenses and strong working capital management. Their average return to shareholders over a five-year period is 7.5%. Hoover's indicates the industry average EBITDA for all freight forwarders is 6.6% so it appears the higher performers earn a higher return for their better quality. Happily, the medium-sized freight forwarders have a lower average EBITDA of 6.3% (Figure 4) so we might be able to glean even more cost savings." "Since we already have rates from our carrier (Figure 5)," Ferguson interjected, "We can assume the forwarder has the same shipping rates or better." Size by Revenue Cash Transportation Purchased Accounts Receivable Inventory Total Current Assets Property, Plant & Equipment Other Non-Current Assets Total Assets Accounts Payable Total Current Liabilities Total Long Term Liabilities Net Worth Total Assets to Sales EBITDA to Sales All 12.7% 65.1% 37.4% 0.9% 58.4% 19.6% Over $50M 11.6% 64.3% 39.1% 0.9% 57.9% 17.9% 24.2% 13.4% 13.0% 65.4% 66.1% 38.4% 35.4% 0.8% 0.9% 60.1% 57.5% 19.7% 20.9% 22.0% 20.1% 21.6% 100.0% 100.0% 100.0% 100.0% 17.1% 16.9% 17.6% 16.9% 35.5% 35.2% 34.0% 21.4% 22.2% 24.2% 43.1% 42.7% 42.4% 37.9% 6.6% 6.3% 37.8% 17.2% $5M - $50M 45.0% 44.8% 6.9% Under $5M 41.9% 44.0% 6.5% Figure 4: Hoover's Online Summary of the Freight Forwarder Industry ConSort, Inc.: Utilizing Consolidation to Lower Transportation Costs "Use these rates to develop a negotiation strategy so we can negotiate a flat rate per CWT for each zone for what we expect to pay." Total Weight Shipped Last Year (000s lbs): Weight (lbs) 0 to 500 to 1,000 to 2,000 to 5,000 to 499.9 999.9 $ 2.60 $2.56 1,999.9 $ 2.52 4,999.9 $ 2.47 9,999.9 $2.43 Zone A 56,250 10,000 to 19,999.9 20,000 to 29,999.9 30,000 + Zone B Zone C Zone D Zone E 100,850 57,800 42,200 28,100 $ 2.35 $ 2.30 $ 2.55 $ 2.50 $2.25 $ 2.20 $ 2.17 $ 2.40 $ 2.15 $2.05 $ 1.85 $1,58 $1,40 All rate information is based on cost per CWT. Figure 5: ConSort Carrier Rates $ 2.45 $ 2.41 $ 2.37 $ 2.30 $ 2.00 $1,55 $ 2.70 $ 2.66 $ 2.61 $ 2.57 $ 2.53 $ 2.50 $ 2.15 $1,65 $ 2.95 $2.90 $ 2.85 $ 2.80 $ 2.75 $ 2.65 $ 2.30 $ 1.80 "Finally," Ferguson continued, "I am interested in your thoughts about the strategy of using a mid-sized freight forwarder with a 6.3% EBITDA. What do you think are the risks associated with this strategy? And, what would be the additional 'cost' to us of using a better performing freight forwarder with an EBITDA of 7.5%?" Q#8: Propose a flat rate for each of the five zones using a cost/CWT. What would be the annual transportation spend at these proposed rates? How much cost savings does this represent? Zone A Zone B Zone C Zone D Zone E s $ s S Q#9: What would be the additional "cost" to us of using a better performing freight forwarder with a 7.5% EBITDA? $ Zone A $ "Should Be" rates using "Better Performer" Zone B Zone C Zone D Zone E

Step by Step Solution

★★★★★

3.46 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started