Nguyen Corporation issued a $8,000,000, 6 percent bond on August 1, 2017. The market interest rate was 8 percent on that date and the

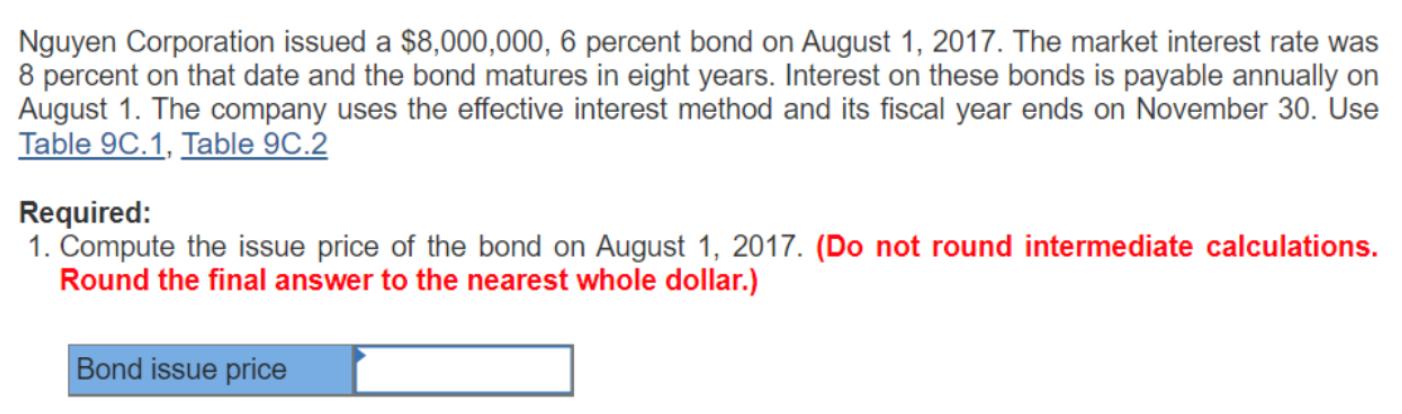

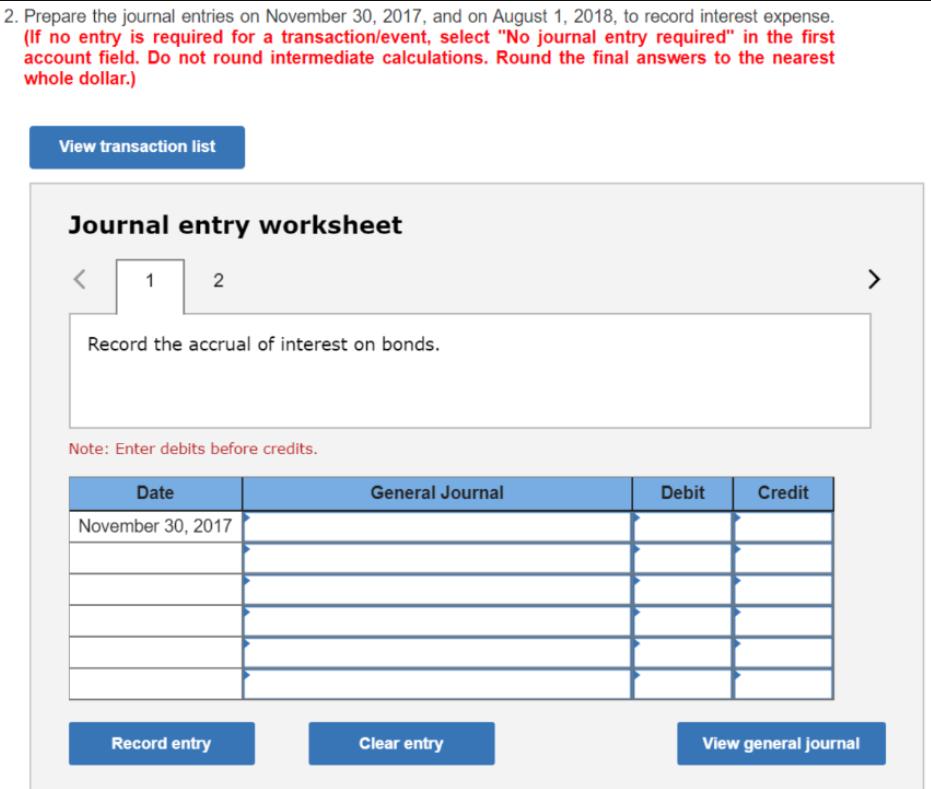

Nguyen Corporation issued a $8,000,000, 6 percent bond on August 1, 2017. The market interest rate was 8 percent on that date and the bond matures in eight years. Interest on these bonds is payable annually on August 1. The company uses the effective interest method and its fiscal year ends on November 30. Use Table 9C.1, Table 9C.2 Required: 1. Compute the issue price of the bond on August 1, 2017. (Do not round intermediate calculations. Round the final answer to the nearest whole dollar.) Bond issue price 2. Prepare the journal entries on November 30, 2017, and on August 1, 2018, to record interest expense. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) View transaction list Journal entry worksheet 1 2 > Record the accrual of interest on bonds. Note: Enter debits before credits. Date General Journal Debit Credit November 30, 2017 Record entry Clear entry View general journal

Step by Step Solution

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Solved 1 Issue price of the bondPresent value of interest paymentPresent value of principal Discount ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started