Zigg Ltd. is a wholesale distributor of a variety of imported goods to a range of retail outlets. The company specialises in supplying ornaments,

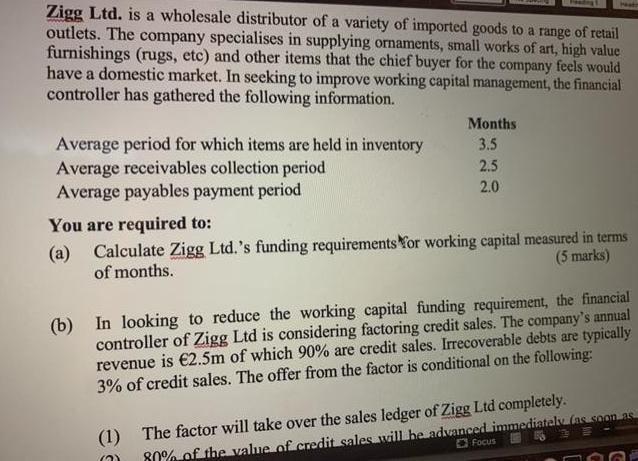

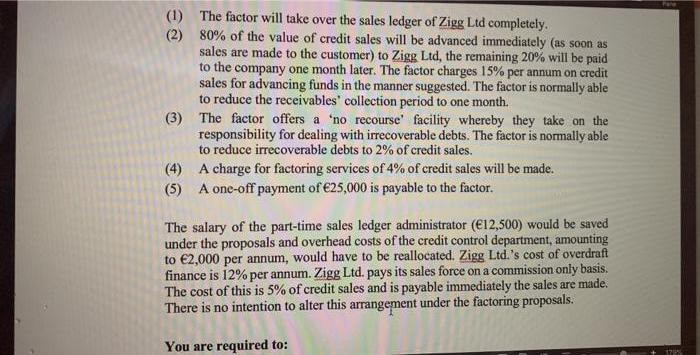

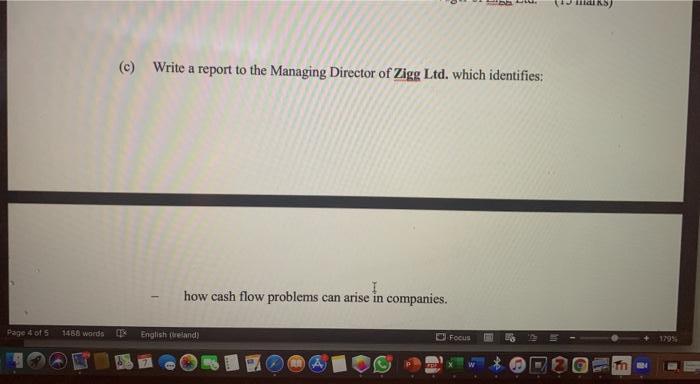

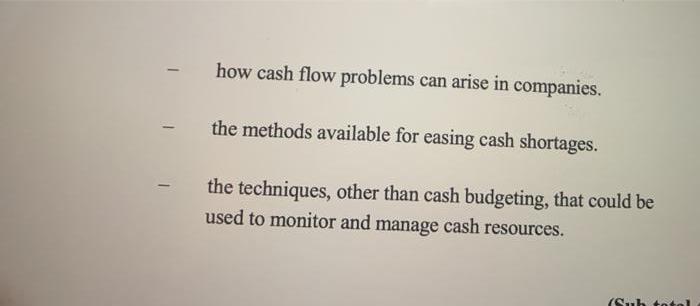

Zigg Ltd. is a wholesale distributor of a variety of imported goods to a range of retail outlets. The company specialises in supplying ornaments, small works of art, high value furnishings (rugs, etc) and other items that the chief buyer for the company feels would have a domestic market. In seeking to improve working capital management, the financial controller has gathered the following information. Months Average period for which items are held in inventory Average receivables collection period Average payables payment period 3.5 2.5 2.0 You are required to: (a) Calculate Zigg Ltd.'s funding requirements Yor working capital measured in terms of months. (5 marks) (b) In looking to reduce the working capital funding requirement, the financial controller of Zigg Ltd is considering factoring credit sales. The company's annual revenue is 2.5m of which 90% are credit sales. Irrecoverable debts are typically 3% of credit sales. The offer from the factor is conditional on the following: (1) The factor will take over the sales ledger of Zigg Ltd completely. O Focus of the value of credit sales will he advanced immediatelv (as soon as (1) The factor will take over the sales ledger of Zigg Ltd completely. (2) 80% of the value of credit sales will be advanced immediately (as soon as sales are made to the customer) to Zigg Ltd, the remaining 20% will be paid to the company one month later. The factor charges 15% per annum on credit sales for advancing funds in the manner suggested. The factor is normally able to reduce the receivables' collection period to one month. (3) The factor offers a 'no recourse' facility whereby they take on the responsibility for dealing with irrecoverable debts. The factor is normally able to reduce irrecoverable debts to 2% of credit sales. (4) A charge for factoring services of 4% of credit sales will be made. (5) A one-off payment of 25,000 is payable to the factor. The salary of the part-time sales ledger administrator (12,500) would be saved under the proposals and overhead costs of the credit control department, amounting to 2,000 per annum, would have to be reallocated. Zigg Ltd.'s cost of overdraft finance is 12% per annum. Zigg Ltd. pays its sales force on a commission only basis. The cost of this is 5% of credit sales and is payable immediately the sales are made. There is no intention to alter this arrangement under the factoring proposals. You are required to: 17% (c) Write a report to the Managing Director of Zigg Ltd. which identifies: how cash flow problems can arise in companies. Page 4 of 5 1488 words English (reland) O Focus 179% how cash flow problems can arise in companies. the methods available for easing cash shortages. the techniques, other than cash budgeting, that could be used to monitor and manage cash resources.

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a Zigg Ltds funding requirements for working capital measured in terms of months is 4 months b The factoring proposal is costlier to Ziggs Ltd by 2250...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started