Answered step by step

Verified Expert Solution

Question

1 Approved Answer

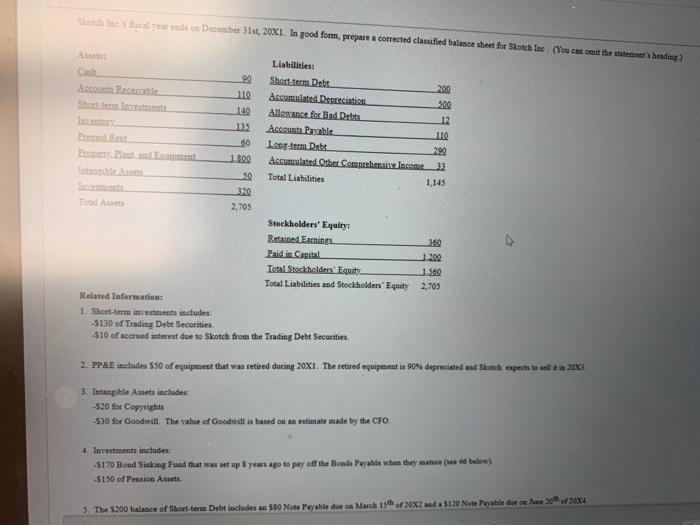

otch lac fiscal vear enda os December 31st, 20X1. In good form, prepare a corrected classified balamce sheet for Skotch Ine. (You can omit

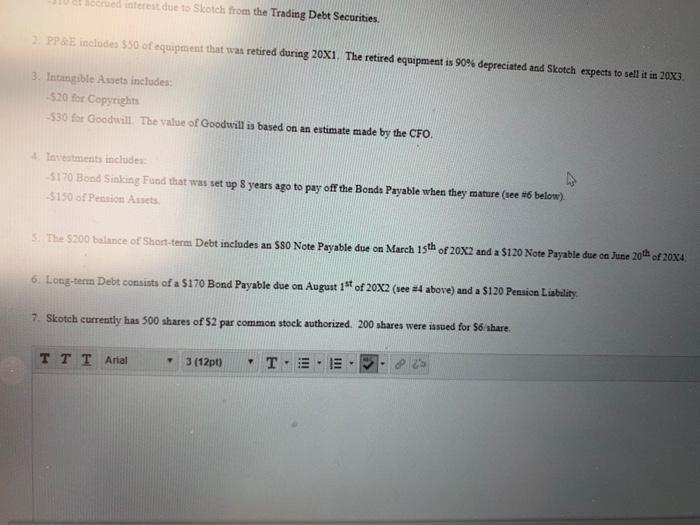

otch lac fiscal vear enda os December 31st, 20X1. In good form, prepare a corrected classified balamce sheet for Skotch Ine. (You can omit the statement's beadng) Assets: Liabilities: Cash Shortterm Debs Accumulated Desceciation Allerance fer Bad Dehts 90 200 Accounts Receirable Shortterm Iestmrsts 110 500 140 12 Ienters 135 Accounts Paable 110 Prepaid Bent Propety Plant and Equinment 60 Loog tem Debt Accumulated Other Comprehenaive lacome 290 1.800 Integihle Aets Total Liabilities 1,145 Incstmenta 320 Total Asets 2,705 Steckholders' Equity: Retained EarninEL Paid in Capital Total Stockholdern' Equity 360 1.200 1.360 Total Liabilities and Stockholden' Equity 2,705 Related Information: 1. Shorn-term inmestments includes: $130 of Trading Debt Securities $10 of accrued interest due to Skotch from the Trading Debt Securities 2. PPAE includes $50 of equipment that was retired during 20X1. The retired equipment ia 90 depreciated and Skotch expects to sell ia 20XA. 3. Intangible Assets includes $20 for Copyrights $30 for Goodwil The value of Goodwill is based on an estimate made by the CFO 4. Iavestments includes: -5170 Bond Sinking Fund that was set up years ago to pay off the Bonds Payable when they mature (ee# below) -$150 of Pension Assets 5. The $200 balance of Short-term Debt includes an S80 Note Payable due on March 15 of 20x2 and a S120 Note Payable due on ue 20of 20X4 Secrued interest due to Skotch from the Trading Debt Securities. 2. PP&E includes $50 of equipment that was retired during 20Xi, The retired equipment is 90%% depreciated and Skotch expects to sell it in 20X3. 3. Intangible Assets includes: $20 for Copyrights 330 for Goodwill The value of Goodwill is based on an estimate made by the CFO. 4. Iavestments includes -$170 Bond Sinking Fund that was set up S years ago to pay off the Bonds Payable when they mature (see #6 below). $150 of Pension Assets. 5. The $200 balance of Short-term Debt includes an S80 Note Payable due on March 15th of 20X2 and a $120 Note Payable due on June 20h of 20X4 6. Long-term Debt consists of a $170 Bond Payable due on August 1st of 20X2 (see #4 above) and a $120 Pension Liability. 7. Skotch currently has 500 shares of 52 par common stock authorized. 200 shares were issued for $6 share. TTT Anal 3 (12pt) T-E- E 4.

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Solution PNol As per the information about the scotch incis Cescal year ends on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started