Nafth Company has an Equipment Services Department that performs all needed maintenance work on the equipment in the company's Fabrication and Assembly Departments. Costs

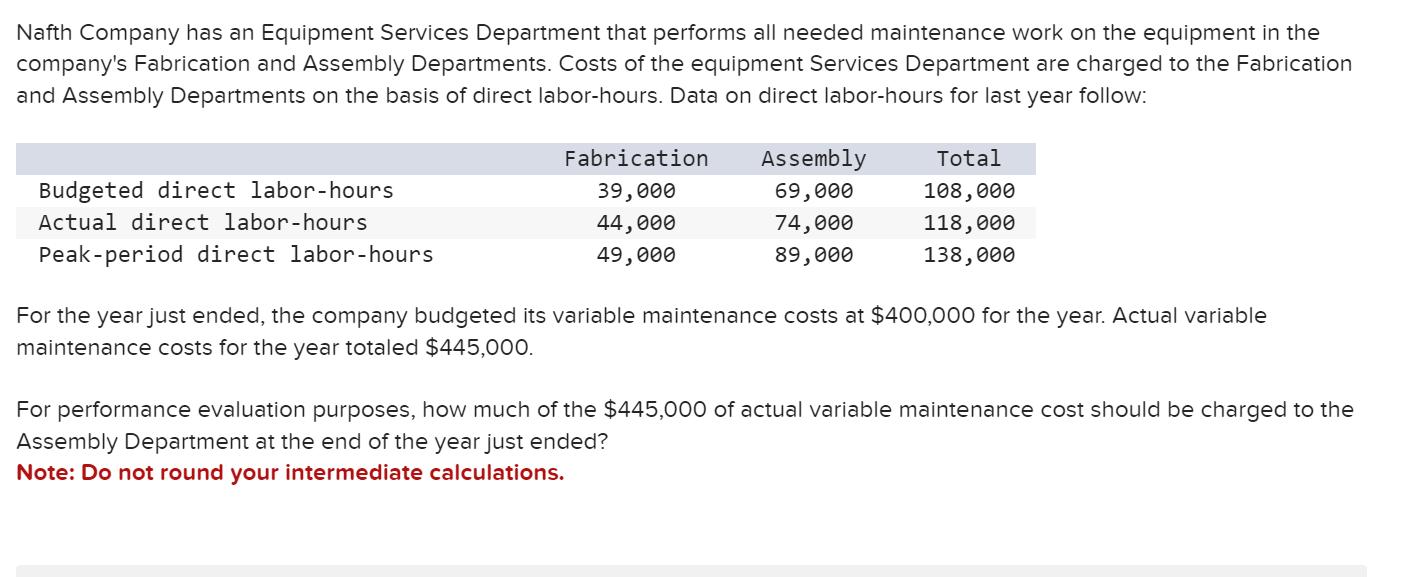

Nafth Company has an Equipment Services Department that performs all needed maintenance work on the equipment in the company's Fabrication and Assembly Departments. Costs of the equipment Services Department are charged to the Fabrication and Assembly Departments on the basis of direct labor-hours. Data on direct labor-hours for last year follow: Budgeted direct labor-hours Actual direct labor-hours Peak-period direct labor-hours Fabrication 39,000 44,000 49,000 Assembly 69,000 74,000 89,000 Total 108,000 118,000 138,000 For the year just ended, the company budgeted its variable maintenance costs at $400,000 for the year. Actual variable maintenance costs for the year totaled $445,000. For performance evaluation purposes, how much of the $445,000 of actual variable maintenance cost should be charged to the Assembly Department at the end of the year just ended? Note: Do not round your intermediate calculations.

Step by Step Solution

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Ms Tanja Umstead COMPUTATION OF TOTAL INCOME vis vis TAXABLE INCOME Note Ms mother lives with her an...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started