Answered step by step

Verified Expert Solution

Question

1 Approved Answer

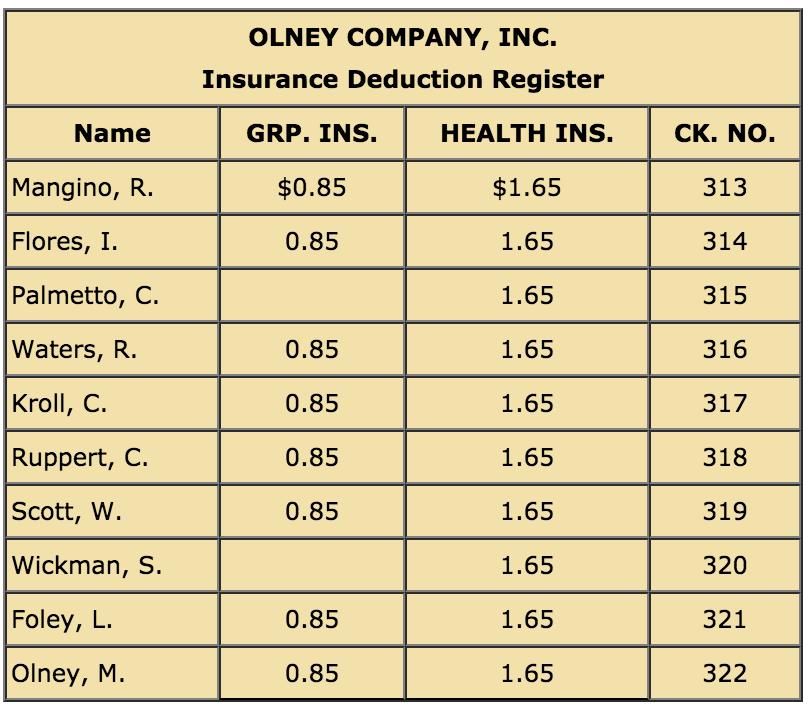

OLNEY COMPANY, INC. Insurance Deduction Register Name GRP. INS. HEALTH INS. CK. NO. Mangino, R. $0.85 $1.65 313 Flores, I. 0.85 1.65 314 Palmetto,

![EARNINGS DEDUC ONS Name Gross OASDI HI FIT SIT SUTA CIT SIMPLE Grp. Ins. Hea Mangino, R. $740.00 $45.88 $10.73 $64.00 $22.72]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2021/10/616fbea408e5e_1634713251395.jpg)

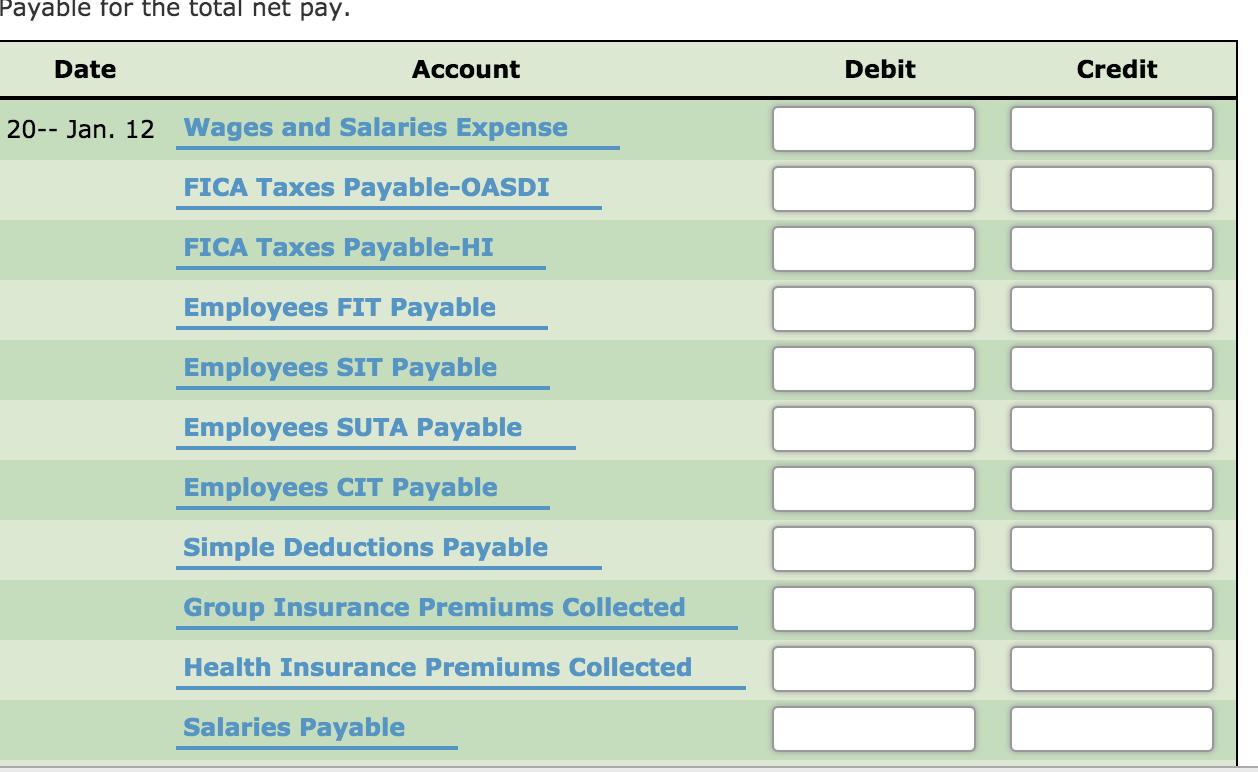

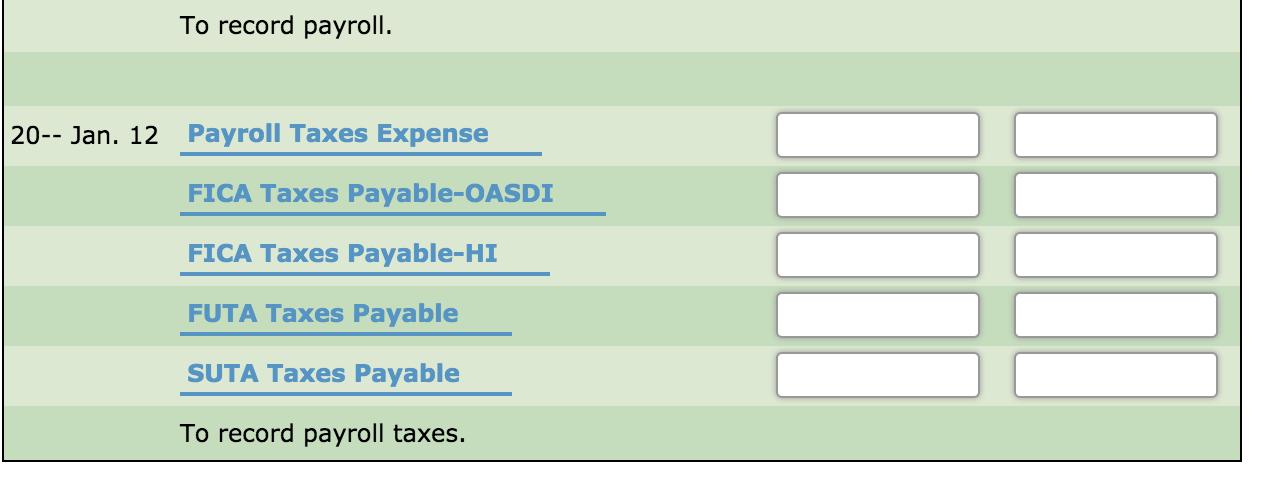

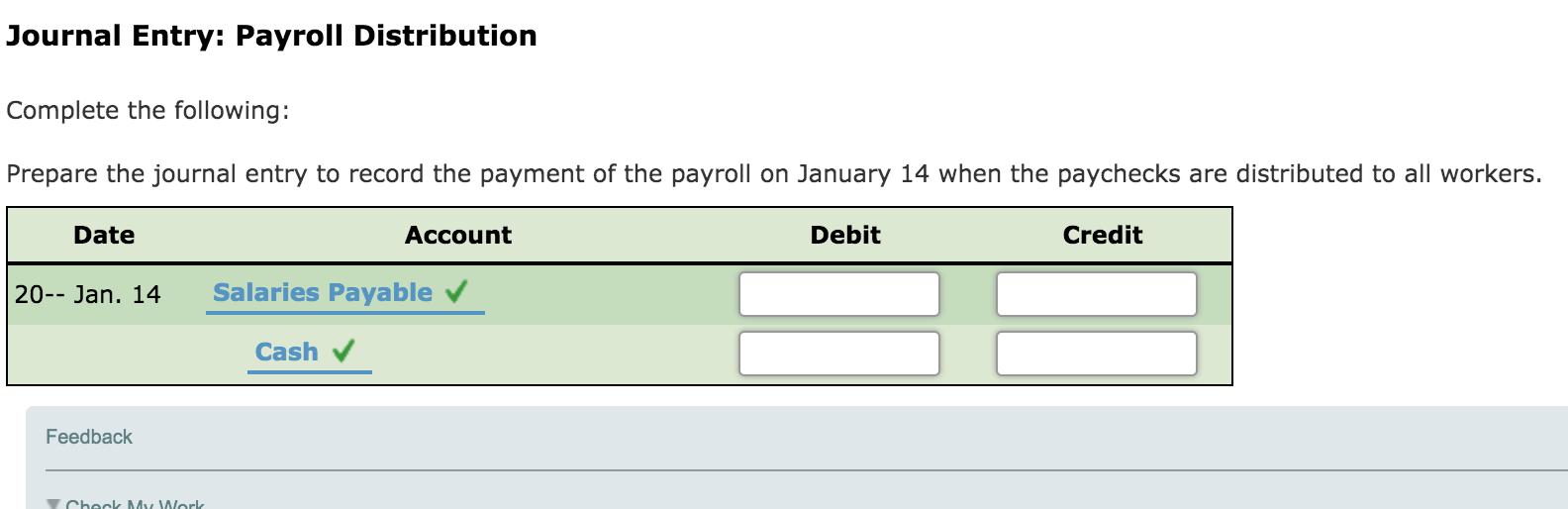

OLNEY COMPANY, INC. Insurance Deduction Register Name GRP. INS. HEALTH INS. CK. NO. Mangino, R. $0.85 $1.65 313 Flores, I. 0.85 1.65 314 Palmetto, C. 1.65 315 Waters, R. 0.85 1.65 316 Kroll, C. 0.85 1.65 317 Ruppert, C. 0.85 1.65 318 Scott, W. 0.85 1.65 319 Wickman, S. 1.65 320 Foley, L. 0.85 1.65 321 Olney, M. 0.85 1.65 322 EARNINGS DEDUC ONS Name Gross OASDI HI FIT SIT SUTA CIT SIMPLE Grp. Ins. Mangino, R. $740.00 $45.88 $10.73 $64.00 $22.72 $0.44 $7.40 $20.00 0.85 Flores, I. 1,058.80 65.65 15.35 127.00 32.51 0.64 10.59 50.00 0.85 Palmetto, C. 685.30 42.49 9.94 26.00 21.04 0.41 6.85 40.00 Waters, R. 1,045.35 64.81 15.16 54.00 32.09 0.63 10.45 60.00 0.85 Kroll, C. 952.00 59.02 13.80 80.00 29.23 0.57 9.52 20.00 0.85 Ruppert, C. 837.50 51.93 12.14 32.00 25.71 0.50 8.38 40.00 0.85 Scott, W. 780.00 48.36 11.31 18.00 23.95 0.47 7.80 50.00 0.85 Wickman, S. 807.69 50.08 11.71 69.00 24.80 0.48 8.08 50.00 Foley, L. 1,233.16 76.46 17.88 61.00 37.86 0.74 12.33 30.00 0.85 Olney, M. 1,500.00 93.00 21.75 68.00 46.05 0.90 15.00 80.00 0.85 Totals $ 9,639.80 $597.68| $139.77| 599.00| $295.96 $5.78 $96.40 $440.00 $4 6.8 > > %24 Payable for the total net pay. Date Account Debit Credit 20-- Jan. 12 Wages and Salaries Expense FICA Taxes Payable-OASDI FICA Taxes Payable-HI Employees FIT Payable Employees SIT Payable Employees SUTA Payable Employees CIT Payable Simple Deductions Payable Group Insurance Premiums Collected Health Insurance Premiums Collected Salaries Payable To record payroll. 20-- Jan. 12 Payroll Taxes Expense FICA Taxes Payable-OASDI FICA Taxes Payable-HI FUTA Taxes Payable SUTA Taxes Payable To record payroll taxes. Journal Entry: Payroll Distribution Complete the following: Prepare the journal entry to record the payment of the payroll on January 14 when the paychecks are distributed to all workers. Date Account Debit Credit 20-- Jan. 14 Salaries Payable v Cash v Feedback Y Check My Work

Step by Step Solution

★★★★★

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Requirement 1 OLNEY COMPANY INC Employee Payroll Register For Period ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started