Answered step by step

Verified Expert Solution

Question

1 Approved Answer

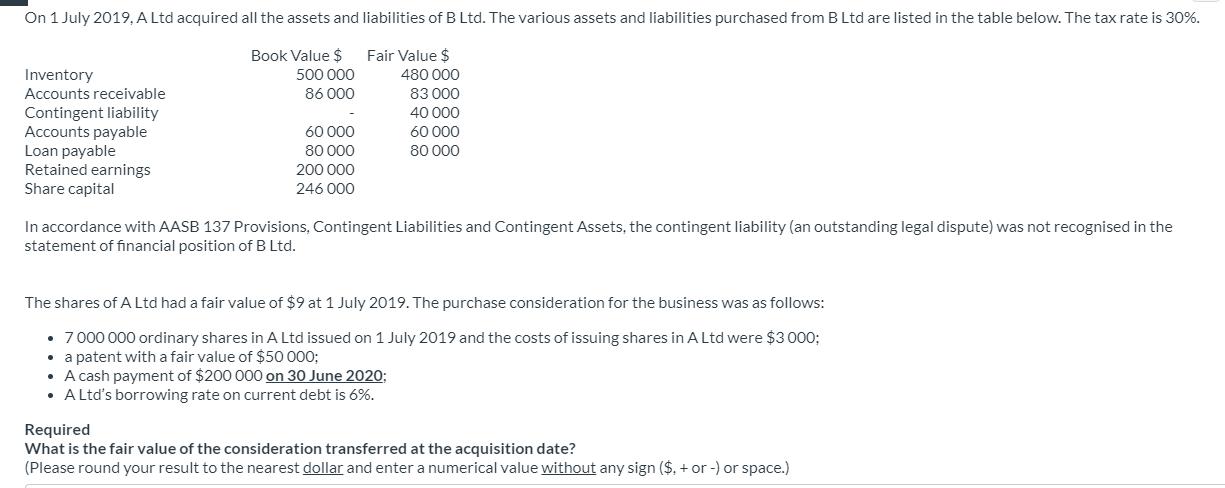

On 1 July 2019, A Ltd acquired all the assets and liabilities of B Ltd. The various assets and liabilities purchased from B Ltd

On 1 July 2019, A Ltd acquired all the assets and liabilities of B Ltd. The various assets and liabilities purchased from B Ltd are listed in the table below. The tax rate is 30%. Fair Value $ 480 000 83 000 40 000 60 000 Book Value $ 500 000 Inventory Accounts receivable 86 000 Contingent liability Accounts payable Loan payable Retained earnings Share capital 60 000 80 000 80 000 200 000 246 000 In accordance with AASB 137 Provisions, Contingent Liabilities and Contingent Assets, the contingent liability (an outstanding legal dispute) was not recognised in the statement of financial position of B Ltd. The shares of A Ltd had a fair value of $9 at 1 July 2019. The purchase consideration for the business was as follows: 7 000 000 ordinary shares in A Ltd issued on 1 July 2019 and the costs of issuing shares in A Ltd were $3 000; a patent with a fair value of $50 000; A cash payment of $200 000 on 30 June 2020; A Ltd's borrowing rate on current debt is 6%. Required What is the fair value of the consideration transferred at the acquisition date? (Please round your result to the nearest dollar and enter a numerical value without any sign ($, + or -) or space.)

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Purchase consideration includes all forms of paymen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started