Question

On 1 June 2018 Robyn Ltd (Robyn) acquired a machine from Plant-R-Us Ltd under the following terms (see the table below). In addition, Robyn

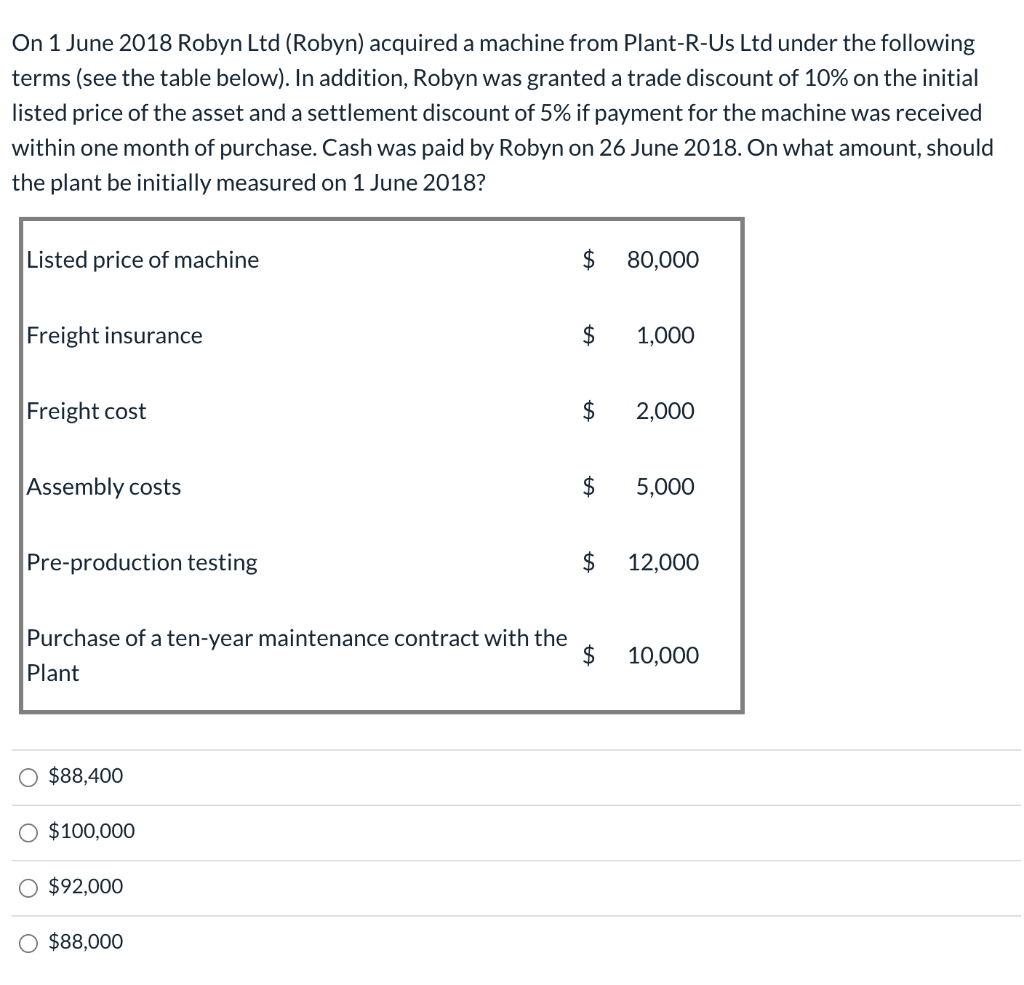

On 1 June 2018 Robyn Ltd (Robyn) acquired a machine from Plant-R-Us Ltd under the following terms (see the table below). In addition, Robyn was granted a trade discount of 10% on the initial listed price of the asset and a settlement discount of 5% if payment for the machine was received within one month of purchase. Cash was paid by Robyn on 26 June 2018. On what amount, should the plant be initially measured on 1 June 2018? Listed price of machine Freight insurance Freight cost Assembly costs Pre-production testing O $88,400 O $100,000 $92,000 $ O $88,000 $ Purchase of a ten-year maintenance contract with the Plant $ $ $ $ 80,000 1,000 2,000 5,000 12,000 10,000

Step by Step Solution

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

All costs incurred to bring an asset to its present location and con...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Earl K. Stice, James D. Stice

19th edition

1133957919, 978-1285632988, 1285632982, 978-0357691229, 978-1133957911

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App