On January 1, 2020, Allan Company bought a 15 percent interest in Sysinger Company. The acquisition price of $228,500 reflected an assessment that all

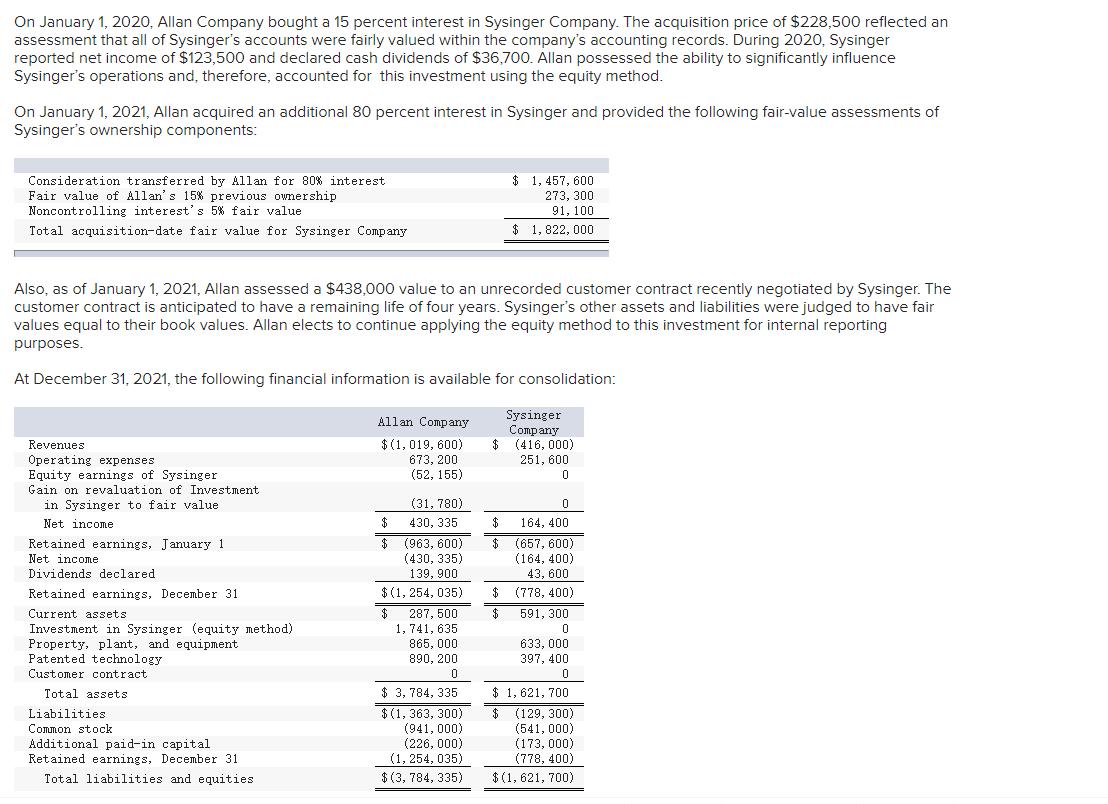

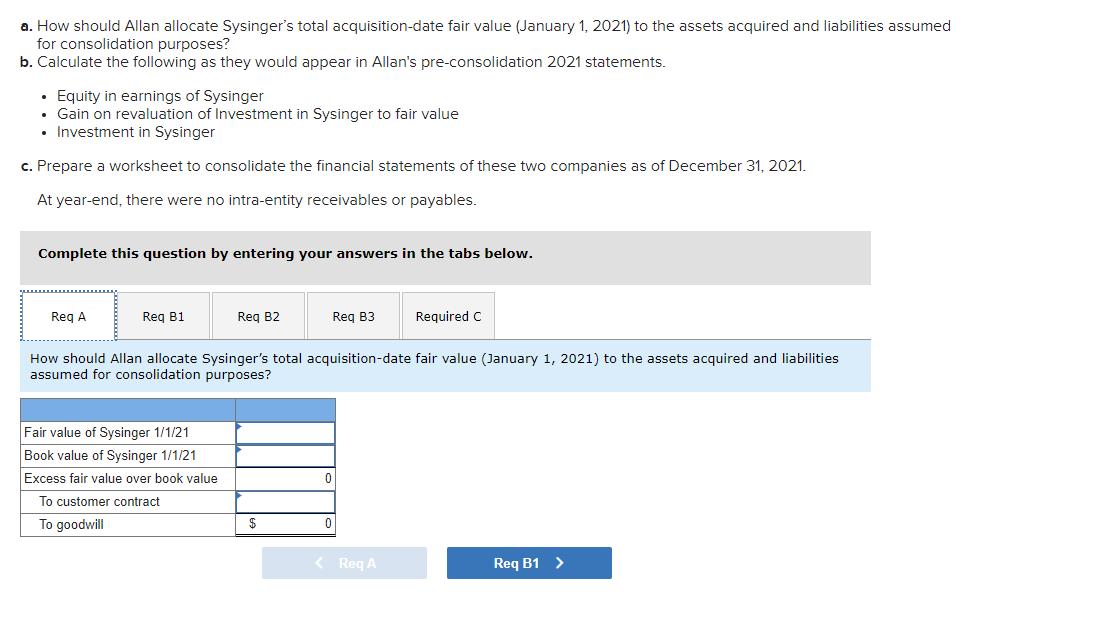

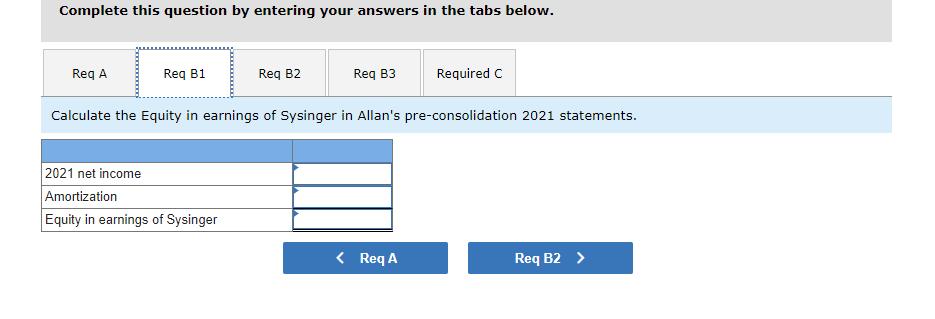

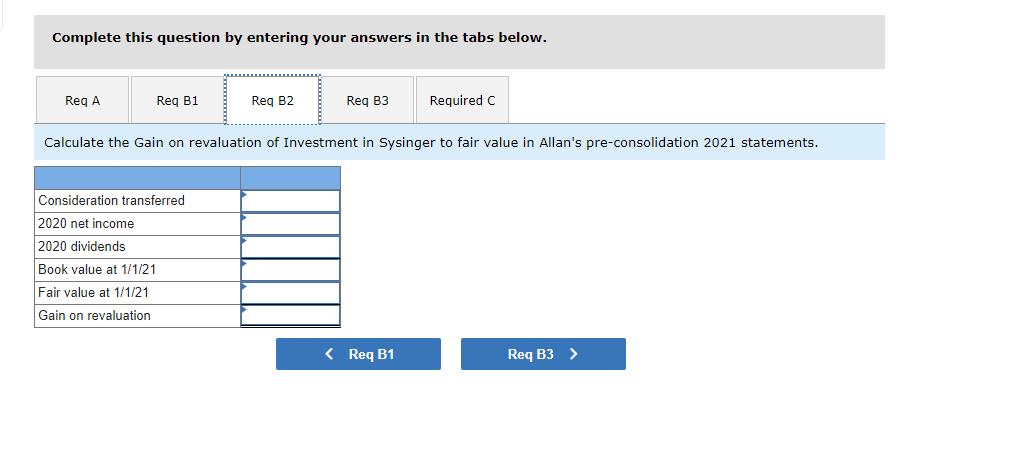

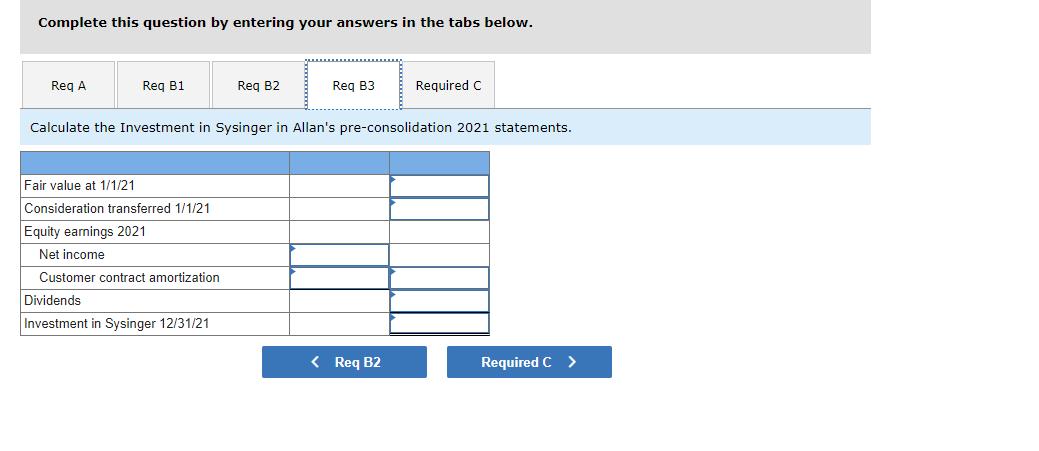

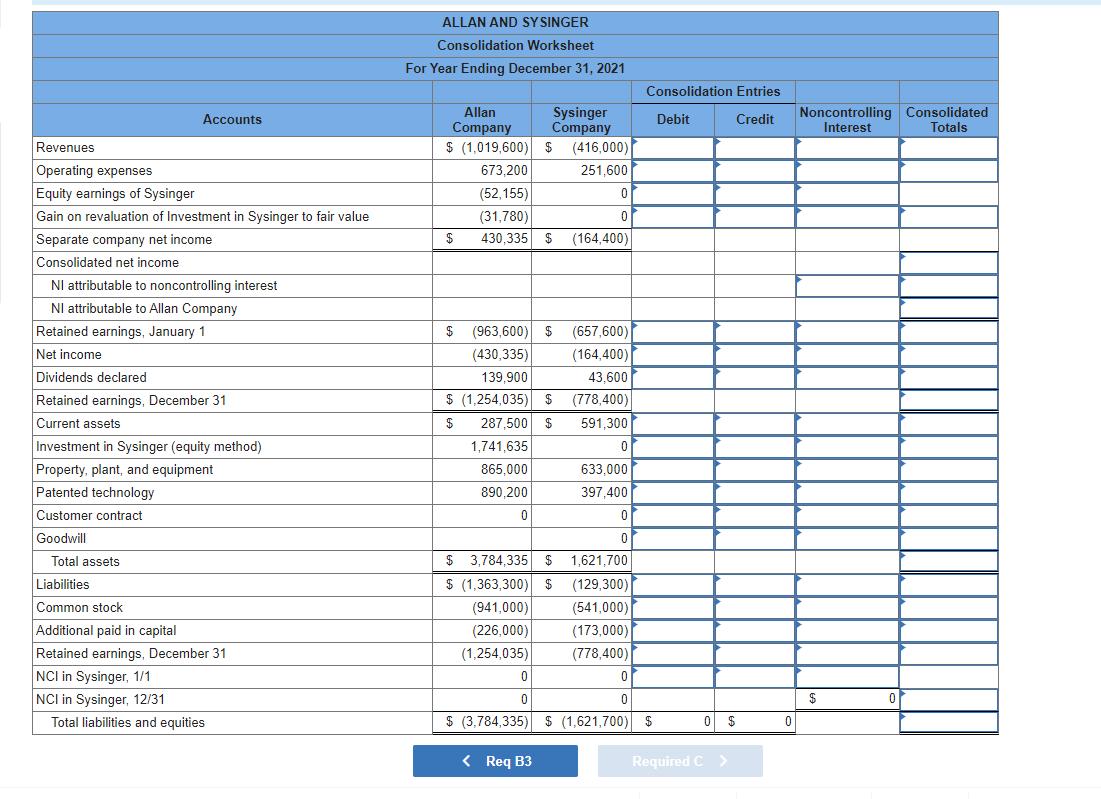

On January 1, 2020, Allan Company bought a 15 percent interest in Sysinger Company. The acquisition price of $228,500 reflected an assessment that all of Sysinger's accounts were fairly valued within the company's accounting records. During 2020, Sysinger reported net income of $123,500 and declared cash dividends of $36,700. Allan possessed the ability to significantly influence Sysinger's operations and, therefore, accounted for this investment using the equity method. On January 1, 2021, Allan acquired an additional 80 percent interest in Sysinger and provided the following fair-value assessments of Sysinger's ownership components: Consideration transferred by Allan for 80% interest Fair value of Allan's 15% previous ownership Noncontrolling interest's 5% fair value $ 1, 457, 600 273, 300 91, 100 Total acquisition-date fair value for Sysinger Company $ 1, 822, 000 Also, as of January 1, 2021, Allan assessed a $438,000 value to an unrecorded customer contract recently negotiated by Sysinger. The customer contract is anticipated to have a remaining life of four years. Sysinger's other assets and liabilities were judged to have fair values equal to their book values. Allan elects to continue applying the equity method to this investment for internal reporting purposes. At December 31, 2021, the following financial information is available for consolidation: Sysinger any $ (416, 000) Allan Company $(1, 019, 600) 673, 200 (52, 155) Revenues Operating expenses Equity earnings of Sysinger Gain on revaluation of Investment in Sysinger to fair value 251, 600 (31, 780) Net income 430, 335 164, 400 Retained earnings, January 1 Net income Dividends declared (963, 600) (430, 335) (657, 600) (164, 400) 43, 600 2$ 139, 900 $ (1, 254, 035) 287, 500 Retained earnings, December 31 (778. 400) 591, 300 Current assets Investment in Sysinger (egquity method) Property, plant, and equipment Patented technology 1, 741, 635 865, 000 890, 200 633, 000 397, 400 Customer contract Total assets $ 3, 784, 335 $ 1, 621, 700 Liabilities Common stock Additional paid-in capital Retained earnings, December 31 $ (1, 363, 300) (941, 000) (226, 000) (1, 254, 035) $ (3, 784, 335) (129, 300) (541, 000) (173, 000) (778, 400) Total liabilities and equities $(1, 621, 700) a. How should Allan allocate Sysinger's total acquisition-date fair value (January 1, 2021) to the assets acquired and liabilities assumed for consolidation purposes? b. Calculate the following as they would appear in Allan's pre-consolidation 2021 statements. Equity in earnings of Sysinger Gain on revaluation of Investment in Sysinger to fair value Investment in Sysinger c. Prepare a worksheet to consolidate the financial statements of these two companies as of December 31, 2021. At year-end, there were no intra-entity receivables or payables. Complete this question by entering your answers in the tabs below. Reg A Reg B1 Reg B2 Reg B3 Required C How should Allan allocate Sysinger's total acquisition-date fair value (January 1, 2021) to the assets acquired and liabilities assumed for consolidation purposes? Fair value of Sysinger 1/1/21 Book value of Sysinger 1/1/21 Excess fair value over book value To customer contract To goodwill $ < Reg A Req B1 > Complete this question by entering your answers in the tabs below. Req A Req B1 Req B2 Reg B3 Required C Calculate the Equity in earnings of Sysinger in Allan's pre-consolidation 2021 statements. 2021 net income Amortization Equity in earnings of Sysinger < Req A Req B2 > Complete this question by entering your answers in the tabs below. Reg A Reg B1 Reg B2 Reg B3 Required C Calculate the Gain on revaluation of Investment in Sysinger to fair value in Allan's pre-consolidation 2021 statements. Consideration transferred 2020 net income 2020 dividends Book value at 1/1/21 Fair value at 1/1/21 Gain on revaluation < Req B1 Req B3 > Complete this question by entering your answers in the tabs below. Reg A Reg B1 Req B2 Reg B3 Required C Calculate the Investment in Sysinger in Allan's pre-consolidation 2021 statements. Fair value at 1/1/21 Consideration transferred 1/1/21 Equity earnings 2021 Net income Customer contract amortization Dividends Investment in Sysinger 12/31/21 < Req B2 Required C > ALLAN AND SYSINGER Consolidation Worksheet For Year Ending December 31, 2021 Consolidation Entries Sysinger Company Noncontrolling Consolidated Interest Allan Accounts Debit Credit Company $ (1,019,600) $ Totals Revenues (416,000) Operating expenses 673,200 251,600 Equity earnings of Sysinger (52,155) Gain on revaluation of Investment in Sysinger to fair value (31,780) Separate company net income $ 430,335 $4 (164,400) Consolidated net income NI attributable to noncontrolling interest NI attributable to Allan Company Retained earnings, January 1 $ (963,600) $ (657,600) Net income (430,335) (164,400) Dividends declared 139,900 43,600 Retained earnings, December 31 $ (1,254,035) $ (778,400) Current assets $ 287,500 $ 591,300 Investment in Sysinger (equity method) 1,741,635 Property, plant, and equipment 865,000 633,000 Patented technology 890,200 397,400 Customer contract Goodwill Total assets 2$ 3,784,335 $ 1,621,700 Liabilities $ (1,363,300) $ (129,300) Common stock (941,000) (541,000) Additional paid in capital (226,000) (173,000) Retained earnings, December 31 (1,254,035) (778,400) NCI in Sysinger, 1/1 NCI in Sysinger, 12/31 Total liabilities and equities $ (3,784,335) $ (1,621,700) $ 0 $ < Req B3 Required C On January 1, 2020, Allan Company bought a 15 percent interest in Sysinger Company. The acquisition price of $228,500 reflected an assessment that all of Sysinger's accounts were fairly valued within the company's accounting records. During 2020, Sysinger reported net income of $123,500 and declared cash dividends of $36,700. Allan possessed the ability to significantly influence Sysinger's operations and, therefore, accounted for this investment using the equity method. On January 1, 2021, Allan acquired an additional 80 percent interest in Sysinger and provided the following fair-value assessments of Sysinger's ownership components: Consideration transferred by Allan for 80% interest Fair value of Allan's 15% previous ownership Noncontrolling interest's 5% fair value $ 1, 457, 600 273, 300 91, 100 Total acquisition-date fair value for Sysinger Company $ 1, 822, 000 Also, as of January 1, 2021, Allan assessed a $438,000 value to an unrecorded customer contract recently negotiated by Sysinger. The customer contract is anticipated to have a remaining life of four years. Sysinger's other assets and liabilities were judged to have fair values equal to their book values. Allan elects to continue applying the equity method to this investment for internal reporting purposes. At December 31, 2021, the following financial information is available for consolidation: Sysinger any $ (416, 000) Allan Company $(1, 019, 600) 673, 200 (52, 155) Revenues Operating expenses Equity earnings of Sysinger Gain on revaluation of Investment in Sysinger to fair value 251, 600 (31, 780) Net income 430, 335 164, 400 Retained earnings, January 1 Net income Dividends declared (963, 600) (430, 335) (657, 600) (164, 400) 43, 600 2$ 139, 900 $ (1, 254, 035) 287, 500 Retained earnings, December 31 (778. 400) 591, 300 Current assets Investment in Sysinger (egquity method) Property, plant, and equipment Patented technology 1, 741, 635 865, 000 890, 200 633, 000 397, 400 Customer contract Total assets $ 3, 784, 335 $ 1, 621, 700 Liabilities Common stock Additional paid-in capital Retained earnings, December 31 $ (1, 363, 300) (941, 000) (226, 000) (1, 254, 035) $ (3, 784, 335) (129, 300) (541, 000) (173, 000) (778, 400) Total liabilities and equities $(1, 621, 700) a. How should Allan allocate Sysinger's total acquisition-date fair value (January 1, 2021) to the assets acquired and liabilities assumed for consolidation purposes? b. Calculate the following as they would appear in Allan's pre-consolidation 2021 statements. Equity in earnings of Sysinger Gain on revaluation of Investment in Sysinger to fair value Investment in Sysinger c. Prepare a worksheet to consolidate the financial statements of these two companies as of December 31, 2021. At year-end, there were no intra-entity receivables or payables. Complete this question by entering your answers in the tabs below. Reg A Reg B1 Reg B2 Reg B3 Required C How should Allan allocate Sysinger's total acquisition-date fair value (January 1, 2021) to the assets acquired and liabilities assumed for consolidation purposes? Fair value of Sysinger 1/1/21 Book value of Sysinger 1/1/21 Excess fair value over book value To customer contract To goodwill $ < Reg A Req B1 > Complete this question by entering your answers in the tabs below. Req A Req B1 Req B2 Reg B3 Required C Calculate the Equity in earnings of Sysinger in Allan's pre-consolidation 2021 statements. 2021 net income Amortization Equity in earnings of Sysinger < Req A Req B2 > Complete this question by entering your answers in the tabs below. Reg A Reg B1 Reg B2 Reg B3 Required C Calculate the Gain on revaluation of Investment in Sysinger to fair value in Allan's pre-consolidation 2021 statements. Consideration transferred 2020 net income 2020 dividends Book value at 1/1/21 Fair value at 1/1/21 Gain on revaluation < Req B1 Req B3 > Complete this question by entering your answers in the tabs below. Reg A Reg B1 Req B2 Reg B3 Required C Calculate the Investment in Sysinger in Allan's pre-consolidation 2021 statements. Fair value at 1/1/21 Consideration transferred 1/1/21 Equity earnings 2021 Net income Customer contract amortization Dividends Investment in Sysinger 12/31/21 < Req B2 Required C > ALLAN AND SYSINGER Consolidation Worksheet For Year Ending December 31, 2021 Consolidation Entries Sysinger Company Noncontrolling Consolidated Interest Allan Accounts Debit Credit Company $ (1,019,600) $ Totals Revenues (416,000) Operating expenses 673,200 251,600 Equity earnings of Sysinger (52,155) Gain on revaluation of Investment in Sysinger to fair value (31,780) Separate company net income $ 430,335 $4 (164,400) Consolidated net income NI attributable to noncontrolling interest NI attributable to Allan Company Retained earnings, January 1 $ (963,600) $ (657,600) Net income (430,335) (164,400) Dividends declared 139,900 43,600 Retained earnings, December 31 $ (1,254,035) $ (778,400) Current assets $ 287,500 $ 591,300 Investment in Sysinger (equity method) 1,741,635 Property, plant, and equipment 865,000 633,000 Patented technology 890,200 397,400 Customer contract Goodwill Total assets 2$ 3,784,335 $ 1,621,700 Liabilities $ (1,363,300) $ (129,300) Common stock (941,000) (541,000) Additional paid in capital (226,000) (173,000) Retained earnings, December 31 (1,254,035) (778,400) NCI in Sysinger, 1/1 NCI in Sysinger, 12/31 Total liabilities and equities $ (3,784,335) $ (1,621,700) $ 0 $ < Req B3 Required C

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

lltin f sysingers ttl quistin Fir vlue f sysinger n 01012021 1776000 Bk vlue f sysinger n 01012021 1352400 Exess f fir vlue ver bk vlue 423600 T ustme...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started