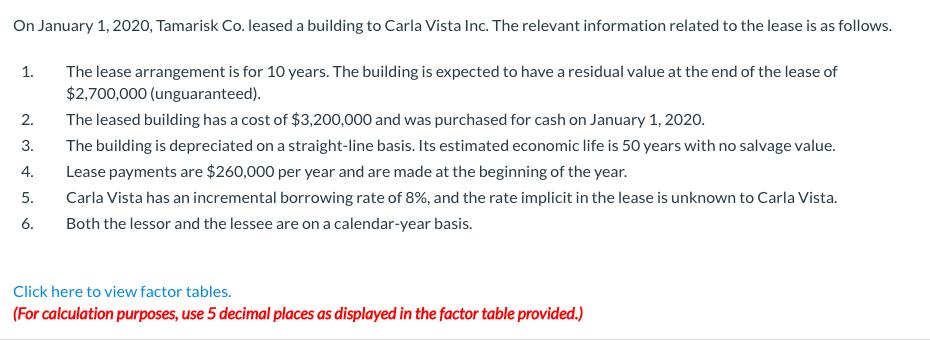

On January 1, 2020, Tamarisk Co. leased a building to Carla Vista Inc. The relevant information related to the lease is as follows. 1.

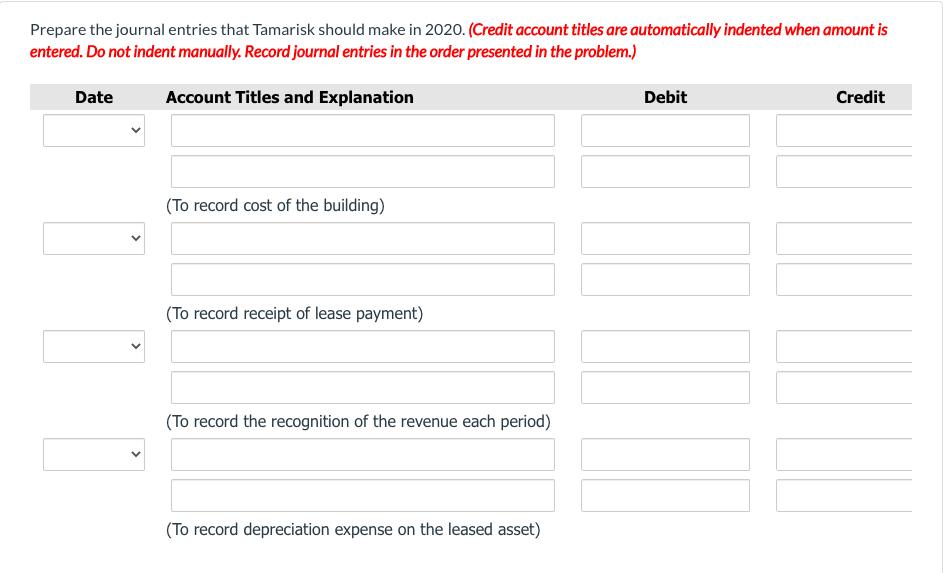

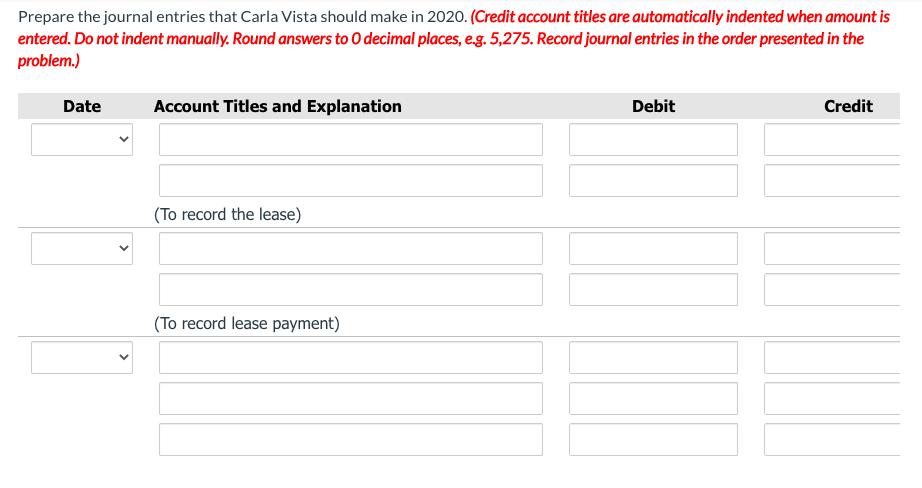

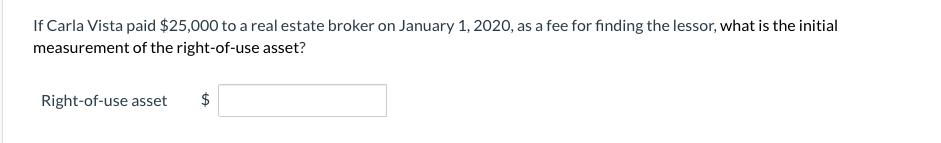

On January 1, 2020, Tamarisk Co. leased a building to Carla Vista Inc. The relevant information related to the lease is as follows. 1. The lease arrangement is for 10 years. The building is expected to have a residual value at the end of the lease of $2,700,000 (unguaranteed). 2. The leased building has a cost of $3,200,000 and was purchased for cash on January 1, 2020. 3. The building is depreciated on a straight-line basis. Its estimated economic life is 50 years with no salvage value. 4. Lease payments are $260,000 per year and are made at the beginning of the year. 5. Carla Vista has an incremental borrowing rate of 8%, and the rate implicit in the lease is unknown to Carla Vista. 6. Both the lessor and the lessee are on a calendar-year basis. Click here to view factor tables. (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Prepare the journal entries that Tamarisk should make in 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit (To record cost of the building) (To record receipt of lease payment) (To record the recognition of the revenue each period) (To record depreciation expense on the leased asset) Prepare the journal entries that Carla Vista should make in 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 0 decimal places, eg. 5,275. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit (To record the lease) (To record lease payment) If Carla Vista paid $25,000 to a real estate broker on January 1, 2020, as a fee for finding the lessor, what is the initial measurement of the right-of-use asset? Right-of-use asset %24

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Part A Under the operating lease Lessor should not record journal entry for lease receivable Under t...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started