Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Open the file Banking a, sheet named Assets list the total assets of 30 largest U.S. banks for 2007 and 2013. The Excel Data

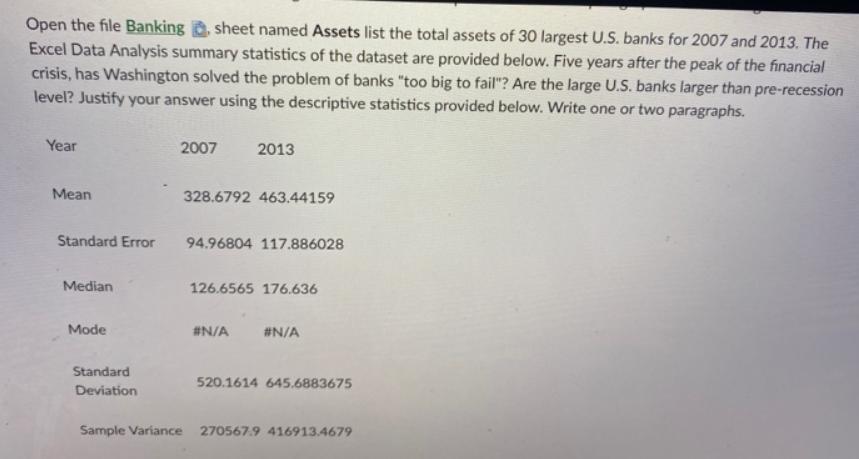

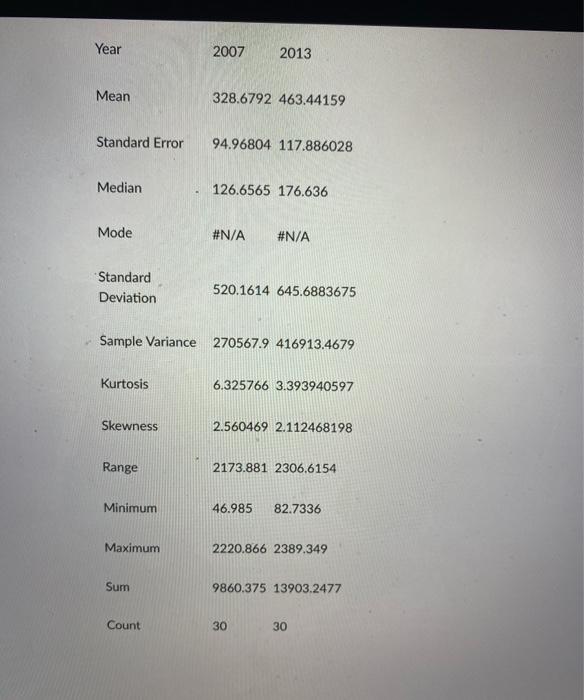

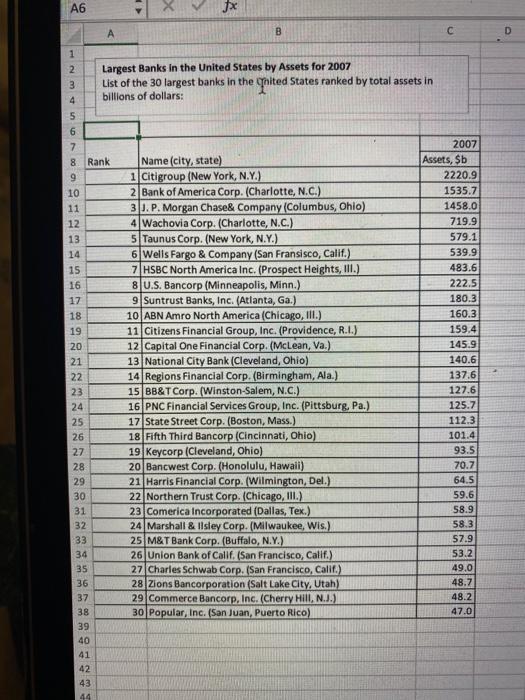

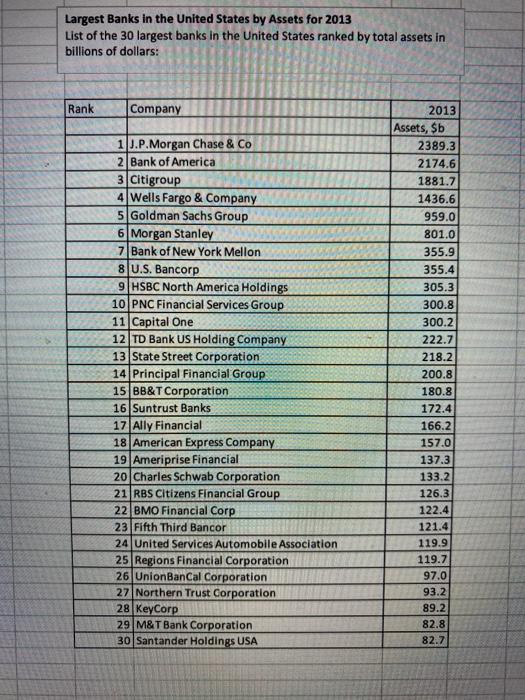

Open the file Banking a, sheet named Assets list the total assets of 30 largest U.S. banks for 2007 and 2013. The Excel Data Analysis summary statistics of the dataset are provided below. Five years after the peak of the financial crisis, has Washington solved the problem of banks "too big to fail"? Are the large U.S. banks larger than pre-recession level? Justify your answer using the descriptive statistics provided below. Write one or two paragraphs. Year 2007 2013 Mean 328.6792 463.44159 Standard Error 94.96804 117.886028 Median 126.6565 176.636 Mode #N/A #N/A Standard 520.1614 645.6883675 Deviation Sample Variance 270567.9 416913.4679 Year 2007 2013 Mean 328.6792 463.44159 Standard Error 94.96804 117.886028 Median 126.6565 176.636 Mode #N/A #N/A Standard 520.1614 645.6883675 Deviation Sample Variance 270567.9 416913.4679 Kurtosis 6.325766 3.393940597 Skewness 2.560469 2.112468198 Range 2173.881 2306,6154 Minimum 46.985 82.7336 Maximum 2220.866 2389,349 Sum 9860.375 13903.2477 Count 30 30 A6 A B D. Largest Banks in the United States by Assets for 2007 List of the 30 largest banks in the Thited States ranked by total assets in billions of dollars: 3. 4. 6. 2007 Assets, $b 2220.9 7. Name (city, state) 1 Citigroup (New York, N.Y.) 2 Bank of America Corp. (Charlotte, N.C.) 3J. P. Morgan Chase& Company (Columbus, Ohio) 4 Wachovia Corp. (Charlotte, N.C.) 5 Taunus Corp. (New York, N.Y.) 6 Wells Fargo & Company (San Fransisco, Calif.) 7 HSBC North America Inc. (Prospect Heights, IlII.) 8 U.S. Bancorp (Minneapolis, Minn.) 9 Suntrust Banks, Inc. (Atlanta, Ga.) 10 ABN Amro North America (Chicago, IlII.) 11 Citizens Financial Group, Inc. (Providence, R.I.) 12 Capital One Financial Corp. (McLean, Va.) 13 National City Bank (Cleveland, Ohio) 14 Regions Financial Corp. (Birmingham, Ala.) 15 BB&T Corp. (Winston-Salem, N.C.) 16 PNC Financial Services Group, Inc. (Pittsburg, Pa.) 17 State Street Corp. (Boston, Mass.) 18 Fifth Third Bancorp (Cincinnati, Ohio) 19 Keycorp (Cleveland, Ohio) 20 Bancwest Corp. (Honolulu, Hawaii) 21 Harris Financial Corp. (Wilmington, Del.) 22 Northern Trust Corp. (Chicago, I.) 23 Comerica Incorporated (Dallas, Tex.) 24 Marshall & llsley Corp. (Milwaukee, Wis.) 25 M&T Bank Corp. (Buffalo, N.Y.) 26 Union Bank of Calif. (San Francisco, Calif.) 27 Charles Schwab Corp. (San Francisco, Calif.) 28 Zions Bancorporation (Salt Lake City, Utah) 29 Commerce Bancorp, Inc. (Cherry Hill, N.J.) 30 Popular, Inc. (San Juan, Puerto Rico) 8 Rank 9. 10 1535.7 11 1458.0 12 719.9 13 579.1 14 539.9 15 483.6 16 222.5 180.3 160.3 17 18 19 159.4 145.9 140.6 20 21 22 137.6 23 127.6 24 125.7 25 112.3 26 101.4 27 93.5 28 70.7 29 64.5 30 59.6 31 58.9 32 58.3 33 57.9 34 53.2 35 49.0 36 48.7 37 48.2 38 47.0 39 40 41 42 43 44 Largest Banks in the United States by Assets for 2013 List of the 30 largest banks in the United States ranked by total assets in billions of dollars: Rank Company 2013 Assets, $b 2389.3 1 J.P.Morgan Chase & Co 2 Bank of America 3 Citigroup 4 Wells Fargo & Company 5 Goldman Sachs Group 6 Morgan Stanley 7 Bank of New York Mellon 2174.6 1881.7 1436.6 959.0 801.0 355.9 8 U.S. Bancorp 355.4 9 HSBC North America Holdings 305.3 10 PNC Financial Services Group 300.8 11 Capital One 12 TD Bank US Holding Company 13 State Street Corporation 14 Principal Financial Group 15 BB&T Corporation 16 Suntrust Banks 17 Ally Financial 18 American Express Company 19 Ameriprise Financial 20 Charles Schwab Corporation 300.2 222.7 218.2 200.8 180.8 172.4 166.2 157.0 137.3 133.2 21 RBS Citizens Financial Group 22 BMO Financial Corp 23 Fifth Third Bancor 126.3 122.4 121.4 24 United Services Automobile Association 119.9 25 Regions Financial Corporation 26 UnionBanCal Corporation 119.7 97.0 27 Northern Trust Corporation 93.2 28 KeyCorp 29 M&TBank Corporation 89.2 82.8 30 Santander Holdings USA 82.7

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Y ES large US banks are lar ger than the pre recession levels as clear due to the fact that i the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started