Question: GNP is developing an Auto Insurance Policy and seeks to determine the optimal combination of Insurance to Sell by type of car. The total value

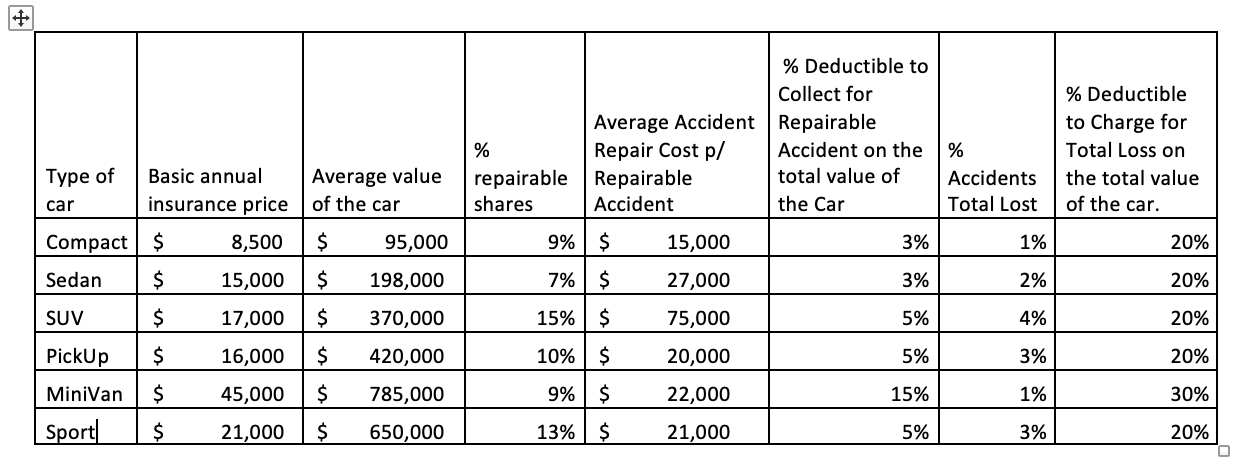

GNP is developing an Auto Insurance Policy and seeks to determine the optimal combination of Insurance to Sell by type of car. The total value that you can invest is 2,500 million pesos, that is, it is the total risk that you can assume to be able to pay the policies, and seeks to maximize its utilization. According to probability and statistical analysis, the following market information is available:

Define the Model Variables.Define the objective function of the Model.Define the Model constraints.Determine the amount of Optima Insurance by type of optimal car to sell to maximize profit.

Type of car Basic annual insurance price Average value of the car 8,500 $ 95,000 15,000 $ 198,000 17,000 $ 370,000 16,000 $ 420,000 45,000 $ 785,000 21,000 $ 650,000 Compact $ Sedan $ SUV $ PickUp $ MiniVan $ Sport $ % repairable shares Average Accident Repair Cost p/ Repairable Accident 9% $ 7% $ 15% $ 10% $ 9% $ 13% $ 15,000 27,000 75,000 20,000 22,000 21,000 % Deductible to Collect for Repairable Accident on the total value of the Car 3% 3% 5% 5% 15% 5% % Accidents Total Lost 1% 2% 4% 3% 1% 3% % Deductible to Charge for Total Loss on the total value of the car. 20% 20% 20% 20% 30% 20% 0

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Model Variables The model variables that need to be defined in order to determine the optimal combin... View full answer

Get step-by-step solutions from verified subject matter experts