Question

Accounting or Bonds Sold at a Discount The Biltmore National Bank raised capital through the sale of $100 million face value of eight percent coupon

Accounting or Bonds Sold at a Discount

The Biltmore National Bank raised capital through the sale of $100 million face value of eight percent coupon rate, ten-year bonds. The bonds paid interest semiannually and were sold at a time when equivalent risk-rated bonds carried a yield rate of ten percent.

Round all answers to the nearest whole number.

PLEASE USE BOTH EXCEL AND THE TABLES OF TIME VALUE FACTORS (and say which table you used: FVSS,PVSS,FVOA,PVOA,PVAD) and explain how you did each step in BOTH WAYS! By doing both ways like asked and explaining them, you will get a thumbs up! Thank you! :)

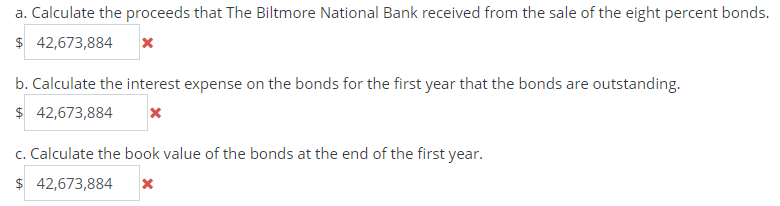

a. Calculate the proceeds that The Biltmore National Bank received from the sale of the eight percent bonds. $ 42,673,884 x b. Calculate the interest expense on the bonds for the first year that the bonds are outstanding. $ 42,673,884 C. Calculate the book value of the bonds at the end of the first year. $ 42,673,884 x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started