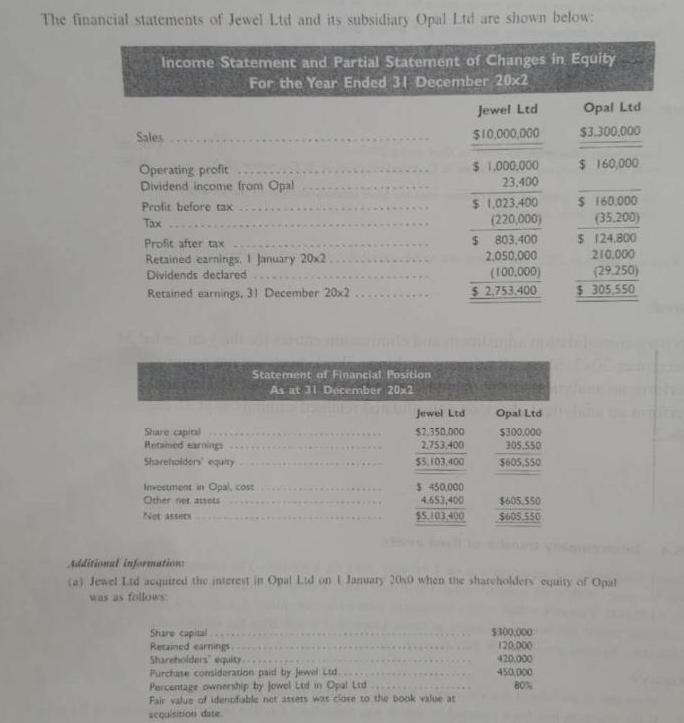

The financial statements of Jewel Ltd and its subsidiary Opal Ltd are shown below: Income Statement and Partial Statement of Changes in Equity For

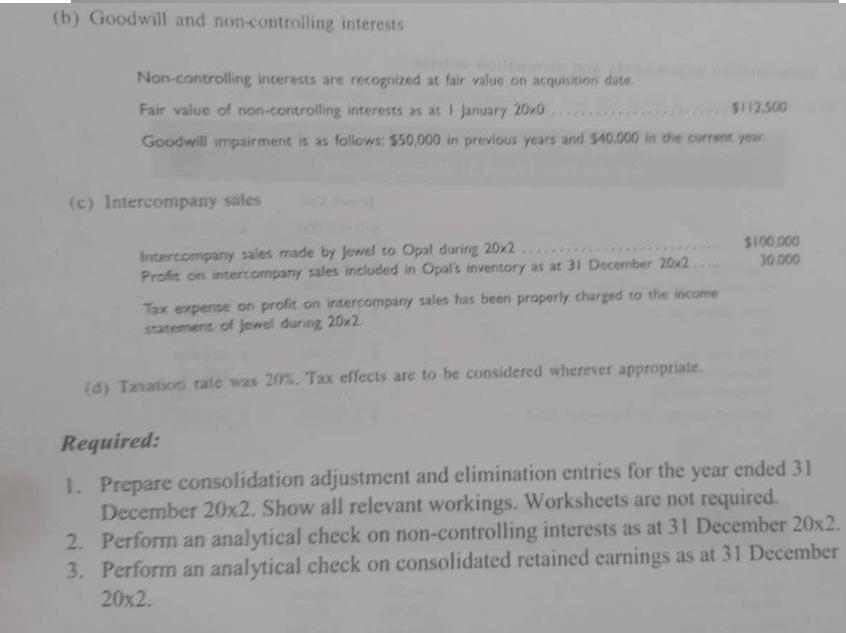

The financial statements of Jewel Ltd and its subsidiary Opal Ltd are shown below: Income Statement and Partial Statement of Changes in Equity For the Year Ended 31 December 20x2 Sales Operating profit. Dividend income from Opal Profit before tax Tax Profit after tax Retained earnings, 1 January 20x2. Dividends declared Retained earnings, 31 December 20x2 Share capital Retained earnings Shareholders' equity Statement of Financial Position As at 31 December 20x2 Investment in Opal, cost Other net atsets Net assets Share capital Retained earnings. br Jewel Ltd $2,350,000 2.753,400 $5,103,400 $ 450,000 4.653,400 $5.103.400 Jewel Ltd $10,000,000 Shareholders equity Purchase consideration paid by Jewel Ltd. Percentage ownership by Jowel Ltd in Opal Ltd Fair value of identifiable not assess was close to the book value at acquisition date $1,000,000 23,400 $ 1,023.400 (220,000) $ 803,400 2,050,000 (100,000) $ 2,753,400 Opal Ltd $300,000 305.550 $605,550 $605.550 $605.550 Opal Ltd $3.300.000 $ 160,000 Additional information: (a) Jenel Ltd acquired the interest in Opal Ltd on 1 January 2010 when the shareholders equity of Opal was as follows: $100,000 120.000 420,000 450,000 80% $ 160,000 (35.200) $ 124.800 210,000 (29.250) $ 305,550 (b) Goodwill and non-controlling interests Non-controlling interests are recognized at fair value on acquisition date Fair value of non-controlling interests as at 1 January 20x0 $112.500 Goodwill impairment is as follows: $50,000 in previous years and $40.000 in the current year. (c) Intercompany sales Intercompany sales made by Jewel to Opal during 20x2. Profit on intercompany sales included in Opal's inventory as at 31 December 20x2. Tax expense on profit on intercompany sales has been properly charged to the income statement of jewel during 20x2 (d) Taxation rate was 20%. Tax effects are to be considered wherever appropriate. $100,000 30.000 Required: 1. Prepare consolidation adjustment and elimination entries for the year ended 31 December 20x2. Show all relevant workings. Worksheets are not required. 2. Perform an analytical check on non-controlling interests as at 31 December 20x2. 3. Perform an analytical check on consolidated retained earnings as at 31 December 20x2.

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries Jewel Retained Earnings NCI Sales Cost ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started