Monarch Products, Inc. provided the following information from its current-year trial balance. (Click the icon to view the trial balance.) Requirements Prepare a single-step

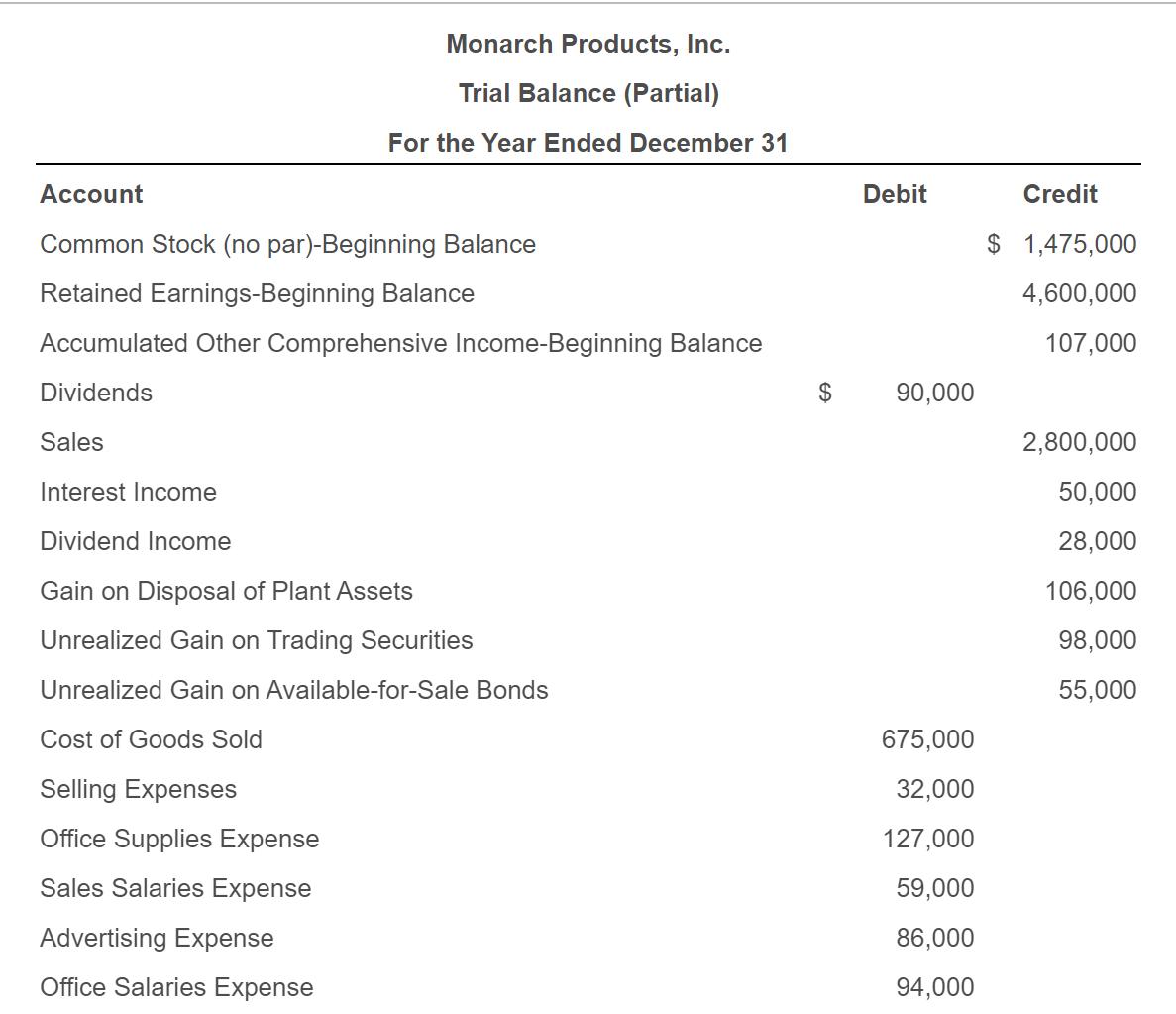

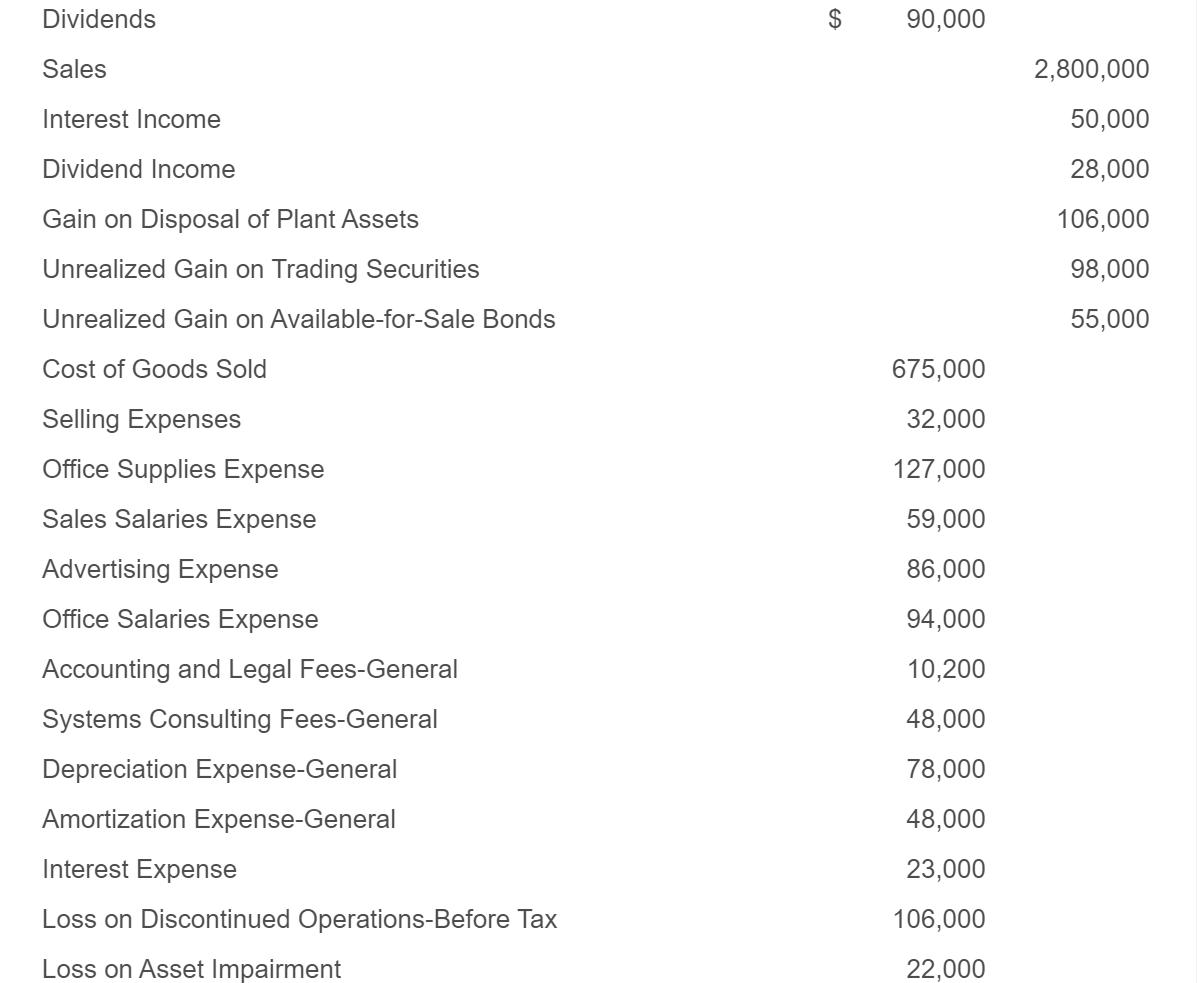

Monarch Products, Inc. provided the following information from its current-year trial balance. (Click the icon to view the trial balance.) Requirements Prepare a single-step income statement for the year ended December 31. The tax rate is 30%. Prepare a multiple-step income statement for the year ended December 31. Monarcn Products, Inc. Statement of Net Income For the Year Ended December 31 a. b. Requirement b. Prepare a multiple-step income statement for the year ended December 31. Prepare Monarch s multiple-step income statement for the current year, one section at a time. (List the subhe minus sign to enter other expenses or a loss from discontinued operations.) Less: Monarch Products, Inc. Statement of Net Income For the Year Ended December 31 Monarch Products, Inc. Trial Balance (Partial) For the Year Ended December 31 Account Common Stock (no par)-Beginning Balance Retained Earnings-Beginning Balance Accumulated Other Comprehensive Income-Beginning Balance Dividends Sales Interest Income Dividend Income Gain on Disposal of Plant Assets Unrealized Gain on Trading Securities Unrealized Gain on Available-for-Sale Bonds Cost of Goods Sold Selling Expenses Office Supplies Expense Sales Salaries Expense Advertising Expense Office Salaries Expense $ Debit 90,000 675,000 32,000 127,000 59,000 86,000 94,000 Credit $ 1,475,000 4,600,000 107,000 2,800,000 50,000 28,000 106,000 98,000 55,000 Dividends Sales Interest Income Dividend Income Gain on Disposal of Plant Assets Unrealized Gain on Trading Securities Unrealized Gain on Available-for-Sale Bonds Cost of Goods Sold Selling Expenses Office Supplies Expense Sales Salaries Expense Advertising Expense Office Salaries Expense Accounting and Legal Fees-General Systems Consulting Fees-General Depreciation Expense-General Amortization Expense-General Interest Expense Loss on Discontinued Operations-Before Tax Loss on Asset Impairment 90,000 675,000 32,000 127,000 59,000 86,000 94,000 10,200 48,000 78,000 48,000 23,000 106,000 22,000 2,800,000 50,000 28,000 106,000 98,000 55,000

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Monarch Products Inc Statement of net income using single step income stat...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started