Obtain the most recent financial statements for BBD. Find the consolidated cash flow statement on page 147. Also, find Note 16 on page 181.+

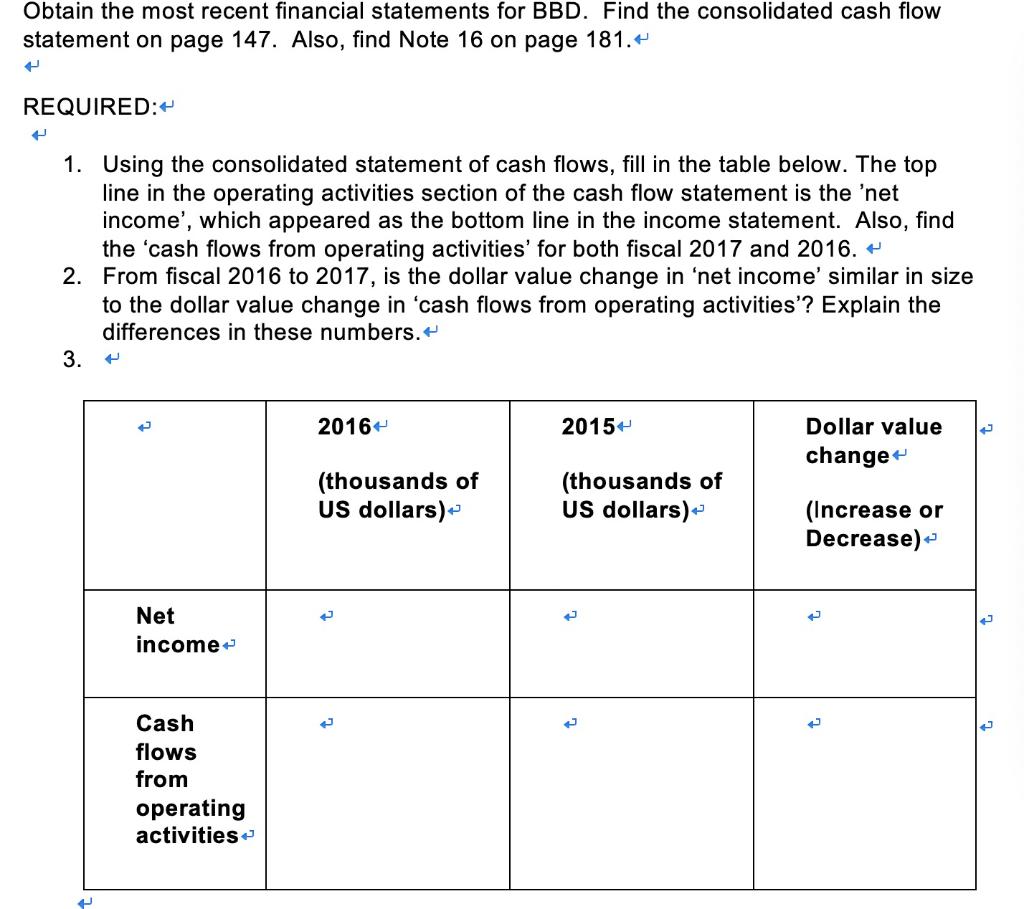

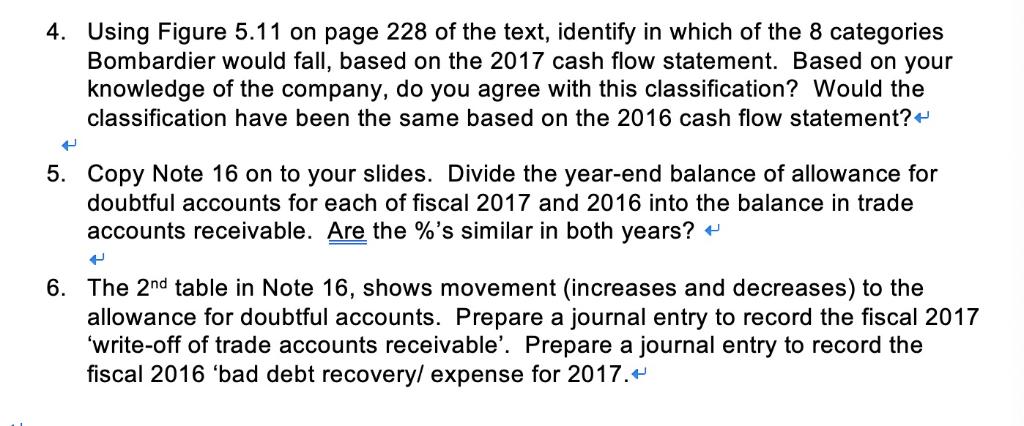

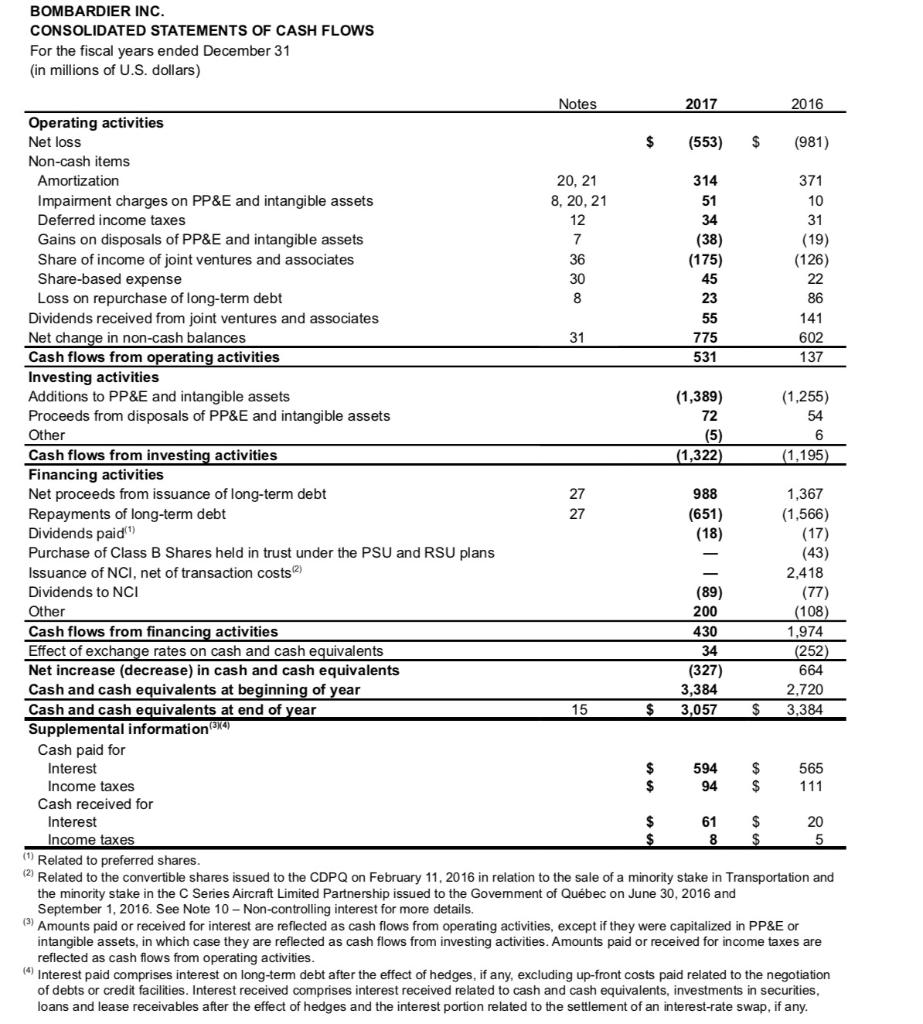

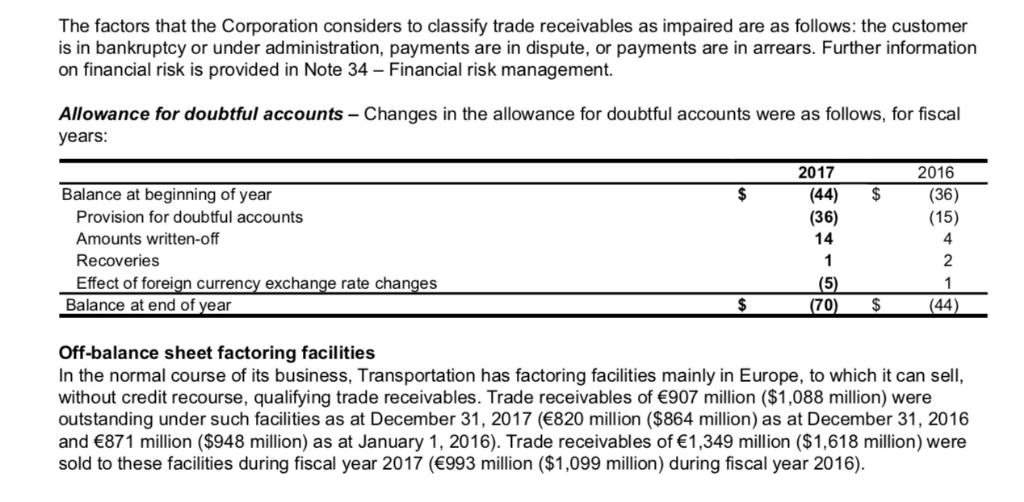

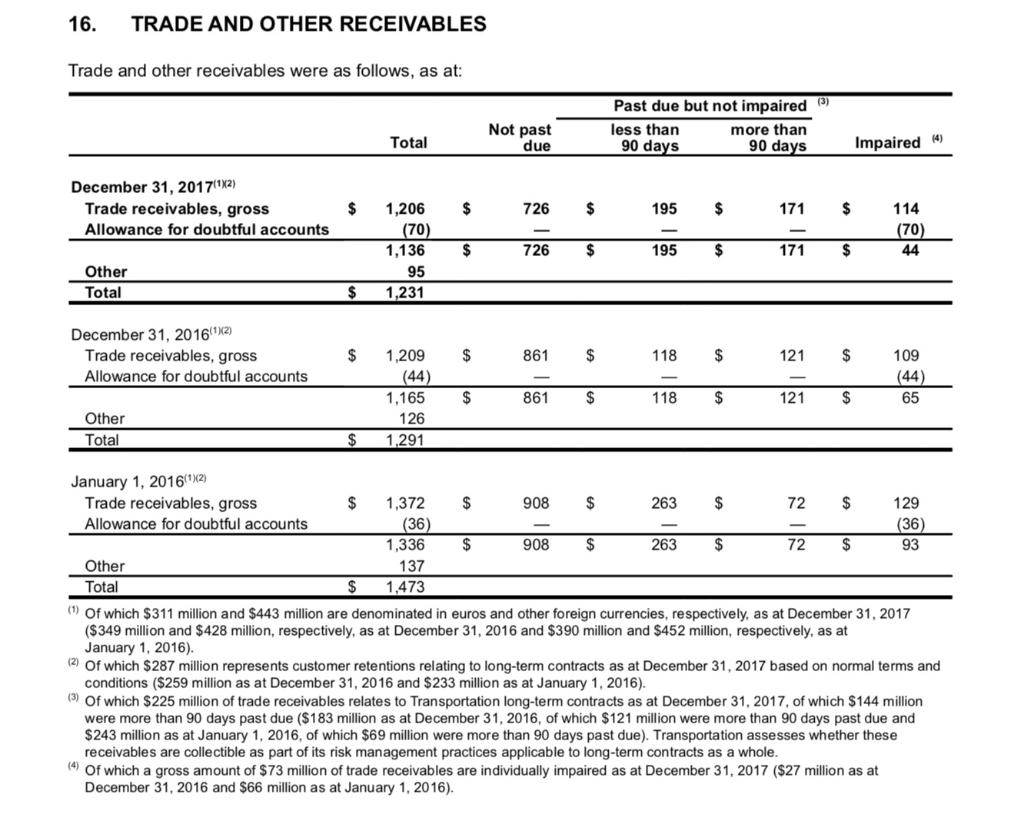

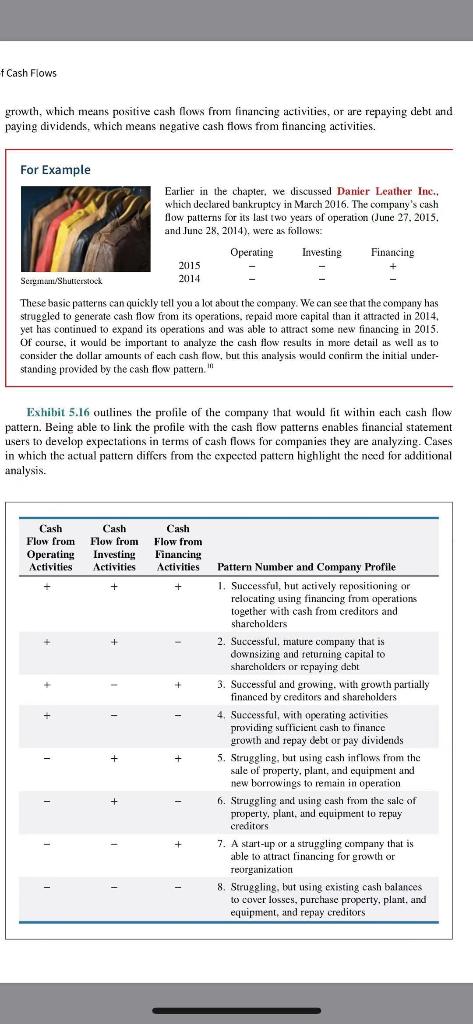

Obtain the most recent financial statements for BBD. Find the consolidated cash flow statement on page 147. Also, find Note 16 on page 181.+ REQUIRED:+ + 1. Using the consolidated statement of cash flows, fill in the table below. The top line in the operating activities section of the cash flow statement is the 'net income', which appeared as the bottom line in the income statement. Also, find the 'cash flows from operating activities' for both fiscal 2017 and 2016. + 2. From fiscal 2016 to 2017, is the dollar value change in 'net income' similar in size to the dollar value change in 'cash flows from operating activities'? Explain the differences in these numbers. < 3. + Net income Cash flows from operating activities 2016+ (thousands of US dollars) < 2015+ (thousands of US dollars) < 3 Dollar value change+ (Increase or Decrease) J 4 + + J 3 4. Using Figure 5.11 on page 228 of the text, identify in which of the 8 categories Bombardier would fall, based on the 2017 cash flow statement. Based on your knowledge of the company, do you agree with this classification? Would the classification have been the same based on the 2016 cash flow statement?+ + 5. Copy Note 16 on to your slides. Divide the year-end balance of allowance for doubtful accounts for each of fiscal 2017 and 2016 into the balance in trade accounts receivable. Are the %'s similar in both years? 6. The 2nd table in Note 16, shows movement (increases and decreases) to the allowance for doubtful accounts. Prepare a journal entry to record the fiscal 2017 'write-off of trade accounts receivable'. Prepare a journal entry to record the fiscal 2016 'bad debt recovery/ expense for 2017. BOMBARDIER INC. CONSOLIDATED STATEMENTS OF CASH FLOWS For the fiscal years ended December 31 (in millions of U.S. dollars) Operating activities Net loss Non-cash items Amortization Impairment charges on PP&E and intangible assets Deferred income taxes Gains on disposals of PP&E and intangible assets Share of income of joint ventures and associates Share-based expense Loss on repurchase of long-term debt Dividends received from joint ventures and associates Net change in non-cash balances Cash flows from operating activities Investing activities Additions to PP&E and intangible assets Proceeds from disposals of PP&E and intangible assets Other Cash flows from investing activities Financing activities Net proceeds from issuance of long-term debt Repayments of long-term debt Dividends paid() Purchase of Class B Shares held in trust under the PSU and RSU plans Issuance of NCI, net of transaction costs (2) Dividends to NCI Other Cash flows from financing activities Effect of exchange rates on cash and cash equivalents Net increase (decrease) in cash and cash equivalents Cash and cash equivalents at beginning of year Cash and cash equivalents at end of year Supplemental information (34) Cash paid for Interest Income taxes Cash received for Interest Income taxes Notes 20, 21 8, 20, 21 12 7 36 30 8 31 27 27 15 $ $ $ $ $ $ 2017 (553) 314 51 34 (38) (175) 45 23 55 775 531 (1,389) 72 (5) (1,322) 988 (651) (18) (89) 200 430 34 (327) 3,384 3,057 594 94 61 8 $ $ $ $ $ $ 2016 (981) 371 10 31 (19) (126) 22 86 141 602 137 (1,255) 54 6 (1,195) 1,367 (1,566) (17) (43) 2,418 (77) (108) 1,974 (252) 664 2,720 3,384 565 111 20 5 () Related to preferred shares. (2) Related to the convertible shares issued to the CDPQ on February 11, 2016 in relation to the sale of a minority stake in Transportation and the minority stake in the C Series Aircraft Limited Partnership issued to the Goverment of Qubec on June 30, 2016 and September 1, 2016. See Note 10-Non-controlling interest for more details. (3) Amounts paid or received for interest are reflected as cash flows from operating activities, except if they were capitalized in PP&E or intangible assets, in which case they are reflected as cash flows from investing activities. Amounts paid or received for income taxes are reflected as cash flows from operating activities. (4) Interest paid comprises interest on long-term debt after the effect of hedges, if any, excluding up-front costs paid related to the negotiation of debts or credit facilities. Interest received comprises interest received related to cash and cash equivalents, investments in securities, loans and lease receivables after the effect of hedges and the interest portion related to the settlement of an interest-rate swap, if any. The factors that the Corporation considers to classify trade receivables as impaired are as follows: the customer is in bankruptcy or under administration, payments are in dispute, or payments are in arrears. Further information on financial risk is provided in Note 34 - Financial risk management. Allowance for doubtful accounts - Changes in the allowance for doubtful accounts were as follows, for fiscal years: Balance at beginning of year Provision for doubtful accounts Amounts written-off Recoveries Effect of foreign currency exchange rate changes Balance at end of year $ $ 2017 $ 2016 (44) (36) (36) (15) 14 4 1 2 (5) 1 (70) $ (44) Off-balance sheet factoring facilities In the normal course of its business, Transportation has factoring facilities mainly in Europe, to which it can sell, without credit recourse, qualifying trade receivables. Trade receivables of 907 million ($1,088 million) were outstanding under such facilities as at December 31, 2017 (820 million ($864 million) as at December 31, 2016 and 871 million ($948 million) as at January 1, 2016). Trade receivables of 1,349 million ($1,618 million) were sold to these facilities during fiscal year 2017 (993 million ($1,099 million) during fiscal year 2016). 16. TRADE AND OTHER RECEIVABLES Trade and other receivables were as follows, as at: December 31, 2017 (2) Trade receivables, gross Allowance for doubtful accounts Other Total December 31, 2016()(2) Trade receivables, gross Allowance for doubtful accounts Other Total January 1, 2016(1)(2) Trade receivables, gross Allowance for doubtful accounts Other Total $ $ $ $ $ Total 1,206 (70) 1,136 95 1,231 1,209 (44) 1,165 126 1,291 1,372 (36) 1,336 137 $ 1,473 $ $ $ $ $ $ Not past due 726 726 861 861 908 908 $ $ $ $ $ $ Past due but not impaired (3) less than 90 days 195 195 118 $ 118 $ $ 263 $ 263 $ $ more than 90 days 171 171 121 72 $ 72 $ 121 $ $ $ $ Impaired (4) 114 (70) 44 109 (44) 65 (4) Of which a gross amount of $73 million of trade receivables are individually impaired as at December 31, 2017 ($27 million as at December 31, 2016 and $66 million as at January 1, 2016). 129 (36) 93 (1) Of which $311 million and $443 million are denominated in euros and other foreign currencies, respectively, as at December 31, 2017 ($349 million and $428 million, respectively, as at December 31, 2016 and $390 million and $452 million, respectively, as at January 1, 2016). (2) Of which $287 million represents customer retentions relating to long-term contracts as at December 31, 2017 based on normal terms and conditions ($259 million as at December 31, 2016 and $233 million as at January 1, 2016). (3) Of which $225 million of trade receivables relates to Transportation long-term contracts as at December 31, 2017, of which $144 million were more than 90 days past due ($183 million as at December 31, 2016, of which $121 million were more than 90 days past due and $243 million as at January 1, 2016, of which $69 million were more than 90 days past due). Transportation assesses whether these receivables are collectible as part of its risk management practices applicable to long-term contracts as a whole. f Cash Flows growth, which means positive cash flows from financing activities, or are repaying debt and paying dividends, which means negative cash flows from financing activities. For Example Earlier in the chapter, we discussed Danier Leather Inc.. which declared bankruptcy in March 2016. The company's cash flow patterns for its last two years of operation (June 27, 2015. and June 28, 2014), were as follows: Operating Investing Sergmam/Shutterstock These basic patterns can quickly tell you a lot about the company. We can see that the company has struggled to generate cash flow from its operations, repaid more capital than it attracted in 2014, yet has continued to expand its operations and was able to attract some new financing in 2015. Of course, it would be important to analyze the cash flow results in more detail as well as to consider the dollar amounts of each cash flow, but this analysis would confirm the initial under- standing provided by the cash flow pattern." I 2015 2014 Exhibit 5.16 outlines the profile of the company that would fit within each cash flow. pattern. Being able to link the profile with the cash flow patterns enables financial statement users to develop expectations in terms of cash flows for companies they are analyzing. Cases in which the actual pattern differs from the expected pattern highlight the need for additional analysis. Cash Cash Cash Flow from Flow from Flow from Operating Investing Financing Activities Activities Activities + + 1 + + Financing + + Pattern Number and Company Profile 1. Successful, hut actively repositioning or relocating using financing from operations together with cash from creditors and shareholders 2. Successful, mature company that is downsizing and returning capital to shareholders or repaying debt 3. Successful and growing, with growth partially financed by creditors and shareholders 4. Successful, with operating activities providing sufficient cash to finance growth and repay debt or pay dividends 5. Struggling, but using cash inflows from the sale of property, plant, and equipment and new borrowings to remain in operation 6. Struggling and using cash from the sale of property, plant, and equipment to repay creditors 7. A start-up or a struggling company that is able to attract financing for growth or reorganization 8. Struggling, but using existing cash balances to cover losses, purchase property, plant, and equipment, and repay creditors.

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started